Good morning. Happy Monday. Hope you had a good weekend.

The Asian/Pacific markets did very well. Japan, Hong Kong, South Korea, India and Australia all posted solid gains. Europe, Africa and the Middle East are also posting solid gains. Poland, France, Turkey, Germany, Finland, Kenya, Spain, the Netherlands, Italy, Israel and Sweden are up more than 1%. Futures in the States point towards a relatively big gap up open for the cash market.

—————

VIDEO: My Favorite Intermediate Term Trading Setup

—————

The dollar is up. Oil and copper are up. Gold and silver are down. Bonds are down.

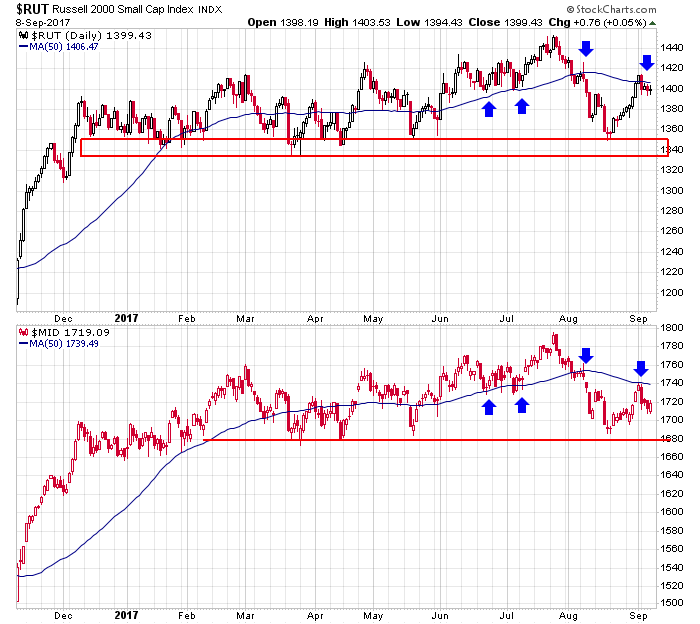

In my eyes the most important charts right now are the Russell 2000 and S&P 400 daily. They’re neutral overall, but they got rejected by their down-trending 50-day MAs last week. For any rally attempt to sustain itself, they both need to reclaim their moving average and then use it as support. Failure to do so would preclude the overall market from moving up. The small- and mid-caps don’t have to lead, but they can’t lag by too much.

Stock headlines from barchart.com…

Incyte (INCY -3.63%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Raymond James.

Allegheny Technologies (ATI -3.03%) was upgraded to ‘Buy from ‘Hold’ at Bank of America/Merrill Lynch.

Mastercard (MA +0.51%) was upgraded to ‘Buy’ from ‘Neutral’ at Guggenheim Securities with a price target of $153.

Alleghany Corp (Y +3.35%) was upgraded to ‘Market Outperform’ from ‘Market Perform’ at JMP Securities.

GrubHub (GRUB -1.75%) was downgraded to ‘Neutral’ from ‘Outperform’ at Credit Suisse.

MGM Resorts (MGM -2.18%) was downgraded to ‘Hold’ from ‘Buy’ at Deutsche Bank.

Kroger (KR -7.51%) was downgraded to ‘Hold’ from ‘Buy’ at Deutsche Bank.

Bank of America (BAC -0.35%) may move higher Monday Morning after Berkshire Hathaway late Friday confirmed a 6.6% stake in the company.

Avexis (AVXS -0.48%) may open lower Monday after Deerfield Management Co LP said it cut its stake in the company to 5.82% from 7.28%.

Cadence Design Systems (CDNS -0.49%) rose 3% in after-hours trading after it was announced that it will replace Staples in the S&P 500.

Whitestone Reit (WSR +1.25%) climbed nearly 4% in after-hours trading after it was announced that it will replace CDI Corp in the S&P SmallCap 600.

Callen Petroleum (CPE -6.29%) gained 3% in after-hours trading after it was announced that it will replace WebMD Health in the S&P MidCap 400.

Today’s Economic Calendar

1:00 PM Results of $24B, 3-Year Note Auction

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

2 thoughts on “Before the Open (Sep 11)”

Leave a Reply

You must be logged in to post a comment.

create, initiate it out

The futures are strange, watch carefully; they are gaming investors ?