Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Hong Kong, China and India moved up; New Zealand dropped 1.1%; Japan was also weak. Europe is currently mostly down. France, the Netherlands, London and the Czech Republic, Norway and Spain are down the most. Poland and Turkey are doing well. Futures in the States point towards a down open for the cash market.

—————

VIDEO: LeavittBrothers.net Overview

—————

The dollar is down. Oil is up; copper is down. Gold and silver are up. Bonds are up.

Another day of across-the-board new highs yesterday (except the S&P 600, which is very close).

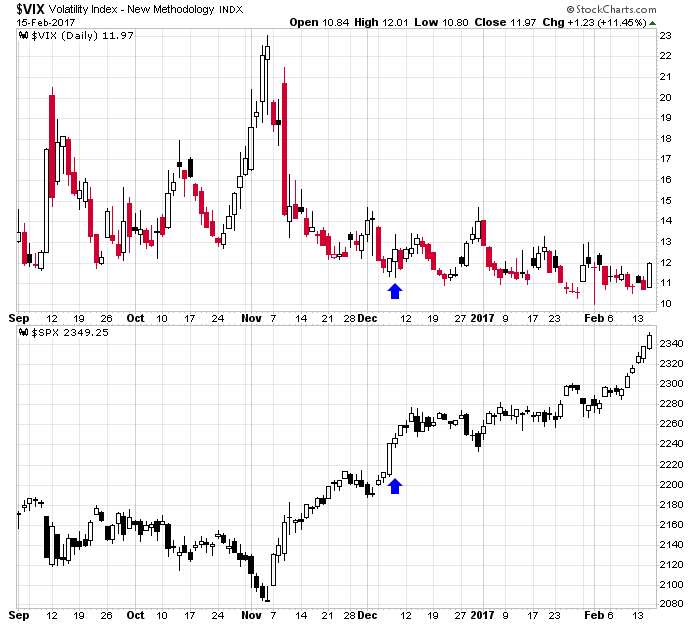

But oddly enough, the $VIX, which is at a very low level and you’d expect to stay at a low level, jumped more than 11%. This combination – strong market, strong VIX – is unusual. The only other time it’s happened in the last 6 months the market followed through for a few days and then settled into a range lasting several weeks. “One” is not a large enough sample size to draw conclusions from. Still, interesting to note.

Stock headlines from barchart.com…

GNC Holdings (GNC +1.46%) tumbled 9% in pre-market trading after it reported Q4 adjusted EPS of 7 cents, well below consensus of 36 cents.

Cisco Systems (CSCO +1.58%) gained almost 2% in after-hours trading after it reported Q2 adjusted EPS of 57 cents, better than consensus of 56 cents.

TripAdvisor (TRIP +0.98%) fell 5% in after-hours trading after it reported Q4 adjusted EPS of 16 cents, well below consensus of 31 cents.

NetApp (NTAP -1.49%) rallied 5% in after-hours trading after it reported Q3 adjusted EPS of 82 cents, higher than consensus of 74 cents, and said it sees Q4 adjusted EPS of 79 cents-84 cents, better than consensus of 77 cents.

Avis Budget Group (CAR +5.83%) dropped 6% in after-hours trading after it reported Q4 adjusted EPS of 15 cents, below consensus of 17 cents, and then said it sees full-year revenue of $8.8 billion-$8.95 billion, less than consensus of $9.01 billion.

Shutterfly (SFLY +2.19%) gained nearly 4% in after-hours trading when it was announced that it will replace Vascular Solutions in the S&P SmallCap 600 at the open of trade on Tuesday, Feb 21.

Progenics Pharmaceuticals (PGNX -0.52%) rose 5% in after-hours trading when it was announced that it will replace Calamos Asset Management in the S&P SmallCap 600 at the open of trade on Tuesday, Feb 21.

GoDaddy (GDDY +3.08%) declined 4% in after-hours trading after it reported an unexpected Q4 loss of -2 cents per share, weaker than consensus of 21 cents EPS.

CF Industries Holdings (CF -5.04%) fell 4% in after-hours trading after it reported Q4 net sales of $867 million, below consensus of $908.6 million.

Synopsys (SNPS +0.64%) climbed 6% in after-hours trading after it reported Q1 adjusted EPS of 94 cents, higher than consensus of 78 cents, and then said it sees 2017 adjusted EPS of $3.21 to $3.26, better than consensus of $3.20.

Omnicell (OMCL -0.26%) dropped over 8% in after-hours trading after it reported Q4 adjusted revenue of $174.6 million, weaker than consensus of $180.5 million.

TiVo (TIVO +0.53%) jumped 12% in after-hours trading after it reported Q4 revenue of $252.3 million, better than consensus of $227.5 million.

Chemours (CC +1.90%) slid 3% in after-hours trading after it reported Q4 adjusted EPS of 8 cents, including a $50 million tax allowance, weaker than consensus of 29 cents.

Molina Healthcare (MOH +0.84%) slumped 13% in after-hours trading after it reported Q4 revenue of $4.46 billion, below consensus of $4.56 billion, and said it sees 2017 adjusted EPS of $2.09, weaker than consensus of $3.69.

TransUnion (TRU -0.21%) lost over 1% in after-hours trading after it announced a secondary offering of 19.88 million shares of common stock.

NMI Holdings (NMIH +0.43%) rose 3% in after-hours trading after it reported Q4 EPS of $1.01, well above consensus of 13 cents.

Agnico Eagle Mines Ltd (AEM -0.06%) lost nearly 2% in after-hours trading after it reported Q3 adjusted EPS of 2 cents, well below consensus of 8 cents.

Cloud Peak Energy (CLD -4.07%) dropped 7% in after-hours trading after it said it sees 2017 adjusted Ebitda of $80 million to $120 million, less than consensus of $129.4 million.

SS&C Technologies Holdings (SSNC +0.52%) climbed 6% in after-hours trading after it reported Q4 adjusted EPS of 46 cents, better than consensus of 44 cents.

Martin Midstream Partners LP (MMLP -0.79%) slid nearly 3% in after-hours trading after it announced an underwritten public offering of 2.6 million common units (plus up to an additional 390,000 units pursuant to an option to be granted to the underwriters).

ConforMIS (CFMS -0.58%) plunged over 35% in after-hours trading after it said it sees 2017 total revenue of $80 million-$84 million, much lower than consensus of $100.9 million.

Wednesday’s Key Earnings

Applied Materials (NASDAQ:AMAT) +1.1% AH topping estimates.

Barrick Gold (NYSE:ABX) +1.8% AH hiking its dividend.

CBS Corp. (NYSE:CBS) -0.9% on declining revenues.

Cisco (NASDAQ:CSCO) -1.2% AH hit by a weak networking market.

Kraft Heinz (NASDAQ:KHC) -2.4% AH expecting more cost-cuts.

Groupon (NASDAQ:GRPN) +23.3% with a good deal on LivingSocial.

Marriott (NYSE:MAR) inched up AH boosted by Starwood.

PepsiCo (NYSE:PEP) -0.2% after guidance fell short.

SodaStream (NASDAQ:SODA) +4.6% accelerating sales.

Today’s Economic Calendar

8:30 Housing Starts

8:30 Initial Jobless Claims

8:30 Philly Fed Business Outlook

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY