Good morning. Happy Monday. Hope you had a great weekend.

The Asian/Pacific markets closed mixed and little changed. Hong Kong, India and Taiwan did the best; New Zealand and Philippines lagged. Europe currently leans to the upside but is also little changed. Turkey, Norway and Austria are doing the best. Futures in the States point towards a mixed and flat open for the cash market.

—————

VIDEO: LeavittBrothers.net Overview

—————

The dollar is down. Oil is up big; copper is up. Gold and silver are up. Bonds are down.

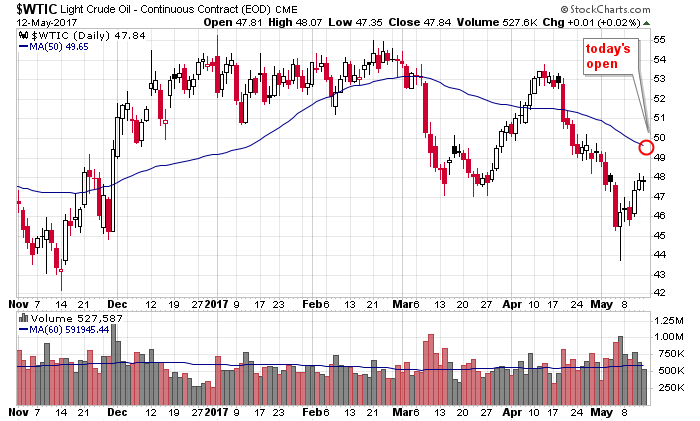

Markets around the world are relatively quiet and unchanged. Almost no major indexes have moved more than 1%. The big weekend news comes from the oil sector, where Saudi Arabia and Russia said oil production cuts will extend from the middle of this year to March 2017, longer than expected. As of this writing, crude is up $1.64 to $49.44, just below the 50-day MA. Here’s the chart.

Aramco, Saudi Arabia’s national oil company is going public with a possible market cap of $2 trillion. It’s not going to happen until 2018 or 2019, but still, you can bet your last dollar Saudi Arabia isn’t going to let oil fall too much. The value of the company will be closely linked to the price of oil at time they go public. They’ll do whatever is necessary to keep it, so they can raise as much money as possible.

Software security fears over the weekend are boosting cybersecurity stocks.

Otherwise my conclusion from the weekly report published yesterday morning was that the long term trend remains solidly in place, but near term I would not be surprised to see a little give back. While the market has traded very quietly the last 2-3 weeks, the internals have weakened. Some are sitting at levels that would suggest the bulls need to hold the line or risk losing control in the near term for a short period. Nothing tells me a trend change is underway – just some near term weakness more possible now than in the last few weeks.

Stock headlines from barchart.com…

Cisco (CSCO -0.54%) climbed nearly 2% in pre-market trading after it was upgraded to ‘Overweight’ from ‘Equal-Weight’ at Morgan Stanley with a price target of $39.

Johnson & Johnson (JNJ +0.36%) was upgraded to ‘Overweight’ from ‘Neutral’ at JP Morgan Chase with a price target of $140.

Acadia Health (ACHC +0.59%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Leerink Partners LLC.

JC Penney (JCP -13.99%) was downgraded to ‘Hold’ from ‘Buy’ at Deutsche Bank.

TD Ameritrade (AMTD -1.30%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Wells Fargo with a price target of $44.

Starbucks (SBUX -0.56%) was upgraded to ‘Buy’ from ‘Hold’ at Deutsche Bank with a price target of $69.

Xylem (XYL +0.20%) was upgraded to ‘Overweight’ from ‘Equal Weight’ at Barclays with a price target of $59.

Cimarex Energy (XEC -0.84%) was upgraded to ‘Buy’ from ‘Hold’ at Williams Capital with a price target of $160.

Buffalo Wild Wings (BWLD -0.19%) was upgraded to ‘Buy’ from ‘Hold’ at Deutsche Bank with a price target of $180.

Tesla (TSLA +0.53%) is down over 2% in pre-market trading after it was downgraded to ‘Equal-Weight’ from ‘Overweight.’

Avis Budget Group (CAR -1.65%) fell 2% in after-hours trading after CFO David Wyshner resigned, effective next month, to pursue other opportunities.

Progressive (PGR -0.62%) announced that its board authorized the repurchase of up to 25 million of its common shares.

Allscripts Healthcare Solutions (MDRX -2.53%) announced that Dennis Olis has been named interim CEO and will replace Melinda Whittington who is leaving the company.

Today’s Economic Calendar

8:30 Empire State Mfg Survey

10:00 NAHB Housing Market Index

4:00 PM Treasury International Capital

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (May 15)”

Leave a Reply

You must be logged in to post a comment.

Watching the US market for a bearish reversal of the price line giving us a bear. European markets seem to be more bullish. Seasonality is warning it can not to be ignored and that the fall is likely be critical.