Good morning. Happy Thursday (is it really Thursday already).

The Asian/Pacific markets closed mostly up. Japan, Honk Kong, Taiwan, Indonesia, Singapore and Philippines did the best; China lost ground. Europe is currently mostly up. The UK, France, Greece, Finland, Hungary and Italy are leading; Russia is down more than 1%. Futures in the States point towards a positive open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is up. Oil is up; copper is down. Gold and silver are down. Bonds are down.

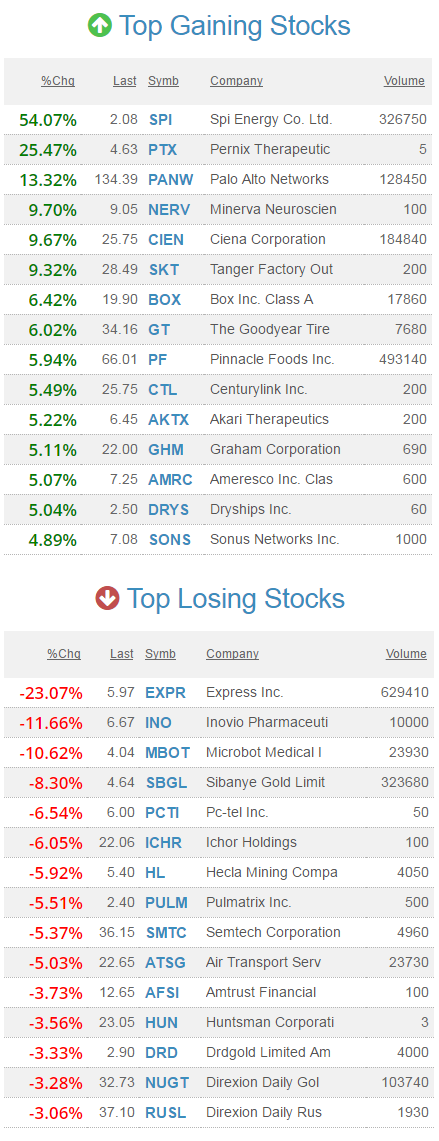

Premarket movers from thestockmarketwatch.com…

Stock headlines from barchart.com…

Goodyear Tire (CTB +0.14%) rose nearly 5% in pre-market trading after it was upgraded to ‘Overweight’ from ‘Underweight’ at Morgan Stanley with a price target of $52.

Illinois Tool Works (ITW +0.09%) climbed over 2% in pre-market trading after it was upgraded to ‘Buy’ from ‘Sell’ at Goldman Sachs with a price target of $155.

Flour (FLR -0.38%) was upgraded to ‘Buy’ from ‘Neutral’ at D.A. Davidson & Co with a 12-month target price of $55.

Palo Alto Networks (PANW +1.36%) rallied 13% in after-hours trading after it reported Q3 revenue of $431.8 million, better than consensus of $411.87 million, and then said it sees Q4 adjusted EPS of 78 cents-80 cents, higher than consensus of 74 cents. Proofpoint (PFPT -0.74%) rose 2% and FireEye (FEYE +0.20%) and Fortinet (FTNT +0.49%) both climbed over 1% in after-hours trading on the news.

Semtech (SMTC +2.83%) dropped 3% in after-hours trading after it reported Q1 net sales of $143.8 million, below consensus of $146.17 million.

Box Inc (BOX +0.70%) climbed over 4% in after-hours trading after it reported Q1 revenue of $117.22 million, better than consensus of $114.92 million, and then raised its view on full-year revenue to $502 million-$506 million from a prior view of $500 million-$504 million.

Caesars Entertainment (CZR -1.35%) was initiated with coverage at Oppenheimer with a recommendation of “Outperform” with an 18-month price target of $15.

Hewlett Packard Enterprise (HPE -0.21%) slipped 2% in after-hours trading after it reported Q2 revenue of $9.9 billion, below consensus of $10.1 billion.

Callon Petroleum (CPE -3.66%) gained almost 1% in after-hours trading after it amended and restated a credit pact for its secured revolving credit facility that boosts the borrowing base by 30% to $650 million.

Minerva Neurosciences (NERV -3.51%) surged 15% in after-hours trading after it said it had amended its pact with Janssen Pharmaceuticals for the MIN-202 drug to treat insomnia were Minerva now has global strategic control over the development of MIN-202.

Wednesday’s Key Earnings

Hewlett Packard Enterprise (NYSE:HPE) -1.1% AH on in-line results.

Palo Alto Networks (NYSE:PANW) +11.9% AH with strong guidance.

Today’s Economic Calendar

Auto Sales

Chain Store Sales

7:30 Challenger Job-Cut Report

8:00 Fed’s Powell speech

8:15 ADP Jobs Report

8:30 Initial Jobless Claims

8:30 Gallup Good Jobs Rate

9:45 PMI Manufacturing Index

9:45 Bloomberg Consumer Comfort Index

10:00 ISM Manufacturing Index

10:00 Construction Spending

10:30 EIA Natural Gas Inventory

11:00 EIA Petroleum Inventories

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

5 thoughts on “Before the Open (Jun 1)”

Leave a Reply

You must be logged in to post a comment.

To much to contemplate is reported today. So. watch dividend stocks. Looking at MAR, what do you think???

MAR has been a monster (had it on the trading list a few months ago), but it’s way too late to chase.

http://leavittbrothers.com/blog/i/mar060117.png

Do you also recommend options?

Not specifically. Many of our stocks trades can be converted to option trades, but we don’t specifically post them.