Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Japan and Australia dropped; India, Hong Kong and Singapore posted gains. Europe currently leans to the upside. The UK, Russia, Poland, Hungary and Greece are up; Austria, Spain, Portugal and the Czech Republic are down. Futures in the States point towards a flat open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is up. Oil is flat; copper is up. Gold and silver are down. Bonds are down.

Dow 20K remains elusive. Numerous times the index has gotten close the last month, but Wall St. just doesn’t have the energy to push the index over the top.

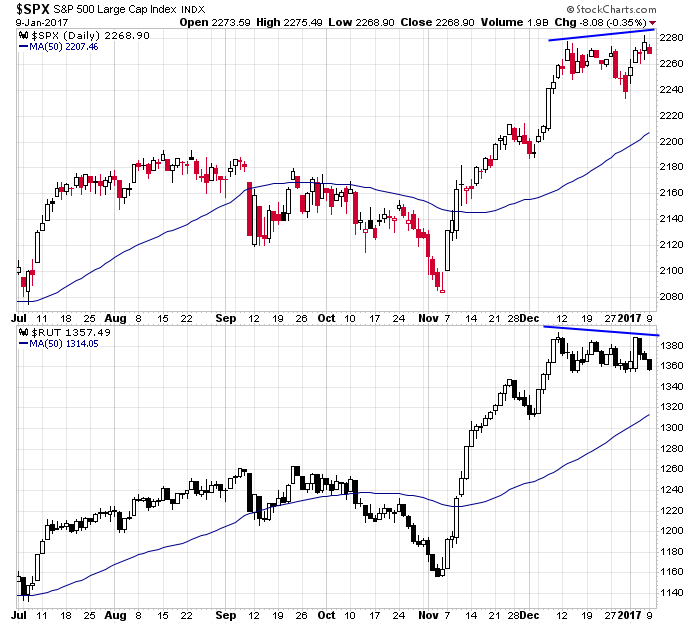

Not covered over the weekend is a slight divergence between the S&P 500 and Russell small caps – the SPX pushed to a new high while the Russell remained within its range. And now the Russell is one down day from dropping to a 1-month low. When money leaves the small caps while the large caps hold up, it’s a sign of internal deterioration that leads to a correction. It doesn’t have to be a big correction – just a correction that allows the charts to reset.

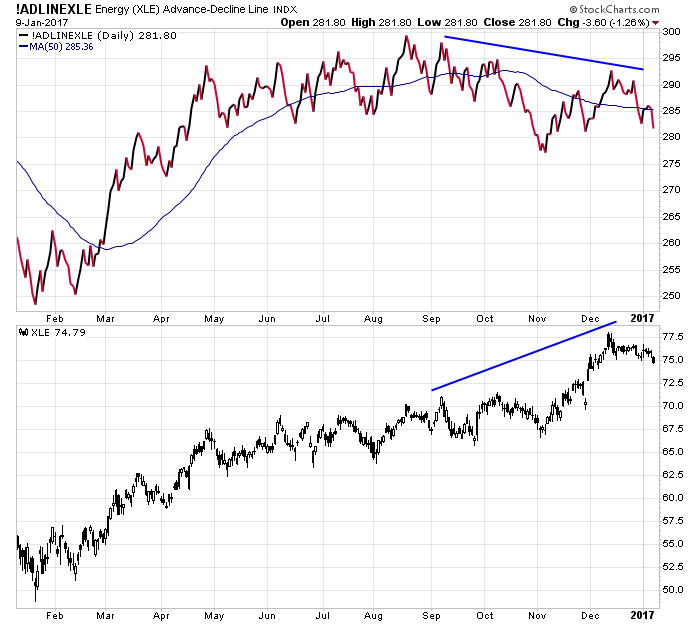

Energy, a group we’ve been active in the last year, is losing some steam. The cumulative AD line of XLE put in an obvious lower high last month while XLE rallied hard to a new high. The divergence has led to the current drop. I like oil overall, but in the near term I’m laying low.

Second week of January, and the market is little changed going back to mid December. And for what it’s worth, volume has been light. The S&P has not had a single day where volume was above average over this time period.

Stock headlines from barchart.com…

American Express (AXP +0.52%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Oppenheimer with an 18-month target price of $98.

Allstate (ALL -1.43%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman Sachs.

Travelers Cos (TRV -0.80%) was downgraded to ‘Sell’ from ‘Neutral’ at Goldman Sachs.

Williams Cos (WMB -1.51%) slumped 7% in after-hours trading after it announced a plan to increase its ownership in Williams Partners to 72% from 58% and that it will launch a 65 million share public offering in order to pay for the share purchase.

Kite Pharma (KITE +1.46%) gained 1% in after-hours trading after it entered into a joint venture licensing deal with Daiichi Sankyo to develop an experimental treatment for an aggressive type of blood cancer and will receive $50 million upfront plus an additional $200 million if developmental and regulatory milestones are met.

Boot Barn Holdings (BOOT -6.54%) dropped 5% in after-hours trading after it reported preliminary Q3 EPS of 39 cents, weaker than consensus of 43 cents.

Barracuda Networks (CUDA +4.35%) jumped 7% in after-hours trading after it reported Q3 adjusted EPS of 22 cents, well above consensus of 14 cents, and said Q3 billings for core products were up +30% y/y to $61.6 million.

Nabors Industries Ltd (NBR -1.16%) fell 4% in after-hours trading after it began an offering of $500 million of exchangeable senior unsecured notes due 2024.

Zeltiq Aesthetics (ZLTQ -1.07%) lost nearly 3% in after-hours trading after it said CCO and President Keith Sullivan will retire effective Jan 16.

WD-40 (WDFC -1.64%) fell 6% in after-hours trading after it reported Q1 net sales of $89.2 million, weaker than consensus of $96.3 million.

Cray Inc. (CRAY -0.74%) lost 4% in after-hours trading after it reported 2016 revenue of $630 million, below consensus if $633.2 million, and said for 2017 it “currently believes it will be difficult to grow over 2016.”

VOXX International (VOXX +6.00%) rose 3% in after-hours trading after it reported Q3 EPS of 24 cents and said Q3 net sales rose 3.3%.

Atwood Oceanics (ATW -2.04%) dropped nearly 6% in after-hours trading after it announced a public offering of 13.5 million common shares.

Shoe Carnival (SCVL +0.55%) fell 2% in after-hours trading after it cut its fiscal-year net sales estimate to $1 billion-$1.003 billion, below a November 28 forecast of $1.002 billion-$1.006 billion

City Office REIT (CIO -0.84%) slid 3% in after-hours trading after it announced a public offering of 4 million shares of common stock.

Papa Murphy’s Holdings (FRSH -2.52%) tumbled 7% in after-hours trading after it reported preliminary Q4 revenue of $35.5 million, weaker than consensus of $38.3 million.

Today’s Economic Calendar

6:00 NFIB Small Business Optimism Index

8:55 Redbook Chain Store Sales

10:00 Job Openings and Labor Turnover Survey

10:00 Wholesale Trade

1:00 PM Results of $24B, 3-Year Note Auction

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (Jan 10)”

Leave a Reply

You must be logged in to post a comment.

Much ado about nothing today. The tax reports from brokers are real, but not today. Isay avoid bonds and hold a few balanced funds.