Good morning. Happy Wednesday.

The Asian/Pacific markets got hit hard. Japan dropped 2%; Hong Kong, Singapore, Australia and India lost more than 1%. Europe is currently down across-the-board. The Netherlands, Poland, Turkey and Norway are down more than 1%; Germany, France, the UK, Austria, Belgium, Sweden, Switzerland, the Czech Republic, Denmark and Finland are also weak. Futures in the States point towards a slight down open for the cash market.

—————

VIDEO: LeavittBrothers.net Overview

—————

The dollar is up a small amount. Oil and copper are down. Gold and silver are down. Bonds are up.

The market got hit yesterday…it’s biggest single-day drop since the ECB news last September.

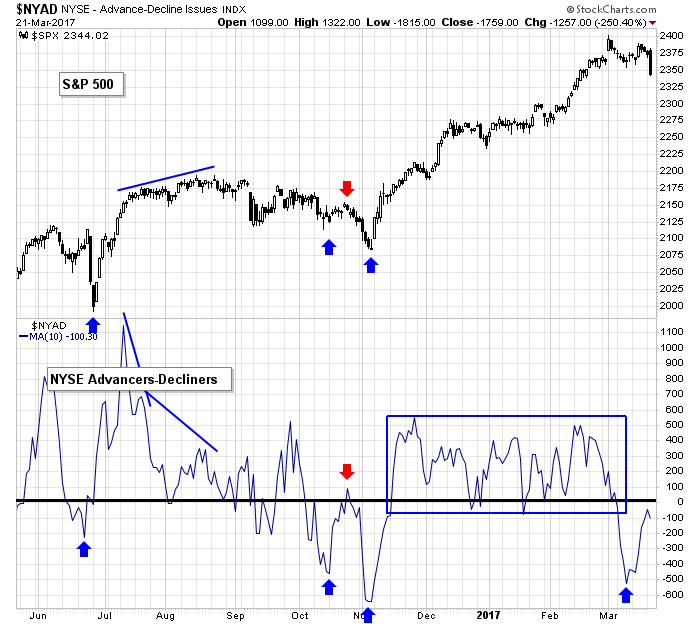

There have been plenty of warnings the last month – most of them discussed in LB Weekly. Many breadth indicators had fallen off, and there’s been a lack of quality set-ups to be had. The overall trend remains solidly up, and I’m sticking with my opinion new highs will continue to be made but in the near term things have turned from neutral to down.

The following remains my guide. If the 10-day of the NYSE AD line fails to get above 0, the market will not move up. So far this is the case. Strong markets, or even flat-ish markets, are characterized by advancers out-numbering decliners.

Stock headlines from barchart.com…

L Brands (LB -2.54%) was downgraded to ‘Underweight’ from ‘Sector Weight’ at Keybanc.

General Mills (GIS -0.83%) was downgraded to ‘Hold’ from ‘Buy’ at Stifel.

Anerican Airlines Group (AAL -3.07%) was downgraded to ‘Equalweight’ from ‘Overweight’ at Morgan Stanley.

FedEx (FDX -0.22%) rose 3% in after-hours trading after the CEO said he sees an “excellent” fiscal Q4.

Nike (NKE -1.14%) lost almost 4% in after-hours trading after it reported Q3 revenue of $8.43 billion, below consensus of $8.47 billion, and said worldwide futures orders ex-currency were down 1%, weaker than estimates of up 3.4%.

Duluth Holdings (DLTH -0.21%) surged 19% in after-hours trading after it reported Q4 adjusted EPS of 37 cents, higher than consensus of 34 cents, and then said it sees full-year sales of $445 million to $465 million, above consensus of $444.2 million.

REGENXBIO (RGNX -8.30%) slid 6% in after-hours trading after it proposed a public offering of $75 million of its common stock.

AAR Corp (AIR -4.02%) jumped nearly 6% in after-hours trading after it reported Q3 sales of $446.7 million, above consensus of $418.5 million.

Silver Wheaton (SLW -0.45%) gained over 2% in after-hours trading after it reported Q4 revenue of $258 million, higher than consensus of $243.3 million.

HealthEquity (HQY -5.03%) rose 3% in after-hours trading after it reported Q4 revenue of $46.8 million, better than consensus of $45.6 million.

Snap (SNAP +2.26%) gained 1% in after-hours trading after it was rated a new ‘Buy’ at Drexel Hamilton with a price target of $30.

Easterly Government Properties (DEA +0.82%) slid nearly 4% in after-hours trading after it commenced a public offering of 4.3 million shares of its common stock.

Synergy Pharmaceuticals (SGYP -8.64%) gained 1% in after-hours trading after it slumped nearly 9% Tuesday and BTIG said that weakness has created a buying opportunity for the stock.

Tuesday’s Key Earnings

FedEx (NYSE:FDX) +2.1% AH with better Ground margins.

General Mills (NYSE:GIS) -0.8% on mixed results.

Nike (NYSE:NKE) -4% AH following tepid U.S. growth.

Today’s Economic Calendar

MBA Mortgage Applications

9:00 FHFA House Price Index

10:00 Existing Home Sales

10:30 EIA Petroleum Inventories

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

5 thoughts on “Before the Open (Mar 22)”

Leave a Reply

You must be logged in to post a comment.

more games today. Looking for bargains T, V, are interesting.

Is your chart from the paid version of stockcharts ?

I did create it within my account. I’ve never tried to create it while logged out. Give it a shot.

oil has been down pretty much every day for a while. gives me a mini free fall feeling. but the medium term chart looks like a bullish flag after a big rally. and the long term chart resembles an inverse head and shoulders pattern, though not the prettiest, most symmetric, or textbook one i have seen.

so there you have it, no matter what happens next, you heard it from me right here. lol

RUT says buy NASDAQ says sell. Put call ratio is too high. I favor a bounce here but not worth the risk.