Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed and little changed. China and the Philippines did well; South Korea was weak. Europe currently leans to the upside. Poland, France, Finland, the Netherlands, Italy and Belgium are up; Greece and Denmark are down. Futures in the States point towards a flat-to-up open for the cash market.

—————

VIDEO: LeavittBrothers.net Overview

—————

The dollar is up. Oil and copper are down. Gold and silver are down. Bonds are down.

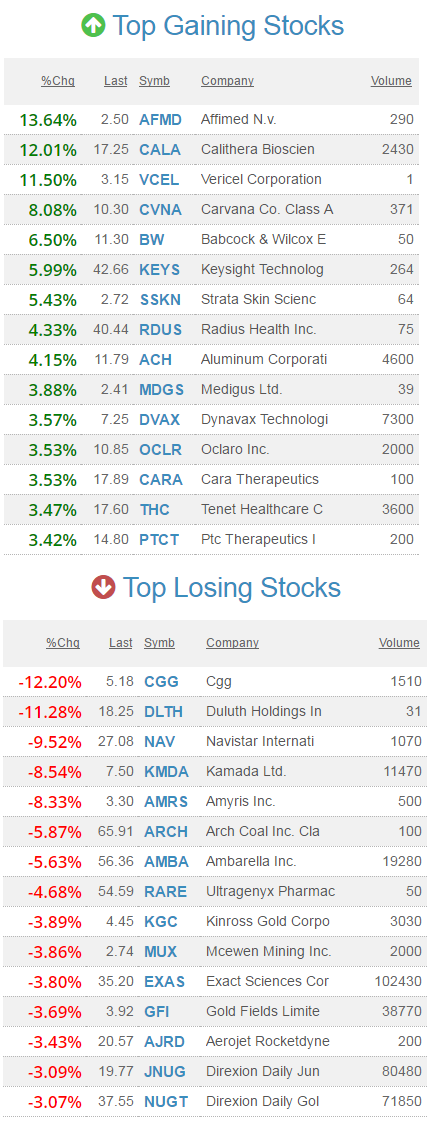

Premarket movers from thestockmarketwatch.com…

Stock headlines from barchart.com…

Humana (HUM +0.32%) was rated a new ‘Overweight at Morgan Stanley with a price target of $262.

UnitedHealth Group (UNH +0.81%) was rated a new ‘Overweight at Morgan Stanley with a price target of $202.

Cigna (CI +0.45%) was rated a new ‘Overweight at Morgan Stanley with a price target of $184.

Dave & Buster’s Entertainment (PLAY +2.95%) lost nearly 3% in after-hours trading after it reported Q1 comparable same-store sales were up +2.2%, below consensus of +2.7%.

Analogic (ALOG -0.60%) sank 10% in after-hours trading after it said it sees full-year revenue down low to mid-single digits and lowered guidance on full-year adjusted EPS to $2.40-$2.70 from a prior view of $3.00-$3.45.

Oxford Industries ({=OXM =}) slid 2% in after-hours trading after it said it sees Q2 adjusted EPS of $1.35-$1.45, weaker than consensus of $1.54.

Ambarella (AMBA +1.31%) dropped over 6% in after-hours trading after it said it see Q2 revenue of $69 million-$72 million, below consensus of $72.52 million.

Keysight Technologies (KEYS +0.83%) climbed over 6% in after-hours trading after it said it sees Q3 adjusted revenue of $840 million-$880 million, the midpoint above consensus of $842.86 million.

United Natural Foods (UNFI -1.14%) slid 2% in after-hours trading after it reported Q3 revenue of $2.37 billion, less than consensus of $2.42 billion, and then said it sees full-year revenue of $9.29 billion-$9.34 billion, below consensus of $9.36 billion.

Exact Sciences (EXAS -1.29%) fell over 2% in after-hours trading after it announced an agreement to sell 7.0 million shares of its common stock in an underwritten public offering.

Duluth Holdings (DLTH -0.29%) tumbled 11% in after-hours trading after it reported Q1 EPS of 1 cents, much weaker than consensus of 5 cents.

Sigma Designs (SIGM +0.81%) dropped almost 5% in after-hours trading after it reported a Q1 adjusted loss per share of -25 cents, wider than consensus of -21 cents.

Golub Capital BDC Inc (GBDC -1.60%) lost over 1% in after-hours trading after it announced that it plans to make a public offering on 1.75 million shares of its common stock.

Carvana (CVNA +5.89%) jumped almost 10% in after-hours trading after it reported Q1 net sales and operating revenues of $159.1 million, above consensus of $157.6 million, and sad it sees 2017 revenue of $850 million-$910 million, the mid-point well above consensus of $854.4 million.

Dynavax Technologies (DVAX +1.45%) rose nearly 3% in after-hours trading after holder Point72 Asset Management boosted its passive stake in the company to 5.2% from 1.5%.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:30 Gallup U.S. Job Creation Index

10:30 EIA Petroleum Inventories

3:00 PM Consumer Credit

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

3 thoughts on “Before the Open (Jun 7)”

Leave a Reply

You must be logged in to post a comment.

Waiting, beginning new stock IVAL which is a another management style with a longer term perspective –i am told by WSJ. Where is everyone????? vacation???

The current administration needs to do something.

Trump cannot fun country like a Casino.

Or market will go nowhere this summer.

I meant run not “fun.”