Good morning. Happy Monday. Hope you had a good weekend.

The Asian/Pacific markets were weak today. Hong Kong, South Korea and Taiwan fell more than 1%; Japan, China and India also posted noticeable losses. Europe is currently mostly down. Poland, France, Germany, Finland, Spain, the Netherlands, Italy, Austria, Belgium, Portugal and Sweden are down about 1% each (give or take a little). Futures in the States point towards a down open for the cash market.

—————

VIDEO: LeavittBrothers.net Overview

—————

The dollar is down. Oil is up; copper is down. Gold and silver are down. Bonds are down.

The selling pressure that took place in big-cap tech stocks on Friday has continued. Facebook, Amazon, Nvidia, Apple, Google, Netflix, Microsoft and others are all down more than 1% in premarket trading.

Coming into this week the question was whether Friday’s selling was a 1-day event or was a hint of what’s in the pipeline.

In either case I’m confident the market will eventually move back up, but I stress ‘eventually.’ I don’t have a crystal ball.

I continue to favor the long side because odds favor a continuation of what’s taken place, not a change. Even if a top was forming, there would be many months of up and down movement before it was officially in place.

For now I’m standing aside and letting the dust settle. I’ll be a buyer at some point…just don’t know exactly when.

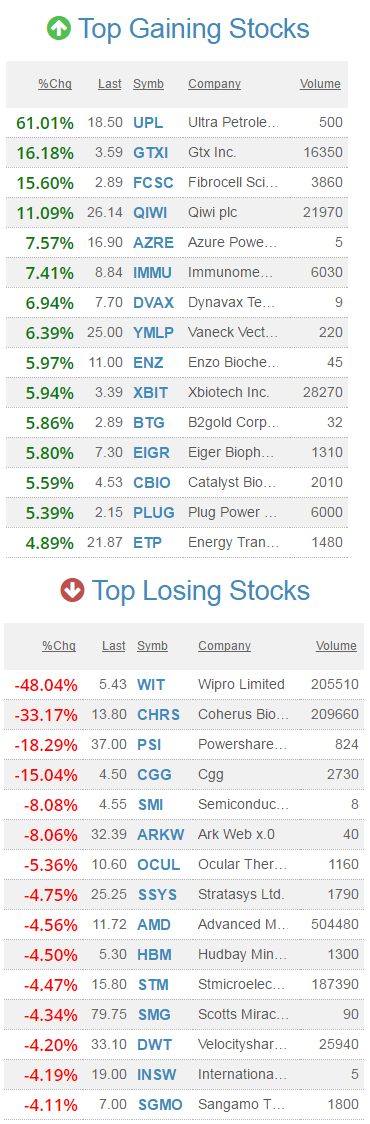

Premarket movers from thestockmarketwatch.com…

Stock headlines from barchart.com…

Apple (AAPL -3.88%) is down 2% in pre-market trading after it was downgraded to ‘Neutral’ from ‘Buy’ at Mizuho Securities.

Adobe Systems (ADBE -3.21%) was downgraded to ‘Sell’ from ‘Hold’ at Pivotal Research Group LLC with a price target of $112.

Crown Castle International (CCI +0.87%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Raymond James.

Pandora Media (P +1.19%) was upgraded to ‘Outperform’ from ‘Market Perform’ at FBR Capital Markets.

Regal Entertainment Group (RGC -1.27%) was downgraded to ‘Sell’ from ‘Neutral’ at MoffetNathanson.

Knight Transport (KNX +1.29%) was upgraded to ‘Overweight’ from ‘Equal-Weight’ at Stephens.

Hilton Worldwide Holdings (HLT -0.42%) climbed over 3% in after-hours trading when it was announced that it will replace Yahoo! in the S&P 500 before the opening on Monday, June 19.

Align Technology (ALGN -1.96%) will replace Teradata (TDC +0.47%) in the S&P 500 before the opening on Monday, June 19.

G1 Therapeutics (GTHX -0.43%) was initiated with a new ‘Buy’ at Needham with a price target of $34.

Ansys (ANSS -1.92%) will replace Ryder System R in the S&P 500 before the opening on Monday, June 19.

Coherus Biosciences (CHRS -9.03%) dropped nearly 6% in after-hours trading after two AbbVie patents on the arthritis drug Humira were rules “unpatentable” by the Patent Trial and Appeal Board.

Ocular Therapeutix (OCUL -1.41%) fell over 2% in after-hours trading after the company confirmed that CMO Jonathan Talamo resigned from his position effective June 15.

Today’s Economic Calendar

1:00 PM Results of $20B, 10-Year Note Auction

2:00 PM Treasury Budget

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

2 thoughts on “Before the Open (Jun 12)”

Leave a Reply

You must be logged in to post a comment.

Fed probably holds the interest rate steady. There is no point in doing anything right now, but the seasonality says this could be the show until the fall.

my dead cats have lost their FANGS

they will be a great lost to the quad witches ,insto market makers

as with most exhaustions they are ”V ” events

as the market making instos take the opposite side of the trades

and their was to many BULL CALLS

thus goldmans say the FANGS ARE OVER PRICED

but a rotation into banks may not happen if fed does not raise rates by 1 %

10 years of BEAR no BULL