Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Japan, South Korea and India did well; Hong Kong and Malaysia were weak. Europe is currently mostly up. France, Germany, Denmark, Hungary, Spain, Italy, Belgium, Portugal and Austria are leading the way. Futures in the States point towards a moderate gap up open for the cash market.

—————

VIDEO: The Trend is Your Friend

—————

The dollar is down slightly. Oil and copper are down. Gold and silver are down. Bonds are down.

Fed day was a nonevent. There was such little reaction after the release of the statement that you can’t tell looking at an intraday chart when the announcement was made.

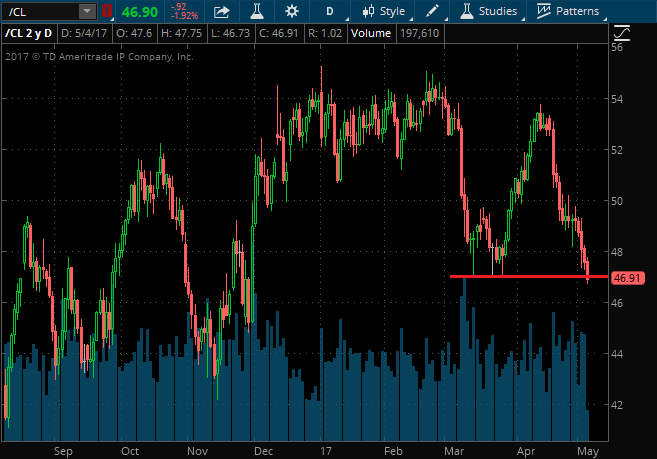

Oil is down almost a buck and now has a 46 handle. This is the lowest print since November. LB subscribers have been out of oil for several months – no reason to be long the single worst performing group.

Tesla is going to take a hit at today’s open. Facebook is also down in premarket trading.

The S&P is in resting mode. It gapped up on April 24 and followed through on April 25 and since then has had seven consecutive closes within close range. Using a line chart, there has been virtually no change from one close to the next.

The Nas has more of an uptrend to it while the RUssell is drifting back into its range.

Stock headlines from barchart.com…

Facebook (FB -0.64%) fell fell -1% in overnight trading after it said that it expects revenue growth to slow “meaningfully” when it slows the frequency of news-feed advertising later this year.

Tesla (TSLA -2.47%) said its Model 3 timeline is intact. Tesla Q1 adjusted EPA was larger than expected.

GoDaddy (GDDY -2.29%) fell -3% in after-hours trading after a new-share filing

AIG (AIG +0.02%) rallied by more than 1% in after-hours trading on positive Q1 EPS and a hike in stock buybacks.

Stamps.com (STMP +0.59%) rallied by +1.3% ion after-hours trading after providing positive annual EPS guidance.

Prudential Financial (PRU +0.86%) rallied by 1% in after-hours trading after a Q1 adjusted EPS beat.

Centurylink (CTL -2.04%) fell 4% in after-hours trading after missing Q1 earnings.

Cheesecake Factory (CAKE +1.79%) fell 8% in after-hours trading after a Q1 revenue miss.

Avis (CAR -2.06%) fell 6% in after-hours trading a Q1 earnings miss on higher costs and pricing pressure.

Wednesday’s Key Earnings

AIG (NYSE:AIG) +1.4% AH boosting its buyback.

Facebook (FB) -1.5% AH changing its earnings style.

Fitbit (NYSE:FIT) +9% AH turning a corner?

Groupon (NASDAQ:GRPN) -13.3% as revenues shrunk.

Kraft Heinz (NASDAQ:KHC) -1.6% AH with declining U.S. sales.

Southern Co. (NYSE:SO) unmoved after strong earnings.

Sprint (NYSE:S) -14.3% missing profit estimates.

Square (NYSE:SQ) +5% AH raising its outlook.

Tesla (TSLA) -1.4% AH following a Q1 loss.

Time Warner (NYSE:TWX) flat despite topping expectations.

Today’s Economic Calendar

Chain Store Sales

7:30 Challenger Job-Cut Report

8:30 Initial Jobless Claims

8:30 Productivity and Costs

8:30 Gallup Good Jobs Rate

8:30 International Trade

9:45 Bloomberg Consumer Comfort Index

10:00 Factory Orders

10:30 EIA Natural Gas Inventory

4:30 Money Supply

4:30 Fed Balance Sheet

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (May 4)”

Leave a Reply

You must be logged in to post a comment.

Voting on some money today in the Congress health care, and more earnings. But this weekend France votes. more excitement does the euro live or wilt?