Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. China, New Zealand and Taiwan did the best. Japan posted a loss. Europe is currently mostly up. Poland and Denmark are up more than 1%; Germany, France, Austria, Belgium, the Netherlands, Switzerland and Finland are also doing well. Russia and Greece are down 1%. Futures in the States point towards a positive open for the cash market.

—————

VIDEO: LeavittBrothers.net Overview

—————

The dollar is flat. Oil is up; copper is down. Gold and silver are up. Bonds are down.

Two huge mergers in the health care sector are dead. Aetna (AET) will not be buying Humana (HUM), and Anthem (ATHM) will not be acquiring Cigna (CI). For consumers this is good. Too much consolidation in the space would lead to less competition and higher prices.

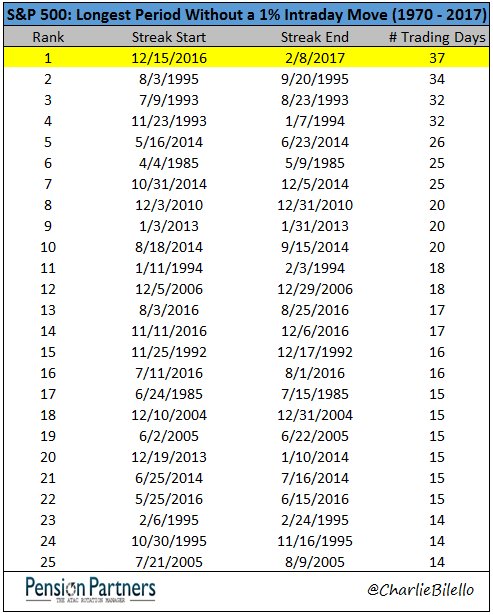

The overall market continues to chug along. The Nas and Nas 100 are in uptrends on all time frames. The small caps are consolidating within an overall uptrend. The rest of the indexes are doing fine, but are spending most of their time moving in tight ranges. In all cases, the indexes aren’t moving much intraday. There are many more overlapping candles on the daily charts than directional moves.

Yesterday was the 37th straight day the S&P has failed to move 1% intraday. This is the longest streak in history. Courtesy of Pension Partners, here are the 25 longest streaks since 1970.

While the indexes don’t do much, stick with the leading groups. We’ve gotten some great moves from gold and silver, and many semiconductor stocks have offered opportunities.

Stock headlines from barchart.com…

Paycom Software (PAYC -0.31%) rallied 10% in after-hours trading after it reported Q4 adjusted EPS of 18 cents, higher than consensus of 13 cents, and then said it sees Q1 revenue of $114.5 million-$116.5 million, above consensus of $113.8 million.

Twitter (TWTR +2.52%) tumbled 9% in pre-market trading after it reported Q4 revenue of $717 million, below consensus of $740 million.

Imperva (IMPV +0.59%) jumped nearly 9% in after-hours trading after it reported Q4 adjusted EPS of 32 cents, well above consensus of 2 cents, and then said it sees 2017 adjusted EPS of 31 cents-24 cents, stronger than consensus of 10 cents.

PayPal Holdings (PYPL +2.15%) lost nearly 2% in after-hours trading after it said it received subpoenas from the DOJ asking for information related to anti-money laundering.

iRobot (IRBT -1.05%) dropped 7% in after-hours trading after it said it sees 2017 EPS of $1.35-$1.65, below consensus of $1.74.

FleetCar Technologies (FLT +1.68%) climbed 6% in after-hours trading after it reported Q4 adjusted EPS of $1.90, above consensus of $1.87, and said it sees 2017 adjusted EPS of $8.10-$6.30 the midpoint above consensus of $8.16.

Zendesk (ZEN -0.28%) jumped 6% in after-hours trading after it reported a Q4 EPS loss of -4 cents, narrower than consensus of -6 cents, and said it sees full-year revenue of $415 million-$425 million, above consensus of $410.3 million.

Pilgrim’s Pride (PPC +0.37%) dropped 3% in after-hours trading after it reported Q4 adjusted EPS of 30 cents, well below consensus of 40 cents.

TTM Technologies (TTMI +2.43%) rallied 5% in after-hours trading after it reported Q4 adjusted EPS of 58 cents, higher than consensus of 45 cents, and then said it sees Q1 adjusted EPS of 25 cents-31 cents, above consensus of 24 cents.

CoreCivic (CXW +1.27%) gained over 2% in after-hours trading after it reported Q4 revenue of $464.1 million, higher than consensus of $459 million.

TrueBlue (TBI -0.62%) slid over 6% in after-hours trading after it forecast Q1 adjusted EPS of 9 cents-14 cents, weaker than consensus of 17 cents.

PCM Inc. (PCMI +1.44%) rallied over 9% in after-hours trading after it reported Q4 adjusted EPS of 51 cents, better than consensus of 45 cents.

Qualys (QLYS +0.27%) dropped over 7% in after-hours trading after it said it sees Q1 adjusted EPS of 17 cents-19 cents, weaker than consensus of 21 cents, and then said its sees 2017 adjusted EPS of 81 cents-86 cents, below consensus of 92 cents.

Sterling Construction (STRL -1.15%) fell 8% in after-hours trading after it reported a Q4 preliminary net loss of -$5.5 million to -$6.5 million, well below a prior forecast of breakeven.

OraSure Technologies (OSUR +0.34%) jumped 12% in after-hours trading after it reported Q4 EPS of 13 cents, stronger than consensus of 6 cents, and then said it sees Q1 revenue of $31 million-$31.5 million, better than consensus of $29.7 million.

Student Transportation (STB +1.63%) rose 3% in after-hours trading after it was awarded a 10-year, $187 million contract starting July 1 to provide the Duval County School District in Jacksonville, Florida, with 230 school vehicles.

Wednesday’s Key Earnings

Allergan (NYSE:AGN) +3.7% after topping expectations.

Centurylink (CTL) -1.4% AH light guidance, Q4 miss.

Exelon (NYSE:EXC) -2.1% amid lower capacity, energy prices.

Humana (HUM) +2.3% beating earnings estimates.

Time Warner (NYSE:TWX) +0.4% boosted by Fantastic Beasts.

Whole Foods (WFM) -1.5% AH on falling comparable sales.

Today’s Economic Calendar

8:30 Initial Jobless Claims

9:10 Fed’s Bullard: U.S. Monetary and Economic Policy

9:45 Bloomberg Consumer Comfort Index

10:00 Wholesale Trade

10:30 EIA Natural Gas Inventory

1:00 PM Results of $15B, 30-Year Note Auction

1:10 PM Fed’s Evans speech

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (Feb 9)”

Leave a Reply

You must be logged in to post a comment.

will the insto’s start selling at high noon