Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. Indonesia rallied more than 2%; Australia and Taiwan moved up more than 1%; Malaysia and Hong Kong also did well. China and South Korea were weak. Europe is currently mixed and little changed. The UK, Poland, Turkey, the Czech Republic and Greece are up; Spain, Italy and Portugal are down. Futures in the States point towards a positive open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is up. Oil and copper are down. Gold is up; silver is down. Bonds are up.

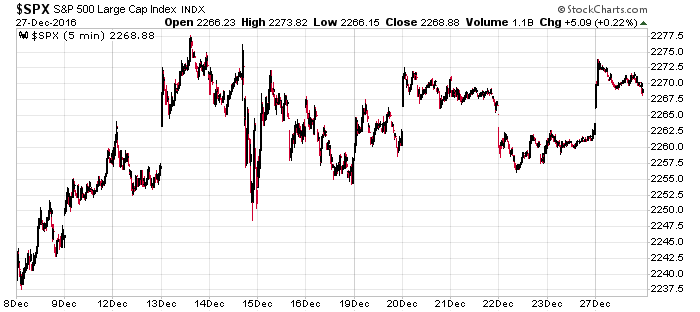

This is the last 13 days of trading for the S&P – basically two weeks of nothingness, which is fine considering the index had gotten over-extended, and we don’t want breakout attempts at this time of year anyways.

The market is resting, and the indicators are being given a chance to cycle. The stage is being set for a continuation of the trend next year. It could happen early or after a mini correction. In either case I’m confident it will happen because overall the market looks great.

Stock headlines from barchart.com…

Bank of New York Mellon (BK +0.32%) was upgraded to ‘Strong Buy’ from ‘Outperform’ at Raymond James with a 12-month target price of $57.

Piper Jaffray warns that GameStop (GME +2.13%) may post a 11% decline in holiday comparable sales and narrow its Q4 comparable sales forecast when it reports holiday sales results in mid-January.

YUM! Brands (YUM +0.34%) may push higher today after it said it plans to sell Kentucky Fried Chicken in Turkey as it refranchises the restaurants it owns in the country.

Terraform Global (GLBL +1.28%) rose over 2% in after-hours trading after Knighthead Capital boosted its stake in the company to 6.4% from 2.0%.

MiMedx Group (MDXG +1.47%) gained almost 2% in after-hours trading after its EpiFix for treatment of partial and full-thickness neuropathic diabetic foot ulcers received coverage from insurer Aetna.

Anthera Pharmaceuticals (ANTH +2.03%) plummeted 55% in pre-market trading after it said its Phase 3 study of its Sulloura drug in cystic fibrosis patients with exocrine pancreatic insufficiency missed its primary endpoint.

Today’s Economic Calendar

8:55 Redbook Chain Store Sales

10:00 Pending Home Sales

11:30 Results of $13B, 2-Year FRN Auction

1:00 PM Results of $34B, 5-Year Note Auction

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers