Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. China and Indonesia did well; Japan, Hong Kong and Taiwan posted losses. Europe is currently doing well. The UK, Poland, Turkey, Germany, Denmark, Spain and Sweden are up; Russia, Norway and Austria are down. Futures in the States point towards a moderate gap up open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is down. Oil and copper are down. Gold is up; silver is down. Bonds are down.

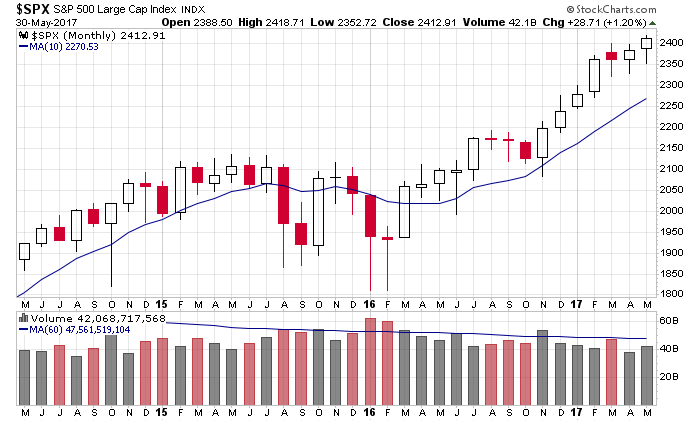

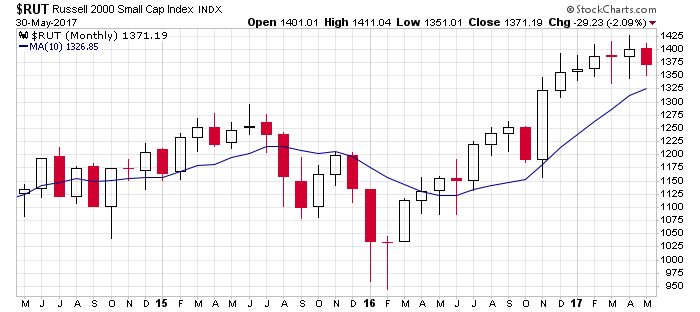

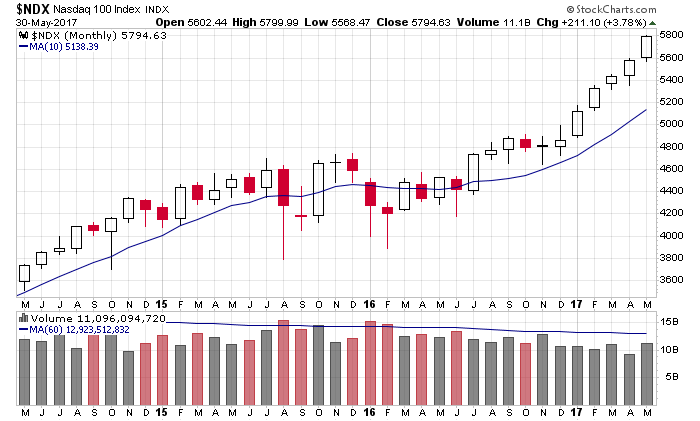

Last day of May. The S&P is up 29 points, or 1.2%. The Russell 2000 is down 29 points, or 2.1%. The Nas 100 is up 211 points, or 3.8%. There’s a big difference between the best and worst. A nearly-4% monthly gain for an index is massive. A 2.1% drop from another index during the same month is noticeable. Here are the charts.

Big-cap tech and boring blue chips are leading. Tesla broke out yesterday to a new high to join Amazon, Netflix, Nvidia, Microsoft and Google. It’s where a lot of money has gone, but 3M, McDonalds, Costco and others like it have done just as well.

The trend is up. Don’t over-analyze.

Stock headlines from barchart.com…

VMware (VMW -0.07%) ws upgraded to ‘Outperform’ from ‘Neutral’ at Baird with a price target of $115.

Irobot (IRBT +2.76%) was downgraded to ‘Hold’ from ‘Buy’ at Canaccord Genuity with a price target of $90.

Gogo (GOGO -0.47%) was initiated with a recommendation pf ‘Outperform’ at Raymond James with a 12-month target price of $15.

Intuitive Surgical (ISRG +0.45%) gained almost 1% in after-hours trading after its da Vinci X Surgical System received FDA clearance in the U.S.

Exact Sciences (EXAS -2.01%) jumped 7% in after-hours trading after UnitedHealth expanded colonography coverage using CT colonography and other preventative care related to colonoscopies.

Mallinckrodt PLC (MNK +0.90%) rose nearly 2% in after-hours trading after Reuters reported that the company is exploring the sale of its generic drug unit.

James River Group Holdings Ltd (JRVR -1.31%) lost over 1% in after-hours trading after it announced a secondary offering of 4.25 million shares by “significant” shareholders.

Apollo Commercial Real Estate Finance (ARI -0.05% slipped 3% in after-hours trading after it announced that it had commenced an underwritten public offering of 12.0 million shares of common stock.

Quanex Building Products (NX -0.26%) rose 5% in after-hours trading after it reported Q2 sales of $209.13 million, better than consensus of $205.5 million.

Extended Stay America (STAY -1.07%) lost almost 1% in after-hours trading after it announced a secondary offering of 25.0 million paired shares with each paired share consisting of a share of common stock of Extended Stay America and a share of Class B common stock of ESH Hospitality.

Hertz Global Holdings (HTZ -0.63%) climbed 3% in after-hours trading after it said it plans a $1 billion sale of secured bonds to refinance debt.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:55 Redbook Chain Store Sales

9:45 Chicago PMI

10:00 Pending Home Sales

2:00 PM Fed’s Beige Book

3:00 PM Farm Prices

7:30 PM Fed’s Williams Speech

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (May 31)”

Leave a Reply

You must be logged in to post a comment.

The economy and consumers in particular are slipping rapidly, but this time is is too late The result is likely to lead to higher volatility and an outcome that may be different than currently rosy U.S. stock investor expectations. Caution is way over due.