Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. South Korea, Singapore and the Philippines led to the upside; Hong Kong and Indonesia were weak. Europe is currently mostly up. The Uk, France, Turkey, Germany, Finland, the Netherlands, Belgium, Portugal and Austria are doing the best. Futures in the States point towards a positive open for the cash market.

—————

VIDEO: My Favorite Intermediate Term Setup

—————

The dollar is up. Oil is down slightly; copper is up. Gold and silver are down. Bonds are down.

In the UK, the Labour party gained many seats, resulting in a hung parliament. This will prevent the Conservative party from executing on its desires without hurdles.

It’s been a quiet week in the US so far. Most of the indexes are flat; the small caps have done well.

Next week there’s an FOMC meeting. It’s not agreed what they’ll do. Some say not rate hike; but the market is near its highs, and the employment situation is is very good. What would cause them to hold off?

The overall trend is solidly up. The market continues to absorb external news items. Be on the side of the trend. That’s where you’re odds are heavily in your favor.

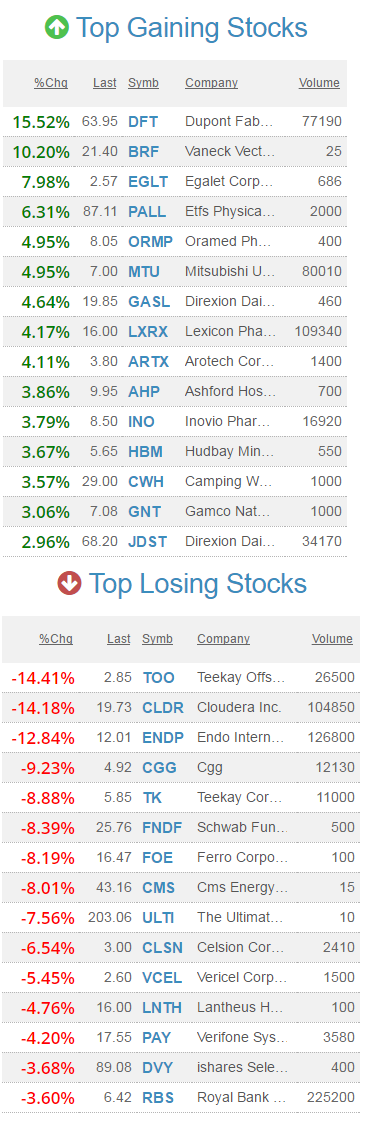

Premarket movers from thestockmarketwatch.com…

Stock headlines from barchart.com…

Nvidia (NVDA +7.26%) rose over 2% in pre-market trading after Citigroup said the stock may double over the next 12-months in a bull-case scenario.

Nordstrom (JWN +10.25%) was downgraded to ‘Neutral’ from ‘Buy’ at Guggenheim Securities.

Starbucks (SBUX -1.98%) was initiated with a ‘Buy’ at Mizuho Securities USA with a 12-month target price of $75.

Hasbro (HAS +0.10%) was initiated with a ‘Buy’ at Jeffries with a 12-month target price of $125.

McDonald’s (MCD -0.34%) was initiated with a ‘Buy’ at Mizuho Securities USA with a 12-month target price of $168.

Actuant (ATU +2.45%) slid nearly 6% in after-hours trading after it lowered guidance on Q3 adjusted EPS to 30 cents-33 cents from a March 22 view of 38 cents-43 cents.

VeriFone Systems (PAY +2.12%) lost over 2% in after-hours trading after it said it sees Q3 adjusted EPS of 35 cents-36 cents, below consensus of 40 cents, and then said it sees full-year adjusted EPS of $1.32-$1.34, weaker than consensus of $1.37.

Monroe Capital (MRCC -0.26%) slid over 1% in after-hours trading after it announced that it had commenced an underwritten public offering of shares of its common stock, although no size was given.

Limoneira (LMNR +6.29%) climbed 4% in after-hours trading after it reported Q2 EPS of 24 cents, better than consensus of 18 cents, and then raised guidance on fiscal 2017 EPS to 51 cents-55 cents from a March 13 view of 48 cents-52 cents.

Endo Pharmaceuticals (ENDP +11.13%) dropped over 13% in after-hours trading after he FDA asked that Endo pull its Opana ER painkiller from the market due to abuse risks.

Collegium Pharmaceutical (COLL +2.77%) rose 5% in after-hours trading after the FDA asked Endo Pharmaceuticals to remove its Opana ER painkiller from the market due to abuse risks. Collegium sells Xtamza ER, an abuse-deterrent form of oxycodone.

Applies Genetic Technologies (AGTC +3.09%) climbed almost 4% in after-hours trading after it said it will announce top-line safety data from its Phase 1/2 X-linked retinoschisis study on June 10 at the Macula Society annual meeting in Singapore.

Zynga (ZNGA -0.28%) gained almost 3% in after-hours trading after it was upgraded to ‘Overweight’ from ‘Equal-Weight’ by Morgan Stanley.

Today’s Economic Calendar

10:00 Wholesale Trade

1:00 PM Baker-Hughes Rig Count

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

4 thoughts on “Before the Open (Jun 9)”

Leave a Reply

You must be logged in to post a comment.

China is ready to move, so look for vehicles for the ride.

Never short a dull market.

Enjoyed the video.

Thanks Jason

RUT hits all time high and NASDAQ at 10 day low?

Never happened before!

Look forward to Jason”s take!