Good morning. Happy Friday.

The Asian/Pacific markets leaned to the downside. Japan, South Korea, New Zealand, Australia and Singapore posted losses; China and Indonesia posted gains. Europe is currently mixed. Russia and Greece are down; Turkey, Switzerland, Norway, Hungary and Italy are up. Futures in the States point towards a down open for the cash market.

The dollar is flat. Oil is flat; copper is up. Gold and silver are up. Bonds are up.

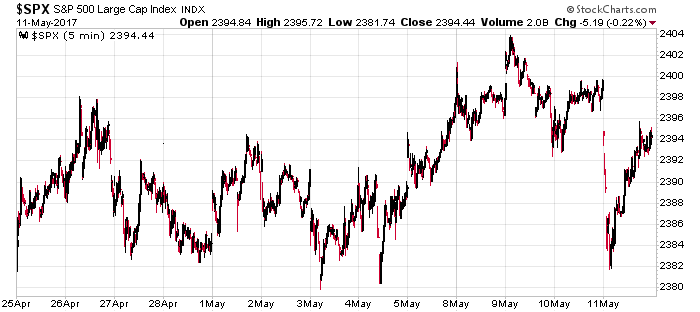

This is the S&P over the last 13 days – a 24-point, or 1%, range. Individual stocks are moving – mostly because of earnings-related gaps – but everything is canceling out and resulting in the overall market going nowhere.

Unfortunately this has left us with very few good trading opportunities. Despite the overall trend, there just isn’t much out there to get excited about.

Stock headlines from barchart.com…

Nordstrom (JWN -7.60%) fell over 3% in pre-market trading after it reported total Q1 comparable-store-sales fell -0.8%, weaker than consensus of unchanged.

General Electric (GE +0.59%) fell over 1% in pre-market trading after it was downgraded to ‘Sell’ from ‘Hold’ at Deutsche Bank.

Hain Celestial Group (HAIN +0.22%) jumped 7% in after-hours trading after it said an internal accounting review was near completion and it will be able to file reports by the end of May.

CyberArk Software Ltd (CYBR -0.18%) dropped over 6% in after-hours trading after it said it sees full-year adjusted EPS of $1.18-$1.22, below consensus of $1.24.

Twilio (TWLO -0.64%) rose nearly 3% in after-hours trading on signs of insider buying after Chairman and CEO Jeff Lawson disclosed a May 10 purchase of 100,000 shares at $23.43.

Spark Therapeutics (ONCE -2.63%) lost over 1% in after-hours trading after 840,000 shares were offered via Morgan Stanley at $56.75-$57.00

Trade Desk (TTD -0.40%) rallied sharply by 17% in after-hours trading after it reported Q1 adjusted EPS of 18 cents, well above consensus of 1 cent, and said it sees Q2 revenue of $67 million, higher than consensus of $60.7 million.

Darling Ingredients (DAR +0.13%) lost 3% in after-hours trading after it reported Q1 adjusted Ebitda of $102.5 million, below consensus of $107.0 million.

CA Inc (CA -0.71%) rose 4% in after-hours trading after it reported Q4 adjusted EPS from continuing operations of 54 cents, higher than consensus of 49 cents.

Presidio (PSDO +0.50%) tumbled nearly 8% in after-hours trading after it reported Q1 revenue of $628.8 million, weaker than consensus of $689.2 million.

Akari Therapeutics PLC (AKTX +4.45%) tumbled over 15% in after-hours trading after CEO Dr. Gur Roshwalb was placed on administrative leave while a review on Edison Investment Research report on “Akari’s Coversin matches Soliris in Phase 2,” which contained “material inaccuracies,” is pending.

Pandora Media (P -4.52%) gained nearly 2% in after-hours trading after Point 72 Asset Management LP reported a 5.4% stake in the company.

Thursday’s Key Earnings

Nordstrom (NYSE:JWN) -4.1% AH on falling comps.

Macy’s (NYSE:M) -17% as weak sales continued.

Teva (NYSE:TEVA) +2% with plans to offload assets.

Today’s Economic Calendar

8:30 Consumer Price Index

8:30 Retail Sales

9:00 Fed’s Evans: Monetary Policy

10:00 Business Inventories

10:00 Consumer Sentiment

12:30 PM Fed’s Harker: Economic Outlook

1:00 PM Baker-Hughes Rig Count

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

3 thoughts on “Before the Open (May 12)”

Leave a Reply

You must be logged in to post a comment.

Retail is weak, housing up, Consumers are very unsure and will remain that way for some time. International stocks, small cap and avoid technology.

I think investors around the world have good reason to stock up on gold. I also think miners have a good reason to start pointing the path higher for the metals.;-D

http://stockcharts.com/h-sc/ui?s=JNUG&p=D&yr=0&mn=6&dy=0&id=p85394776442

there is to be a invasion of telepathic marsian panda bears,american eagle bears australian golden kolala

bears and kangaroos

did nas 100 just top as adam and eve just eat a apple that had worms and will sue the internet in tort for nervios dispepsia causing gold to go up