Good morning. Happy Monday. Happy New Years.

The Asian/Pacific markets closed mostly up. China and Australia rallied more than 1%; South Korea, Hong Kong and Singapore also did well. Europe is currently up across-the-board. Russia is up more than 2%; Austria, Switzerland, Poland and Greece are up more than 1%; the UK, France, Italy, Spain and the Czech Republic are also doing well. Futures in the States point towards a big gap up open for the cash market.

—————

LB Weekly – the indexes, the breadth indicators, a look at the big picture

—————

The dollar is up. Oil is up big; copper is up. Gold is flat; silver is up. Bonds are down.

2016 ended with a whimper (biggest down week since the election), and 2017 will start with a bang. In LB Weekly, published over the weekend, I talked about how New Years can act as a major news event. For tax reasons, investors will either buy or sell right before the end of a year or right at the beginning of the next year. It doesn’t matter what the charts or indicators say. New Years isn’t a news item per se, but it can act like one in the sense that the date can trump the charts.

The Dow will start the year 240 points from 20K.

Oil is trading at a new high premarket.

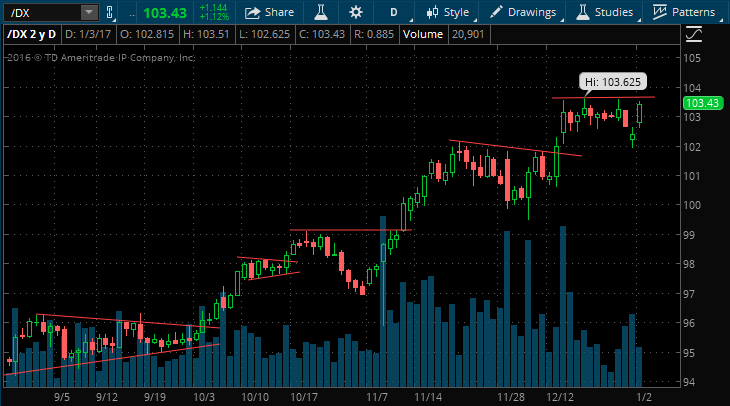

The dollar is starting the year with a big gain and is back near resistance.

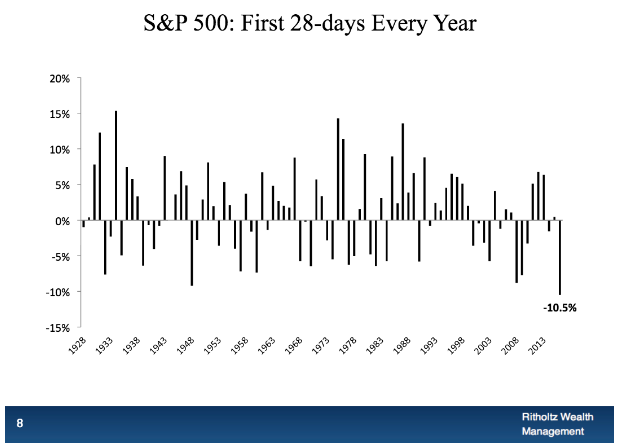

For now it looks like a continuation of last year’s trend. But remember last January was the single-worst January in history, and the year ended with the biggest post-election rally in 88 years. January isn’t always very telling. Here is the performance of the first 28 days of each year going back to the 20’s.

Overall trend is up. Things have softened in the near term. Let’s see if New Years causes investors to forget about how last year ended and if the lagging breadth indicators can right themselves soon.

Stock headlines from barchart.com…

Disney (DIS -0.33%) was upgraded to ‘Buy’ from ‘Hold’ at Evercore ISI with a 12-month target price of $120.

Facebook (FB -1.12%) was rated a new ‘Buy’ at Aegis Capital with a 12-month target price of $150.

QEP Resources (QEP -1.60%) was upgraded to ‘Outperform’ from ‘Market Perform’ at FBR Capital Markets with a 12-month target price of $20.

eBay (EBAY -0.97%) was rated a new ‘Buy’ at Aegis Capital with a 12-month target price of $36.

21st Century Fox (FOXA -0.85%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Wells Fargo Securities.

Boot Barn Holdings (BOOT -1.34%) was upgraded to ‘Buy’ from ‘Neutral’ at B Riley with a price target of $15.50.

CR Bard (BCR +0.24%) was upgraded to ‘Overweight’ from ‘Equal-Weight’ at Morgan Stanley with a price target of $260.

CenturyLink (CTL -1.04%) was upgraded to ‘Overweight’ from ‘Neutral’ at JPMorgan Chase with a 12-month target price of $28.

Verizon Communications (VZ -0.67%) was upgraded to ‘Buy’ from ‘Neutral’ at Citigroup.

Avis Budget Group (CAR -1.40%) was rated a new ‘Overweight’ at Consumer Edge Research with a price target of $45.

Wright Medical Group NV (WMGI -0.69%) was downgraded to ‘Neutral’ from ‘Buy’ at Guggenheim Securities.

Cardinal Health (CAH -0.53%) was downgraded to ‘Neutral’ from ‘Buy’ at Mizuho Securities USA was a target price of $79.

Xilinx (XLNX -0.61%) was downgraded to ‘Reduce’ from ‘Neutral’ at Nomura with a 12-month target price of $45.

Today’s Economic Calendar

9:45 PMI Manufacturing Index

10:00 ISM Manufacturing Index

10:00 Construction Spending

2:00 PM Gallup US ECI

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

2 thoughts on “Before the Open (Jan 3)”

Leave a Reply

You must be logged in to post a comment.

Sell this gap up.

Nice charts.