Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. Japan, India, Australia and Malaysia posted the biggest gains. Europe, Africa and the Middle East are currently mostly up. Poland, France, Germany, Greece, South Africa, Finland, Switzerland, Italy, Belgium, Portugal and the Czech Republic are up the most. Turkey and Nigeria are down. Futures in the States point towards a positive open for the cash market.

—————

VIDEO: My Favorite Intermediate Term Trading Setup

—————

The dollar is up a small amount. Oil is up; copper is down. Gold and silver are down. Bonds are down.

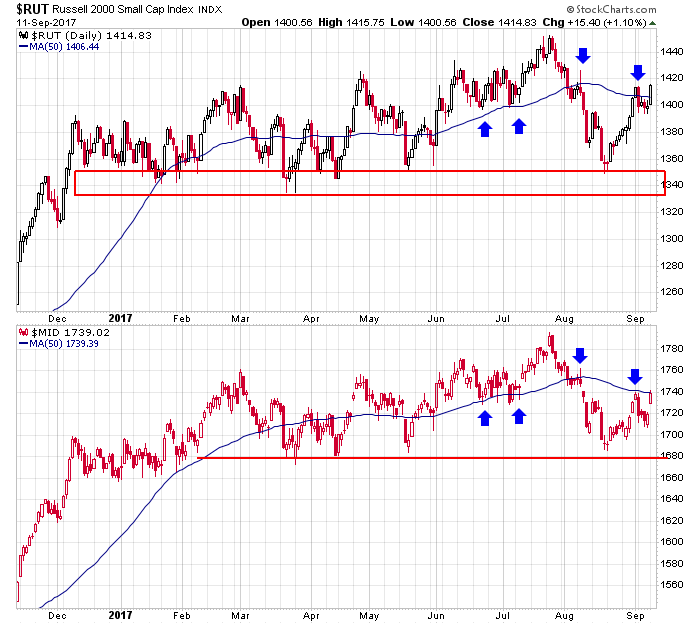

Here’s an update of the Russell 2000 and S&P 400 dailies. RUT is back above its 50; MID is sitting just below. If the market wants to rally, these need to establish themselves above this key moving average.

Stock headlines from barchart.com…

Apple (AAPL +1.81%) was rated a new ‘Buy’ at Citic Securities with a price target of $200.

Comerica (CMA +3.14%) was upgraded to ‘Overweight’ from ‘Neutral’ at Piper Jaffray with a price target of $80.

Advanced Auto Parts (AAP +0.39%) was downgraded to ‘Sell’ from ‘Neutral’ at Citigroup with a price target of $82.

DXC Technology (DXC +1.28%) was initiated a new ‘Buy’ at Bank of America/Merrill Lynch with a price target of $101.

Alcoa (AA +2.32%) was upgraded to ‘Buy’ from ‘Hold’ at Deutsche Bank.

Life Storage (LSI -2.89%) was initiated a new ‘Underperform’ at BMO Capital Markets with 12-month target price of $73

Ross Stores (ROST +1.28%) was initiated a new ‘Outperform’ at Bernstein with a price target of $74.

Western Digital (WDC +0.44%) climbed over 4% in after-hours trading after Nikkan Kogyo reported that Toshiba will sell its chip unit to a group that included Western Digital.

Epam Systems (EPAM +0.17%) was initiated a new ‘Buy’ at Bank of America/Merrill Lynch with a price target of $1110.

Public Storage (PSA -2.25%) was downgraded to ‘Underperform’ from ‘Hold’ at BMO Capital Markets.

Archer Daniels Midland (ADM +0.99%) was initiated a new ‘Outperform’ at Baird with a price target of $50.

Investors Real Estate (IRET +1.29%) reported Q1 FFO of 10 cents per share, better than consensus of 8 cents.

CTI Biopharma (CTIC +0.31%) was initiated a new ‘Buy’ at Jeffries with a price target of $7.50.

Today’s Economic Calendar

6:00 NFIB Small Business Optimism Index

8:55 Redbook Chain Store Sales

10:00 Job Openings and Labor Turnover Survey

1:00 PM Results of $20B, 10-Year Note Auction

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

2 thoughts on “Before the Open (Sep 12)”

Leave a Reply

You must be logged in to post a comment.

look at VTSAX,VTI,VTSMX. The moves in the Dow are my fear of a fall error.

Did not get my full note posted…..so, The destruction from Hurricane Harvey and Irma could be the catalyst that pushes the US into a recession and sets the dollar collapse in motion. That remains to be seen, but it appears pretty clear the greenback is in a dangerous place right now.