Good morning. Happy Tuesday. Hope you had a great weekend.

The Asian/Pacific markets closed mostly up. India and Indonesia moved up more than 1%; Singapore also did well. Hong Kong, Australia and New Zealand were closed. Europe is currently mostly up. Greece is up more than 1%; Norway, Switzerland, Sweden, Belgium, Hungary and Portugal are also doing well. Futures in the States point towards a flat open for the cash market.

—————

FEEE Ebook – Safe Bets: Keeping the Odds in Your Favor

—————

The dollar is up. Oil is up; copper is down. Gold and silver are up. Bonds are down.

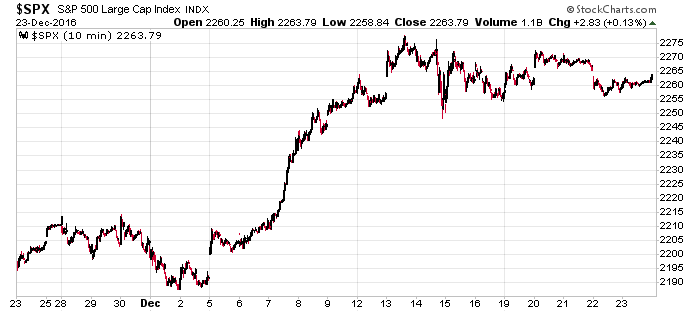

Quick reminder of what the market has been doing lately: The indexes have been stuck in a range for two weeks. This has followed across-the-board all-time highs and some very good action from many of the important groups.

I don’t have anything to add to the comments made in LB Weekly, published over the weekend. Overall things look good, but I look for a mini correction to play out in the next few weeks or at least a continuation of the current churning action to allow the indicators to cycle and the charts to reset. Then I expect more new highs. My S&P price target (2300-2400), which I set last summer, remain in place. Odds favor a continuation of the trend rather than a trend change, and for now I have no reason to abandon my expectations.

Stock headlines from barchart.com…

Disney (DIS -0.26%) may move to the upside in today’s trading after its ‘Rogue One’ movie was the number one movie seen over the weekend according to ComScore.

Lions Gate Entertainment (LGF +4.40%) was initiated with a ‘Buy’ at Argus Research with a 12-month price target of $34.

Ritchie Bros. Auctioneers (RBA +2.21%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Raymond James.

Sotheby’s (BID +1.84%) was rated a new ‘Buy’ at Sidoti & Company with a 12-month target price of $54.

Hologic’s (HOLX +0.65%) received U.S. FDA approval for commercial distribution of its HIV-1 test.

MacroGenics (MGNX +6.59%) was granted orphan drug status by the U.S. FDA for its Cd123 X drug in treatment of acute myeloid leukemia.

Shire (SHPG +1.43%) said the U.S. FDA approved its hemophilia therapy of Adynovate in pediatric patients under 12 years old and for use in surgical settings for adult patients.

International Value Advisers cut its stake in DeVry Education Group (DV +0.47%) to 7.0% from 8.5%.

Point72 Asset Management cut its stake in Whiting Petroleum (WLL +0.32%) to 1.9% from 5.7%.

Protalix Biotherapeutics (PLX unch) jumped 8% in pre-market trading after it received a $24.3 million order for its alfataligilicerase drug to treat Gaucher patients in Brazil by the Brazilian Ministry of Health.

Thursday’s Key Earnings

ConAgra (NYSE:CAG) +3.4% on better-than-expected profit.

Rite Aid (NYSE:RAD) -0.4% facing pharmacy pressure.

Today’s Economic Calendar

9:00 S&P Corelogic Case-Shiller Home Price Index

10:00 Richmond Fed Mfg.

10:00 Consumer Confidence

10:00 State Street Investor Confidence Index

10:30 Dallas Fed Manufacturing Survey

1:00 PM Results of $26B, 2-Year Note Auction

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

One thought on “Before the Open (Dec 27)”

Leave a Reply

You must be logged in to post a comment.

Nothing is revealed today,but later this month is a hint at the 2017 market. Thinking a few balanced funds 64/40 are the openers.