Good morning. Happy Monday. Hope you had a good weekend.

So let’s see. The Cavs came back from a 3-1 deficit. The Cubs came back from being down 3-1. And then the Patriots came back from that! Wow. Never give up. Never ever give up.

The Asian/Pacific markets closed mostly up. Hong Kong, India, Indonesia and Taiwan led the way. Europe currently leans to the downside. Greece and Italy are down more than 1%; Russia, Germany, Austria, France, Spain and Hungary are also weak. Futures in the States point towards a down open for the cash market.

—————

VIDEO: LeavittBrothers.net Overview

—————

The dollar is up. Oil is flat; copper is up. Gold and silver are up. Bonds are up.

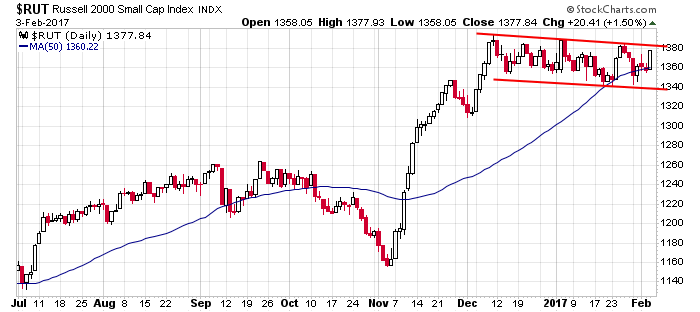

Last week the indexes that fell back into their patterns jumped on Friday and closed near their highs. The small caps, which have been lagging, continue to trade constructively in a falling rectangle pattern. Here’s the chart. There’s nothing wrong with this set up – consolidation pattern within an uptrend. And if it resolves up, the entire market will rally with force.

Stock headlines from barchart.com…

American Airlines Group (AAL +0.43%) was upgraded to ‘Market Perform’ from ‘Underperform’ at Bernstein with a price target of $43.

Delta Air Lines (DAL +0.91%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Bernstein with a price target of $61.

FedEx (FDX +1.95%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Raymond James.

AutoNation (AN -3.86%) was downgraded to ‘Hold’ from ‘Buy’ at Evercore ISI.

Walgreens Boots Alliance (WBA -0.15%) was upgraded to ‘Overweight’ from ‘Neutral’ at Atlantic Equities with a 12-month target price of $95.

CVS Health Corp. (CVS +0.88%) was downgraded to ‘Neutral’ from ‘Overweight’ at Atlantic Equities with a 12-month target price of $84.

Barracuda Networks (CUDA +2.54%) was rated a new ‘Buy’ at Needham with a price target of $28.

Nvidia (NVDA -0.88%) was downgraded to ‘Neutral’ from ‘Buy’ at Roth Capital

Parexel International (PRXL -1.44%) was downgraded to ‘Neutral’ from ‘Outperform’ at Credit Suisse with a target price of $65.

CBS (CBS +0.02%) was upgraded to ‘Overweight’ from ‘Neutral’ at Atlantic Equities with a price target of $78.

U.S. Steel (X -3.07%) was upgraded to ‘Buy’ from ‘Hold’ at Argus with a price target of $39.

Lone Star boosted its stake in Edgewater Technology (EDGW -2.90%) to 6.2% from 1.4%.

Credit Acceptance Corp. (CACC +2.01%) slipped 2% in after-hours trading after the company received FTC civil investigative demand seeking information on car dealers using GPS Starter Interrupters on consumer vehicles.

Atwood Oceanics (ATW +4.37%) lost 1% in after-hours trading after it reported Q1 revenue of $157.6 million, below consensus of $159.4 million.

Today’s Economic Calendar

8:30 Gallup US Consumer Spending Measure

10:00 Labor market condition index

12:30 PM TD Ameritrade IMX

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (Feb 6)”

Leave a Reply

You must be logged in to post a comment.

Reits portfolio last week reurned 45%. over 50% lost money. My dividends doing very little. This weeks earnings will disappoint. Smile, I am still learning….. slowly.