Good morning. Happy Tuesday.

The Asian/Pacific markets closed with a lean to the downside, but movement was minimal (no big winners or losers). Singapore did well; Japan, India and New Zealand were weak. Europe is currently mostly up. London, Germany, the Netherlands, Sweden and Switzerland are doing the best. Futures in the States point towards a moderate gap up open for the cash market.

—————

VIDEO: LeavittBrothers.net Overview

—————

The dollar is up. Oil and copper are down. Gold and silver are flat. Bonds are down.

The market traded quietly yesterday. The range was small; volume was on the lighter side; all the S&P’s movement took place within the high and low of Friday’s intraday range.

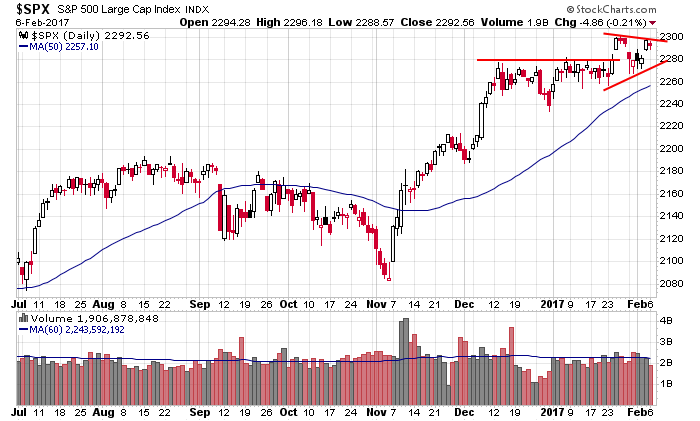

Here’s the S&P’s daily chart. Since breaking out two weeks ago, the index hasn’t done much (the market is, after all, mean reverting in the near term). Today’s open will be near Friday’s high. This chart is rock-solid. There’s no reason to be anything but long.

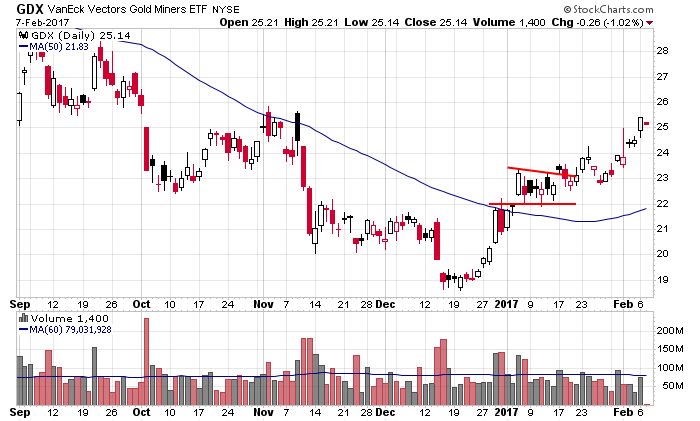

Gold and silver were big winners yesterday. We’ve been long since the beginning of January. In most cases we had to sit through some grinding action, but the nascent trends remain. There was no reason to sell, and our patience is now paying off. Here’s GDX.

There’s been more grinding action than trending action lately – very typical. It’s why we look beneath the surface and find the bull markets. Gold and silver are where it’s been. You only need a couple good ones each month to make a solid living. More after the open.

Stock headlines from barchart.com…

Biogen (BIIB +0.09%) is up 1% in pre-market trading after it was upgraded to a ‘Buy’ at Citigroup with a price target of $305.

Sysco (SYY -2.55%) was upgraded to ‘Outperform’ from ‘Neutral’ at Credit Suisse with a price target of $59.

Twenty-First Century Fox (FOXA -1.08%) gained 1% in after-hours trading after it reported Q2 adjusted EPS continuing operations of 53 cents, higher than consensus of 49 cents.

FMC Corp. (FMC +0.61%) fell nearly 5% in after-hours trading after it reported Q4 revenue of $865.6 million, below consensus of $916.1 million.

The Gap (GPS +0.04%) rose 3% in after-hours trading after it said it sees Q4 adjusted EPS of 50 cents-51 cents, above consensus of 45 cents.

Allison Transmission Holdings (ALSN -0.34%) rallied 5% in after-hours trading after it said it will buy back all ValueAct’s holdings in the company at $34.50 a share.

HealthEquity (HQY -0.70%) lost over 5% in after-hours trading after it forecast preliminary 2017 EPS of 38 cents-42 cents, below consensus of 42 cents.

Fabrinet (FN -0.64%) climbed over 3% in after-hours trading after it reported Q2 adjusted EPS of 91 cents, better than consensus of 79 cents, and then said it sees Q3 revenue of $360 million-$364 million, higher than consensus of $334.7 million.

YRC Worldwide (YRCW -1.31%) dropped 4% in after-hours trading after it reported a Q4 loss of -23 cents, a wider loss than consensus of -12 cents.

Teva Pharmaceutical (TEVA -0.26%) lost nearly 1% in after-hours trading after CEO Erez Vigodman was said to step down immediately.

Houlihan Lokey (HLI -0.58%) slid nearly 2% in after-hours trading after it announced a primary offering of 10 million shares of Class A common stock.

Luminex (LMNX -0.50%) fell 2% in after-hours trading after it reported Q4 adjusted EPS of 11 cents, weaker than consensus of 18 cents.

Cellectis SA (CLLS +0.05%) climbed nearly 5% in after-hours trading after it received an Investigational New Drug (IND) approval from the FDA to conduct a Phase 1 trial with its UCART123 in patients with acute leukemia and blastic plasmacytoid dendreitic cell neoplasm.

Antero Midstream Partners LP (AM +0.39%) slid 3% in after-hours trading after it launched a public offering of 5-million common units.

Monday’s Key Earnings

21st Century Fox (NASDAQ:FOXA) +1% AH as cable profits improved.

Hasbro (NASDAQ:HAS) +14.1% growing Frozen-themed sales.

Tyson Foods (NYSE:TSN) -3.5% disclosing an SEC investigation.

Today’s Economic Calendar

8:30 International Trade

8:30 Gallup US ECI

8:55 Redbook Chain Store Sales

10:00 Job Openings and Labor Turnover Survey

1:00 PM Results of $24B, 3-Year Note Auction

3:00 PM Consumer Credit

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

2 thoughts on “Before the Open (Feb 7)”

Leave a Reply

You must be logged in to post a comment.

Playing with the strong reits.

wherewolfs roam the streets

as the bears gather for a feeding frenzy

nas breakout unconfirmed by other indexes world wide

is this the end of the world as the bulls know it

if dow and spx confirm nas then bulls may party