Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. Japan rallied 2.5%; New Zealand did better than 1%; China, Singapore and Malaysia also did well. Europe currently leans to the downside, but movement is minimal. Russia is down more than 1%; Turkey and Sweden are also weak. Hungary is doing well. Futures in the States point towards a gap up open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is down. Oil and copper are up. Gold and silver are up. Bonds are flat.

2017 started off on a good note yesterday, and it’ll continue today.

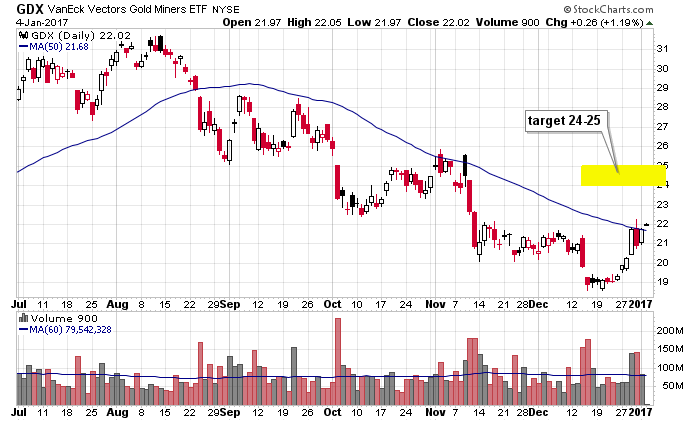

Gold & silver look very interesting. The groups rallied nicely the last two weeks of 2016, and despite dropping the last day of the year, they regained the losses yesterday. Now, GDX is set to open above its down-sloping 50-day MA. If the ETF can establish itself above the moving average, odds favor a good trading opportunity for us the next few weeks. Here’s the daily chart. Longer term I’m not so sure, but right now, yeah, the groups may be turning the corner.

Stock headlines from barchart.com…

Athenahealth (ATHN +3.21%) was upgraded to ‘Overweight’ from ‘Sector Weight’ at KeyBanc Capital Markets with a 12-month price target of $140.

Chevron (CVX +0.13%) was upgraded to ‘Buy’ from ‘Neutral’ at Bank of America/Merrill Lynch.

Intuitive Surgical (ISRG +1.20%) was downgraded to ‘Hold’ from ‘Buy’ at Evercore ISI with a 12-month target price of $690.

Hologic (HOLX +0.07%) was downgraded to ‘Hold’ from ‘Buy’ at Evercore ISI with a 12-month target price of $42.

Priceline Group (PCLN +0.79%) was initiated with a ‘Buy’ at Needham & Co. with a price target of $1,800.

Apple (AAPL +0.28%) was rated a new ‘Buy’ at Guggenheim Securities with a price target of $140.

Tesla Motors (TSLA +1.54%) dropped 2% in after-hours trading after it reported 76,230 vehicle deliveries for 2016, below the company’s own forecast of 80,000 vehicles.

Netgear (NTGR +1.20%) was initiated at a ‘Buy’ at Guggenheim Securities with a price target of $70.

Idexx Laboratories (IDXX +0.28%) gained 1% in after-hours trading when it was announced that it will replace St. Jude Medical in the S&P 500 after the close of trading on Wednesday, Jan 4.

Chemours (CC -3.94%) rose over 1% in after-hours trading when it was announced that it will replace Idexx Laboratories in the S&P Midcap 400 after the close of trading on Wednesday, Jan 4.

Shake Shack ({=SHAK =}) climbed nearly 5% in after-hours trading when it was announced that it will replace Chemours in the S&P SmallCap 600 after the close of trading on Wednesday, Jan 4.

Humana (HUM -3.15%) was rated a new ‘Overweight’ at Piper Jaffray with a 12-month target price of $231.

Amgen (AMGN +3.09%) rose 1% in after-hours trading after a trial judge let stand a patent win on Amgen’s PCSK9 patent. Regeneron Pharmaceuticals (REGN +3.44%) fell nearly 2% in after-hours trading on the news.

Agile Therapeutics (AGRX -12.28%) plummeted over 70% in after-hours trading after it said a Phase 3 study of its Twirla contraceptive patch scored a 4.8 using the Pearl Index, an index that shows the number of times the contraceptive fails over a calculated 100 years of use, worse than a competitors Pearl Index score of 3.19.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:15 ADP Jobs Report

8:30 Gallup U.S. Job Creation Index

8:55 Redbook Chain Store Sales

2:00 PM Gallup US Consumer Spending Measure

2:00 PM FOMC minutes

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY