Good morning. Happy Thursday.

The Asian/Pacific markets closed with a lean to the downside. Japan dropped more than 1%; Hong Kong, Singapore and South Korea were also weak. Indonesia is doing well. Europe currently leans to the upside. Greece and Italy are up more than 1%; the UK, the Netherlands, Finland, Portugal and Spain are doing well. Denmark and Norway are down. Futures in the States point towards a down open for the cash market.

—————

VIDEO: There’s a Bull Market Somewhere

—————

The dollar is down. Oil is up; copper is down. Gold and silver are up. Bonds are up.

The Fed left rates unchanged yesterday. The market barely reacted – first time in a while we didn’t at least get some moderate up and down swings.

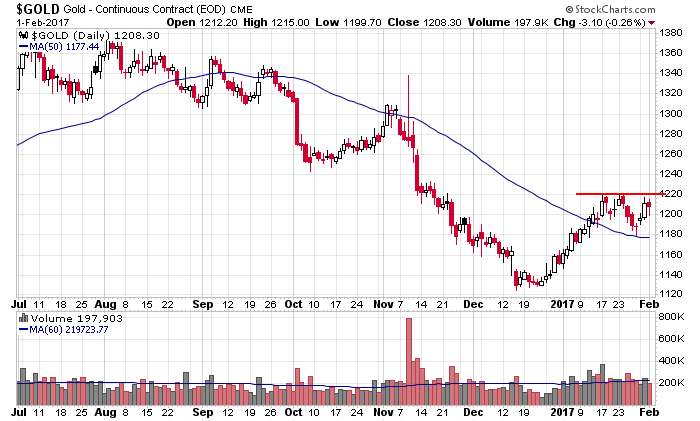

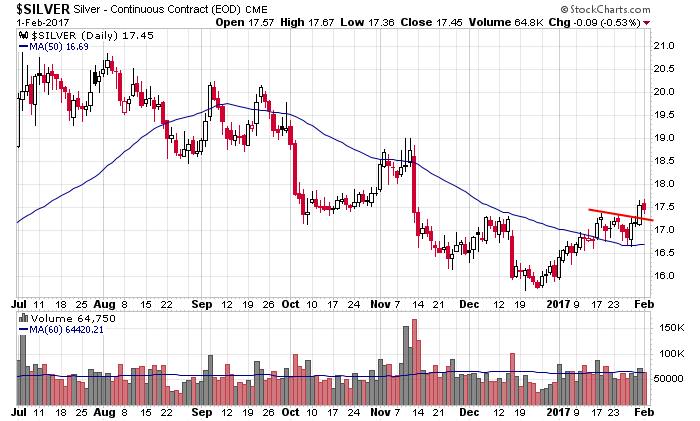

Gold and silver remain the most interesting groups. They’ve been flat or moving up but have been testing our patience. Here are the charts. Gold is set to above above resistance; silver will open above the high from the last two days.

Otherwise my stance stays the same. I like the market overall but am much less optimistic in the near term. There are definite warnings out there the market needs to overcome with either a correction or some sideways movement.

—————

VIDEO: The Trend is Your Friend

—————

Stock headlines from barchart.com…

Facebook (FB +2.23%) is up over 1% in pre-market trading after it reported Q4 adjusted EPS of $1.41, higher than consensus of $1.31.

Symantec (SYMC -1.09%) dropped over 2% in after-hours trading after it said it sees Q4 non-GAAP revenue between $1.07 billion-$1.09 billion, below consensus of $1.10 billion.

Tractor Supply (TSCO -1.76%) rallied over 3% in after-hours trading after it reported Q4 EPS of 94 cents. stronger than consensus of 92 cents.

Shutterfly (SFLY +0.86%) sank 15% in after-hours trading after it reported Q4 EPS of $263, weaker than consensus of $2.82, and said it sees Q1 revenue of $185 million-$190 million, below consensus of $199.2 million.

Qorvo (QRVO +0.53%) slid 7% in after-hours trading after it said it sees Q4 adjusted revenue of $610 million-$650 million, below consensus of $718.1 million.

Cadence Design Systems (CDNS -0.81%) rose over 2% in after-hours trading after it said it sees Q1 revenue of $470 million-$480 million, above consensus of $462.2 million.

MetLife (MET -0.17%) lost 1% in after-hours trading after it reported Q4 operating EPS of $1.28, weaker than consensus of $1.35.

Lannett (LCI +2.73%) climbed 4% in after-hours trading after it reported Q2 adjusted EPS of 92 cents, better than consensus of 85 cents.

Cavium (CAVM +0.47%) rose 2% in after-hours trading after it reported Q4 adjusted EPS of 56 cents, higher than consensus of 54 cents.

Hologic (HOLX +0.79%) lost 1% in after-hours trading after it said it sees fiscal 2017 adjusted EPS of $1.90-$1.94, below consensus of $1.94.

Axcelis Technologies (ACLS +2.96%) gained almost 4% in after-hours trading after it reported Q4 WPS of 13 cents, better than consensus of 10 cents, and then said it sees Q1 EPS of 20 cents-24 cents, above consensus of 18 cents.

CACI International (CACI +0.37%) rallied 5% in after-hours trading after it reported Q2 adjusted EPS of $2.30, well above consensus of $1.46.

Legg Mason ({=LM =}) dropped over 4% in after-hours trading after it reported Q3 EPS of cents, weaker than consensus of 64 cents.

Brooks Automation (BRKS +1.55%) rose over 3% in after-hours trading after it reported Q1 adjusted EPS of 25 cents, better than consensus of 20 cents.

Manitowoc (MTW +0.44%) fell 5% in after-hours trading after it reported Q4 net sales of $378.2 million, below consensus of $390.2 million.

Electro Scientific Industries (ESIO unch) surged 14% in after-hours trading after it reported Q3 revenue of $33.8 million, better than expectations of $30 million.

Civeo Corp. (CVEO +1.69%) tumbled 11% in after-hours trading after it announced a public offering of 20 million shares of common stock.

Wednesday’s Key Earnings

Altria (NYSE:MO) +0.3% squeezing out a profit.

Anthem (NYSE:ANTM) +4.3% after topping expectations.

Dominion Resources (NYSE:D) -5.8% with a soft outlook for 2017.

Facebook (FB) +2.3% AH buoyed by mobile advertising.

Metlife (NYSE:MET) -1.1% AH stung by its U.S. retail unit.

Today’s Economic Calendar

Chain Store Sales

7:30 Challenger Job-Cut Report

8:30 Initial Jobless Claims

8:30 Productivity and Costs

8:30 Gallup Good Jobs Rate

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

4:30 Money Supply

4:30 Fed Balance Sheet

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

9 thoughts on “Before the Open (Feb 2)”

Leave a Reply

You must be logged in to post a comment.

FED does nothing, Holding dividends.

how long does this go on? until they understand Trump plans.

Want terrorism insurance?

Talk to an insurance company.

They have lots to sell.

Why?

Cause they know you will die from heart disease and old age.

use greece to fry the markets as the bears get set

gold is insurance from the alien lizard people invasion

silver is best

alien invassion by the 10th

germany has no defences

japan to be sunk by aquatic bears

usa to default as corruption exposed

become a technical analyst

i am a alien from another demension