Good morning. Happy Monday. Hope you had a good weekend.

The Asian/Pacific markets closed with a lean to the downside. New Zealand dropped 1.4%; Australia, India and South Korea were also weak. Hong Kong and China posted gains. Europe is currently mostly down, but losses are small. Russia, Germany, France, Poland, Hungary and Spain are down the most. Futures in the States point towards a slight down open for the cash market.

—————

VIDEO: LeavittBrothers.net Overview

—————

The dollar is up a small amount. Oil and copper are down. Gold and silver are flat. Bonds are down.

We got across-the-board improvement last week. The small caps led, and several breadth indicators reversed.

Long term I consider the market to be in great shape and am very confident new highs will continue to be made this year. Short term I consider the price action to be more neutral. The S&P is flat going back about three weeks, and the Russell small caps are flat going back to early December. I like the market, but there isn’t much near-term momentum.

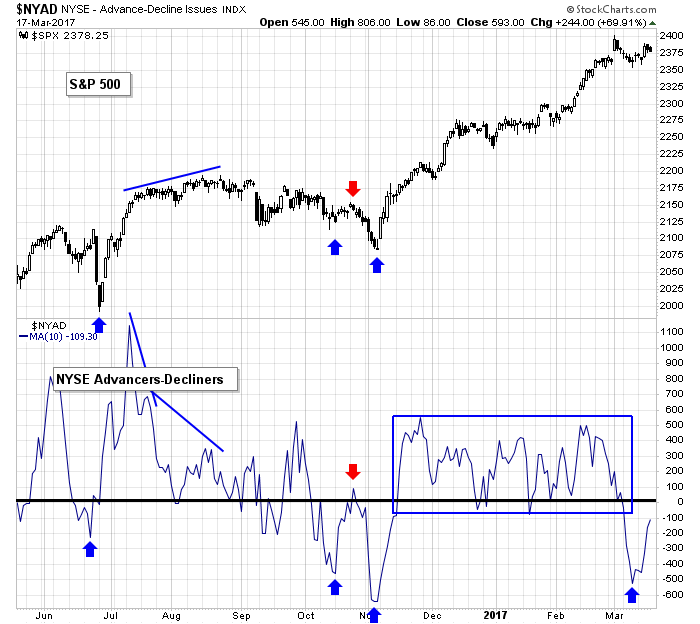

The 10-day of the NYSE AD line is a good example of what I’m following right now. If the indicator gets above 0 and stays there, odds favor a continuation of the current move which began right before the election. But if the indicator gets rejected by 0 and drops (similar to what happened in October (red arrow)), the market will weaken further.

Pretty simple. The market bounced last week, but the internals need to improve more to support further upside.

Stock headlines from barchart.com…

Stifel Financial (SF -2.04%) was downgraded to ‘Neutral’ from ‘Buy’ at Goldman Sachs.

Tiffany (TIF +2.71%) was upgraded to ‘Outperform’ from ‘Market Perform’ at William Blair & Co.

Sunoco LP (SUN +0.33%) was downgraded to ‘Equal-Weight’ from ‘Overweight’ at Stephens.

Ingersoll-Rand PLC (IR +0.55%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Wells Fargo Securities with a price target of $86.

Bunge (BG +0.22%) was downgraded to ‘Neutral’ from ‘Buy’ at Goldman Sachs.

Illumina (ILMN +0.60%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Leerink Partners LLC with a price target of $195.

Nimble Storage (NMBL -0.64%) was downgraded to ‘Hold’ from ‘Buy’ at Needham & Co.

Alaska Air Group (ALK -0.83%) was upgraded to ‘Buy’ from ‘Hold’ at Stifel with a price target of $145.

Snap (SNAP -1.76%) was rated a new ‘Buy’ at Monness Crespi with a price target of $25.

Apollo Global Management LLC (APO -0.82%) climbed 2% in after-hours trading after Tiger Global Management LLC reported a 7% passive stake in the company.

ViewRay (VRAY -3.53%) slid 3% in after-hours trading after it filed a 10.3 million share prospectus that were sold to accredited investors in a private placement.

Thursday’s Key Earnings

Adobe ADBE +4.4% AH after FQ1 beat, raising guidance.

Today’s Economic Calendar

8:30 Chicago Fed National Activity Index

8:30 Fed’s Evans: Monetary Policy

1:10 PM Fed’s Evans speech

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (Mar 20)”

Leave a Reply

You must be logged in to post a comment.

In S&P the smaller company stocks are lagging the big caps. Seeing some weakness. High yield bonds, JNK seem to be responding to petroleum weakness. I Am Nervous. Getting ready to rain???