Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up. Japan led with a 2.5% gain; Singapore, Australia, Malaysia and Taiwan also did well. Europe is currently mixed, but most markets are quiet. Greece is up 2.4%; the Czech Republic and Poland are also doing well. Belgium, Turkey, Spain, Italy and Russia are down. Futures in the States point towards a positive open for the cash market.

—————

VIDEO: LeavittBrothers.net Overview

—————

The dollar is up. Oil and copper are up. Gold and silver are down. Bonds are down.

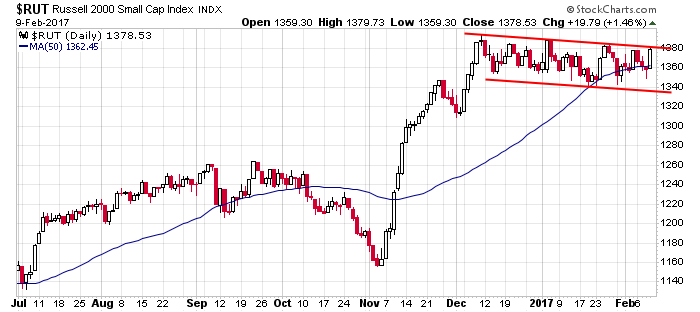

Across-the-board gains yesterday have put several indexes at new all-time highs and the small caps right at resistance. If the Russell breaks out, the entire market could go vertical. Here’s $RUT.

Don’t bet against this market. It’s resilient. Its ability to absorb everything thrown its way is great. Eventually we’ll get a dip – not sure when or how much – but even then only short term traders should bother with it. Intermediate term traders could lighten up, but they’d be wise to maintain longs and build a list of stocks they want to buy at discount prices. No sense making pennies to the downside and risk missing the market’s next leg up. But I’m getting ahead of myself. The trend is up. Period. And it’s a strong trend. Over the years, more money is lost not riding the obvious trend than is lost via losses themselves.

Stock headlines from barchart.com…

Activision Blizzard (ATVI +1.38%) jumped 10% in after-hours trading after it reported Q4 adjusted EPS of 92 cents, well above consensus of 73 cents, and its board authorized a $1 billion stock buyback over the next two years.

CyberArk Software Ltd (CYBR +2.90%) dropped over 3% in after-hours trading after it said it sees full-year EPS of $1.20-$1.24, weaker than consensus of $1.34.

Ellie Mae (ELLI -0.67%) climbed 5% in after-hours trading after it reported Q4 adjusted EPS of 57 cents, better than consensus of 49 cents.

VeriSign (VRSN -0.06%) gained 1% in after-hours trading after it reported Q4 adjusted EPS of 92 cents, higher than consensus of 88 cents.

Seattle Genetics (SGEN +2.11%) slid over 4% in after-hours trading after it said it sees 2017 revenue of $405 million-$445 million, below consensus of $490.5 million.

Columbia Sportswear ({=COLM =}) rose 4% in after-hours trading after it reported Q4 EPS of $1.20, above consensus of $1.10.

Monolithic Power Systems (MPWR -1.00%) slid nearly 7% in after-hours trading after it said Q4 revenue for consumer end market fell to $38 million from $38.6 million y/y, the first year-on-year decline in consumer revenue in over a year.

Trivago (TRVG +0.61%) jumped over 7% in after-hours trading after Expedia said Trivago’s Q4 revenue surged +65% y/y to $183 million.

Yelp (YELP +0.19%) tumbled 9% in after-hours trading after it said it sees Q1 revenue of $195 million-$199 million, less than consensus of $204.4 million.

Cliffs Natural Resources (CLF +19.43%) fell 4% in after-hours trading after it announced an offering of 50-million common shares.

Hortonworks (HDP +2.83%) jumped 8% in after-hours trading after it said it sees 2017 GAAP revenue of $235 million-$240 million, above consensus of $234.8 million.

Regal Entertainment Group (RGC +1.16%) gained over 2% in after-hours trading after it reported Q4 adjusted EPS of 33 cents, higher than consensus of 26 cents.

MagnaChip Semiconductor (MX -2.96%) lost 3% in after-hours trading after it said it sees Q1 revenue of $157 million-$163 million, less than consensus of $166.5 million.

Control4 Corp. (CTRL +2.94%) rallied nearly 7% in after-hours trading after it reported Q4 adjusted EPS of 31 cents, better than consensus of 24 cents, and then said it sees 2017 adjusted EPS of 90 cents-98 cents, higher than consensus of 85 cents.

Radisys (RSYS +0.24%) sank nearly 15% in after-hours trading after it said it sees 2017 adjusted EPS of 7 cents-17 cents, below consensus of 25 cents.

Thursday’s Key Earnings

Activision Blizzard (NASDAQ:ATVI) +7.6% AH raising its dividend.

Coca-Cola (NYSE:KO) -1.8% posting a drop in unit case volume.

Cummins (NYSE:CMI) +3.1% after topping expectations.

CVS Health (NYSE:CVS) +0.4% affirming its 2017 forecast.

Expedia (NASDAQ:EXPE) +0.4% AH on mixed results.

Nvidia (NASDAQ:NVDA) +1.2% AH reporting sizzling earnings.

Kellogg (NYSE:K) +4% following a Q4 beat.

Pandora (NYSE:P) -1.8% AH disclosing light guidance.

Twitter (NYSE:TWTR) -12.3% with no growth, weak guidance.

Western Union (NYSE:WU) -0.2% AH following in-line results.

Viacom (NYSE:VIA) +3.8% unveiling a turnaround plan.

Yelp (NYSE:YELP) -9.3% AH punished after a soft outlook.

Yum! Brands (NYSE:YUM) +1.2% with a lift from Taco Bell.

Today’s Economic Calendar

8:30 Import/Export Prices

10:00 Consumer Sentiment

1:00 PMBaker-Hughes Rig Count

2:00 PMTreasury Budget

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

6 thoughts on “Before the Open (Feb 10)”

Leave a Reply

You must be logged in to post a comment.

WATCH housing growth. VBR and other small caps could learn a move up soon.

What does thee percentage figure inside the parens mean?

That’s yesterday’s percentage move.

Time to re-balance in new highs.

I noticed that the Russell 2000 [IWM] was trending down a bit, perhaps that is why most of the info on Stocks Listed today was from mainly Larger Caps. But I would be interested in more information with regards to exclusively the Smaller Caps – What have Ye ? Or how do i adjust my Preferences for these Newsletters, do you have less expensive info for Newer Investors with smaller capital ? (Please Email me, I did not notice an option for Contacting You ?)

I want to know Jasons worst trade ever… Just not bad enough to sing up for something.