Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. China and Hong Kong moved up; Japan and the Philippines moved up. Europe currently leans to the upside. Poland, Greece, Hungary, Spain and Italy are doing well; Russia, Switzerland, Norway and Portugal are weak. Futures in the States point towards a positive open for the cash market.

—————

VIDEO: My Favorite Intermediate Term Setup

—————

The dollar is up. Oil is down; copper is up. Gold and silver are down. Bonds are down.

The James Comey hearing begins at 10:00 this morning.

The UK is heading to the polls for parliamentary elections.

The ECB meets to discuss rates.

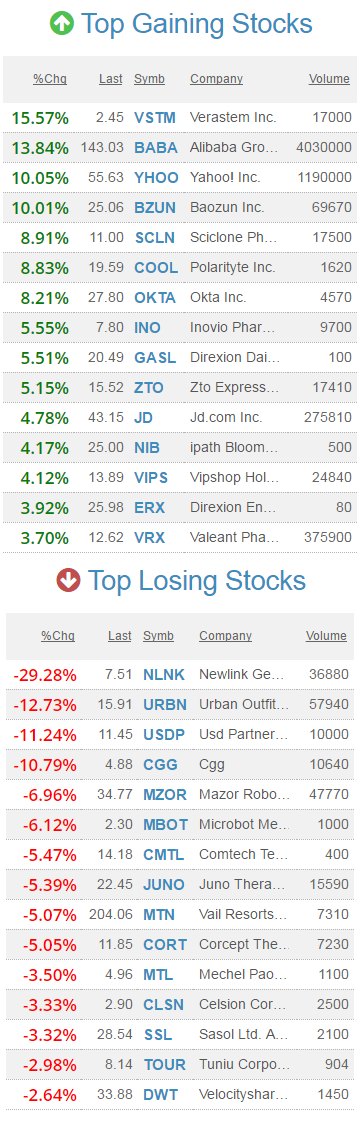

Premarket movers from thestockmarketwatch.com…

Stock headlines from barchart.com…

Sanderson Farms (SAFM +2.37%) was initiated with a ‘Buy’ at Mizuho Securities USA with a 12-month target price of $142.

T-Mobile (TMUS -0.29%) was initiated with a ‘Buy’ at Drexel Hamilton with a price target of $80.

Molson-Coors Brewing (TAP -6.50%) was downgraded to ‘Sell’ from ‘Neutral’ at Bryan Garnier.

Brown-Forman ({=BF/B=}) was downgraded to ‘Neutral’ from ‘Outperform’ at Credit Suisse.

Kite Pharma (KITE +7.12%) was upgraded to ‘Buy’ from ‘Neutral’ at BTIG LLC with a 12-month target price of $100.

Tyson Foods (TSN +1.85%) was initiated with a ‘Buy’ at Mizuho Securities USA with a 12-month target price of $71.

Deckers Outdoor (DECK +0.23%) lost 1% in after-hours trading after it was downgraded to ‘Neutral’ from ‘Buy’ at Buckingham Research.

Argan (AGX +1.32%) rose 4% in after-hours trading after it reported Q1 revenue of $230.5 million, higher than consensus of $190.5 million.

Greif (GEF +1.07%) tumbled over 9% in after-hours trading after it reported Q2 adjusted EPS of 67 cents, below consensus of 74 cents.

Verint Systems (VRNT -1.29%) rallied over 3% in after-hours trading after it reported Q1 adjusted EPS of 49 cents, well above consensus of 39 cents.

Okta (OKTA +3.38%) climbed over 5% in after-hours trading after it reported Q1 revenue of $53 million, above consensus of $48.22 million, and then said it sees full-year revenue of $233 million-$236 million, higher than consensus of $226.8 million.

MidSouth Bancorp (MSL +1.08%) dropped nearly 4% in after-hours trading after it announced that it had commenced a public offering of $50 million of its common stock.

Tailored Brands (TLRD +5.75%) gained nearly 2% in after-hours trading after it reported Q1 adjusted EPS of 27 cents, better than consensus of 19 cents.

Today’s Economic Calendar

8:30 Initial Jobless Claims

9:45 Bloomberg Consumer Comfort Index

10:00 Quarterly Services Report

10:30 EIA Natural Gas Inventory

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

2 thoughts on “Before the Open (Jun 8)”

Leave a Reply

You must be logged in to post a comment.

SPHD good dividend stock 3.8%. No idea of what today’s market can do, but seasonality is in the wind.

market is in its own World/