Good morning. Happy Tuesday.

The Asian/Pacific markets closed with a lean to the upside. South Korea rallied 1%; Taiwan and New Zealand also did well. Europe is currently mostly up. France, Austria, Norway, the Czech Republic, Spain, Italy and Russia are doing the best. Hungary is weak. Futures in the States point towards a positive open for the cash market.

—————

VIDEO: LeavittBrothers.net Overview

—————

The dollar is down. Oil is up; copper is down. Gold and silver are down. Bonds are down.

The indexes are trading in ranges – most are in the middle of their ranges; the Nas is near the top.

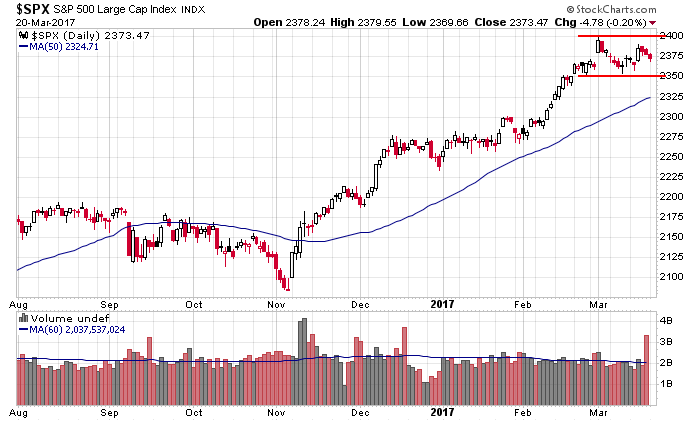

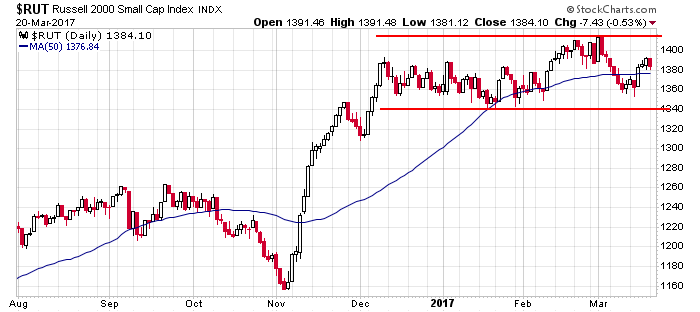

Here’s the S&P 500 and the Russell 2000.

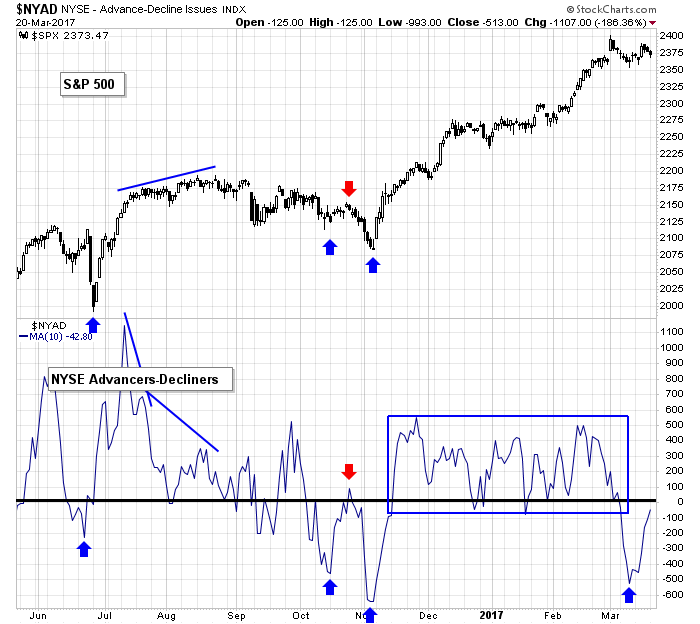

By now you know the following chart, and others like it, are my guide. If the 10-day of the AD line at the NYSE gets above 0 and stays there, buy dips. The market is going higher. If it gets rejected, like last October, don’t buy dips. The market will move down further.

Stock headlines from barchart.com…

Facebook (FB +0.07%) rose nearly 1% in pre-market trading after it was upgraded to ‘Buy’ from ‘Neutral’ at BTIG with a price target of $175.

Progressive Corp (PGR -0.22%) was upgraded to ‘Buy’ from ‘Hold’ at Sandler O’Neill with a 12-month target price of $45.

JM Smucker (SJM -0.04%) was downgraded to ‘Underperform’ from ‘Market Perform’ at Bernstein with a target price of $130.

Kellogg (K -0.17%) was downgraded to ‘Underperform’ from ‘Market Perform’ at Bernstein with a target price of $69.

General Mills (GIS -0.66%) was downgraded to ‘Underperform’ from ‘Market Perform’ at Bernstein with a 12-month target price of $52.

Dave & Busters (PLAY -0.45%) was initiated with a ‘Buy’ at Maxim Group LLC with a price target of $72.

Campbell Soup (CPB -0.34%) was downgraded to ‘Underperform’ from ‘Market Perform’ at Bernstein with a price target of $54.

Veritex Holdings (VBTX -0.64%) was initiated with a ‘Buy’ at DA Davidson with a price target of $34.

Carnival Cruise Lines (CCL +0.21%) was upgraded to ‘Outperform’ from ‘Market Perform’ at William Blair with a price target of $59.

Triumph Bancorp (TBK -3.54%) was rated a new ‘Buy’ at DA Davidson with an 18-month target price of $31.

Conagra Brands (CAG -1.45%) was downgraded to ‘Underperform’ from ‘Market Perform’ at Bernstein with a price target of $36.

La Jolla Pharmaceuticals (LJPC +7.13%) dropped over 3% in after-hours trading after it announced a proposed underwritten public offering of $100 million of its common stock.

Genesis Energy LP (GEL +1.17%) lost nearly 2% in after-hours trading after it announced a public offering of 4 million units.

Merit Medical Systems (MMSI +0.64%) fell 3% in after-hours trading after it announced a public offering of $125 million of common stock.

Calithera Biosciences (CALA -0.40%) slumped nearly 7% in after-hours trading after it announced a proposed underwritten public offering of 4.5 million shares of its common stock.

Golub Capital BDC (GBDC +0.10%) lost over 2% in after-hours trading after it announced a 1.75 million share public offering of its common stock.

Ocular Therapeutix (OCUL +3.89%) dropped over 4% in after-hours trading after CFO Brad Smith announced his resignation effective March 31 to pursue other opportunities.

Today’s Economic Calendar

8:30 Current Account

8:55 Redbook Chain Store Sales

12:00 PM Fed’s George speech

6:00 PM Fed’s Mester speech

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY