Good morning. Happy Tuesday.

The Asian/Pacific markets closed with a lean to the downside. Japan, India, Australia, Indonesia and the Philippines were weak. Europe is currently mostly down. France, Germany, Greece, Switzerland, Norway, Hungary and Belgium are weakest. Futures in the States point towards a moderate gap down open for the cash market.

—————

SUBSCRIBE to LB Weekly – it’s only $12.40/month when you sub for a year.

—————

The dollar is down. Oil is down a small amount; copper is down. Gold and silver are up solidly. Bonds are up.

Yesterday the small and mid caps posted moderate losses while the S&P traded in a super small range.

In the near term there’s lots of potential market-moving news pending. James Comey will be testifying. British election and ECB meeting this week. Next week there’s an FOMC meeting and options expire.

The overall trend is up, and those who’ve simply stayed in that direction have been richly rewarded. Yes there will be disruptions along the way, but your odds of success are significantly higher if you align yourself with the overall trend.

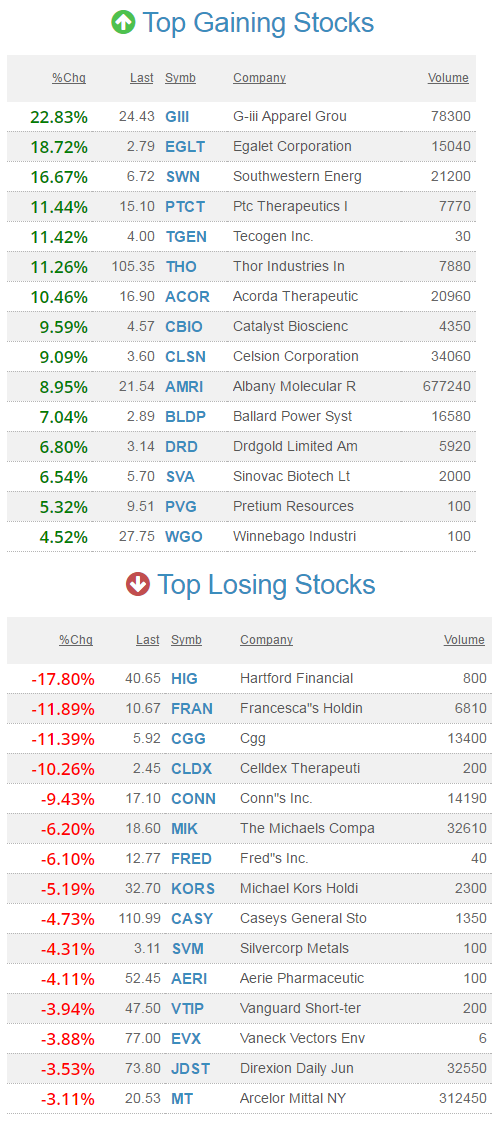

Premarket movers from thestockmarketwatch.com…

Stock headlines from barchart.com…

Cognizant (CTSH +0.13%) was downgraded to ‘Hold’ from ‘Buy’ at Societe Generale.

ITT Inc (ITT -0.62%) was downgraded to ‘Neutral’ from ‘Buy’ at Goldman Sachs.

Old Dominion Freight Line (ODFL +1.22%) was upgraded to ‘Neutral’ from ‘Underperform’ at Bank of America/Merrill Lynch with a price target of $96.

Thor Industries (THO +1.12%) climbed almost 5% in after-hours trading after it reported Q3 EPS from continuing operations of $2.11, better than consensus of $1.87.

MRC Global (MRC +1.51%) was rated a new ‘Buy’ at Stifel with a price target of $22.

Casey’s General Stores (CASY +0.11%) fell 4% in after-hours trading after it reported Q4 EPS of 76 cents, below consensus of 85 cents.

Signet Jewelers Ltd (SIG -0.26%) dropped nearly 4% in after-hours trading after COO Bryan Morgan resigned on Jun 2 due to violations of company policy unrelated to financial matters.

Resolute Energy (REN -1.50%) rose almost 5% in after-hours trading after it said it began a registered-exchange offer to exchange up to $125 million its outstanding 8.5% senior notes due 2020.

Alere (ALR -0.49%) moved up over 2% in after-hours trading after it filed a 10-K for 2016 after months of delay and reported Q4 revenue of $597 million, right on consensus.

Coupa Software (COUP -0.44%) gained over 2% in after-hours trading after it reported Q1 revenue of $41.1 million, above consensus of $38.33 million, and then raised its view for full-year revenue to $172 million-$175 million, better than consensus of $168.71 million.

Acorda Therapeutics (ACOR +0.66%) jumped over 6% in after-hours trading after it hit its goal and showed statistically significant improvement in motor function versus a placebo in a Phase 3 trial of CVT-301 on patients with Parkinson’s disease.

Today’s Economic Calendar

8:30 Gallup US ECI

8:55 Redbook Chain Store Sales

10:00 Job Openings and Labor Turnover Survey

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (Jun 6)”

Leave a Reply

You must be logged in to post a comment.

WSJ page A17,Malkiel says index funds beat active portfolio mgt. Today looks like a downer. Four legislative weeks to recess. So MALKIEL is ri right for another reason?????