Good morning. Happy Thursday.

The Asian/Pacific markets closed with a lean to the upside. Japan dropped more than 1%; Indonesia rallied more than 1%, and India and Malaysia also did well. Europe currently leans to the downside, but movement is minimal. Russia, Poland and Turkey are up. The Czech Republic, Germany, Finland, Hungary and Sweden are down. Futures in the States point towards a flat open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is down. Oil is down; copper is up. Gold and silver are up. Bonds lean to the upside.

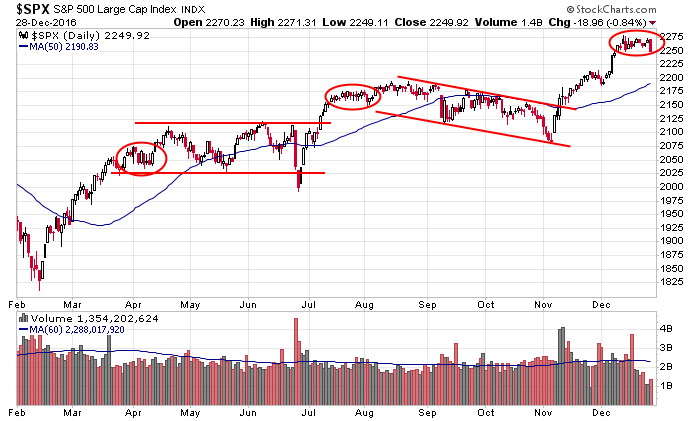

Two more days of trading this year. The S&P suffered its biggest down day since the election yesterday but remains within the range which has persisted for 2+ weeks. The index ran up 200 points and is now resting. Some shorter term indicators hint at a need for a further rest or mini correction, but long term the market is in good shape. Here’s the daily – like twice before this year, a nearly-vertical rally has been followed by a low-volume, small-range period.

Stocks aren’t getting much follow through now, so this isn’t a time to be aggressive.

Stock headlines from barchart.com…

Senior Housing Properties (SNH -0.28%) was initiated with a recommendation of ‘Overweight’ at Cantor Fitzgerald with a 12-month target price of $23.

Patrick Industries (PATK -1.22%) was initiated with a ‘Buy’ at Sidoti & Company with a 12-month target price of $100.

Sears Holdings (SHLD -1.33%) said it received a secured standby letter of credit for an initial $200 million that may be expanded with consent of lenders up to an additioanl $300 million.

Cempra (CEMP +3.39%) plunged 30% in pre-market trading after the U.S. FDA failed to approve Cempra’s Solithromycin to treat community-acquired baterial pneumonia in adults.

PHH Corp. (PHH -1.38%) said it will sell its portfolio of mortgage servicing rights and related servicing advances to New Residential Investment and said it sees $912 million in proceeds.

MainSource Financial Group (MSFG +0.35%) announced the retirement of President and CEO, Daryl R. Tressler, effective December 31 of this year.

McKesson (MCK -0.38%) cut its accretion view of its acquisition view of Rexall to flat adjusted fiscal-2107 earnings, weaker than a March 2 view that saw the deal modestly adding to earnings.

Fortress Biotech (FBIO -5.37%) surged 30% in after-hours trading after it said its MB-101 drug achieved complete remission in a patient with recurrent glioblastoma after a Phase 1 clinical trial.

Today’s Economic Calendar

8:30 Initial Jobless Claims

8:30 International trade in goods

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

11:00 EIA Petroleum Inventories

1:00 PM Results of $28B, 7-Year Note Auction

3:00 PM Farm Prices

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

One thought on “Before the Open (Dec 29)”

Leave a Reply

You must be logged in to post a comment.

Be humble since the year ahead has two outcomes. I am setting on lots of cash and a few ETFs: SPY,VTI,XLE etc. Where is Gold going???