Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up. Malaysia and New Zealand did the best; China and Australia lost ground. Europe is currently mostly up. France, Belgium, the Netherlands, Norway, Switzerland, Spain, Italy and Portugal are doing the best. Futures in the States point towards a positive open for the cash market.

—————

VIDEO: LeavittBrothers.net Overview

—————

The dollar is up. Oil is up; copper is down. Gold and silver are down. Bonds are down.

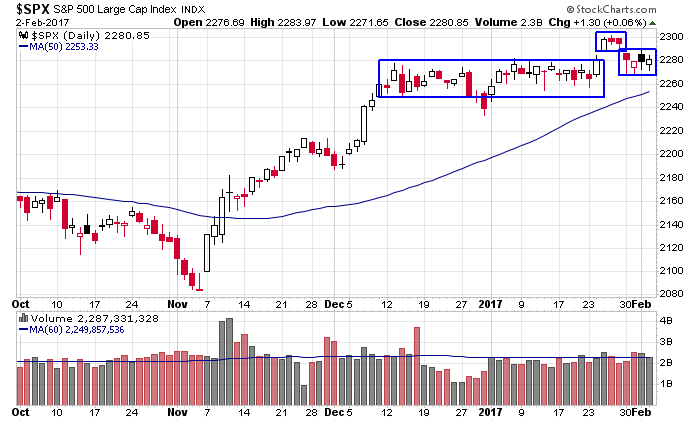

For almost two months the market has been stuck in an historically small range. Here’s the daily S&P. There was a gap up last week and a gap down to start this week. But intraday there have been no big moves and no big ranges. We haven’t even gotten a string of wins or losses that would constitute a trend.

The inauguration didn’t help. Earnings season hasn’t kick-started things. The reaction to the Fed was nonexistent. Despite these important events on the calendar, nothing has been able to ignite the market.

But no worries. Beneath the surface groups are moving. There are several groups in obvious trends, so despite the overall market doing nothing, there have been opportunities. There is, after all, a bull market somewhere.

Stock headlines from barchart.com…

Visa (V -0.17%) rose 3% in after-hours trading after it reported Q1 operating revenue of $4.5 billion, above consensus of $4.3 billion, and then was initiated with an ‘Outperform’ at RBC Capital Markets with a 12-month target price of $97.

Amazon.com (AMZN +0.91%) fell 4% in after-hours trading after it reported Q4 net sales of $43.7 billion, below consensus of $44.7 billion, and said it sees Q1 net sales of $33.3 billion-$35.8 billion, less than consensus of $36.0 billion.

Esterline Technologies (ESL +0.70%) rallied over 4% in after-hours trading after it reported Q1 adjusted EPS continuing operations of 82 cents, well above consensus of 46 cents.

Tableau Software (DATA -0.52%) surged 13% in after-hours trading after it reported Q4 revenue of $250.7 million, well above consensus of $230.2 million.

Amgen (AMGN -0.06%) rose nearly 3% in after-hours trading after it reported that a Phase 3 trial of its Repatha showed significantly reduced risk of cardiovascular events in patients with atherosclerotic cardiovascular disease.

Computer Sciences (CSC +1.12%) gained 2% in after-hours trading after it reported Q3 adjusted EPS continuing operations of 81 cents, higher than consensus of 70 cents.

Fortinet (FTNT +0.24%) climbed 10% in after-hours trading after it forecast full-year EPS of 87 cents-89 cents, better than consensus of 80 cents.

Cypress Semiconductor (CY -1.58%) rallied 5% in after-hours trading after it reported Q4 adjusted revenue of $530.2 million, higher than consensus of $525.6 million.

athenahealth (ATHN +1.41%) tumbled 7% in after-hours trading after it reported Q4 revenue of $288.2 million, below consensus of $303.7 million.

Hanesbrands (HBI -2.24%) sank over 10% in after-hours trading after it said it sees 2017 adjusted EPS of $1.93-$2.03, below consensus of $2.14.

GoPro (GPRO +3.78%) tumbled 13% in after-hours trading after it said it sees Q1 revenue of $190 million=-$210 million, well below consensus of $267.6 million.

Paylocity Holding (PCTY -1.32%) jumped 8% in after-hours trading after it said it sees fiscal 2017 adjusted EPS of 41 cents-43 cents, stronger than consensus of 38 cents.

Deckers Outdoor (DECK -2.30%) plunged over 20% in after-hours trading after it reported Q3 adjusted EPS of $4.11, below consensus of $4.22, and then cut its 2017 adjusted EPS forecast to $3.45-$3.55 from a prior view of $4.05-$4.25.

Neos Therapeutics (NEOS unch) slumped 14% in after-hours trading after it announced an offering of common stock, although no size was given.

Thursday’s Key Earnings

Amazon (AMZN) -3.5% AH amid revenue miss, weak guidance.

Amgen (NASDAQ:AMGN) +1.8% AH on Repatha success.

Chipotle (NYSE:CMG) -0.5% AH due to tightening margins.

ConocoPhillips (NYSE:COP) +0.4% after further cost cuts.

Eaton (NYSE:ETN) -1.8% following mixed results.

FireEye (NASDAQ:FEYE) -18.7% AH with billings down sharply.

GoPro (NASDAQ:GPRO) -12% AH on disappointing guidance.

Merck (NYSE:MRK) +3.4% as profit soared on new drugs.

Philip Morris (NYSE:PM) +3% with revenue boosted by Asia.

Sirius XM (NASDAQ:SIRI) -0.4% following in-line earnings.

Visa (NYSE:V) +3.3% AH on strong payments growth.

Today’s Economic Calendar

8:30 Non-farm payrolls

9:15 Fed’s Evans speech

9:45 PMI Services Index

10:00 Factory Orders

10:00 ISM Non-Manufacturing Index

1:00 PM Baker-Hughes Rig Count

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

3 thoughts on “Before the Open (Feb 3)”

Leave a Reply

You must be logged in to post a comment.

What will we believe???? Less than yesterday’s Commercial numbers… they say.

But jobs day is a bore. The thing to do is own some bonds and add some Dividends. This is a plan that goes into May 2017. Who? is Trump?

island reversals and pos H/S –so far

A/D Looks bullish Most are up nicely except the NASDAQ. ????