Good morning. Happy Monday. Hope you had a good weekend.

The Asian/Pacific markets closed mostly up. China, Hong Kong, India, New Zealand, Taiwan and Sinagpore led; South Korea was weak. Europe, Africa and the Middle East are currently mostly up. Turkey, Greece, Finland, Russia, Kenya, Hungary, Spain, Portugal, Austria and the Czech Republic are up the most. Futures in the States point towards a flat open for the cash market.

The dollar is flat. Bitcoin is down. Oil is down; copper is up. Gold and silver are flat. Bonds are down.

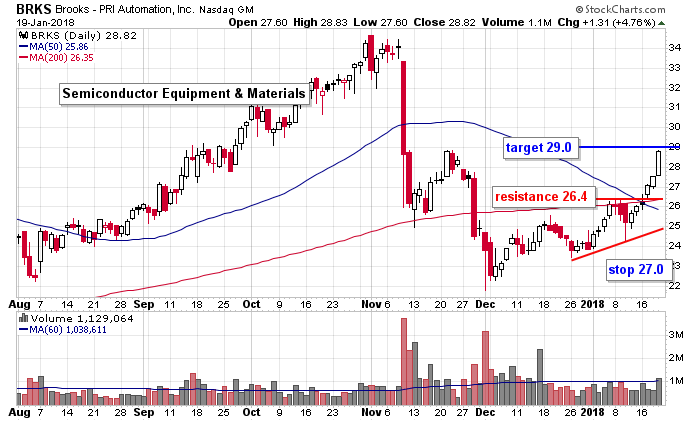

BRKS was one of our trades from last week.

Stock headlines from barchart.com…

Apple (AAPL -0.45%) was downgraded to ‘Neutral’ from ‘Overweight’ at Atlantic Equities LLP.

Halliburton (HAL +1.24%) is up nearly 2% in pre-market trading after it was upgraded to ‘Buy’ from ‘Neutral’ at Guggenheim Securities.

Abbott Laboratories (ABT +0.41%) was downgraded to ‘Neutral’ from ‘Buy’ at BTIG LLC.

American Express (AXP -1.83%) was downgraded to ‘Neutral’ from ‘Buy’ at Guggenheim Securities.

Harley-Davidson (HOG +1.26%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Wells Fargo Securities with a price target of $59.

Aflac (AFL +0.44%) was upgraded to ‘Strong Buy’ from ‘Outperform’ at Raymond James with a price target of $100.

Palo Alto Networks (PANW -0.38%) was downgraded to ‘Neutral’ from ‘Buy’ at Goldman Sachs.

Juno Therapeutics ({=JUNO will move higher this morning after Celgene agreed to acquire the company for $87 a share, a 28% premium to Friday’s closing price.

Celgene (CELG +0.91%) said investigational data showed results from its Abraxane regimen for patients with locally advanced pancreatic cancer were “encouraging.”

Genmab A/S (GNMSF +1.46%) may get a boost this morning after said the U.S. FDA late Friday granted priority review for its Daratumumab in combination with bortezomib, melphalan and prednisone for the treatment of patients with multiple myeloma ineligible for autologous stem cell transplant

Bunge Ltd (BG +11.37%) rose nearly 2% in after-hours trading on top of the 11% the stock rallied during Friday’s session after people familiar with the matter said ADM made a takeover approach for Bunge.

Sanmina (SANM +1.43%) plunged 18% in after-hours trading after it reported preliminary Q1 adjusted EPS of 48 cents, well below consensus of 71 cents, and then said it sees Q2 adjusted EPS of 40 cents to 50 cents, weaker than consensus of 70 cents.

Thursday’s Key Earnings

American Express (NYSE:AXP) -2.7% AH suspending its buyback.

IBM (NYSE:IBM) -3.4% despite the first growth in 23 quarters.

Morgan Stanley (NYSE:MS) +0.9% beating expectations.

Today’s Economic Calendar

8:30 Chicago Fed National Activity Index

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

3 thoughts on “Before the Open (Jan 22)”

Leave a Reply

You must be logged in to post a comment.

Confusing government shut down. In general, historically it does not set back the market for any significant period. But when no one is driving, things can deteriorate. Noon ”’ someone votes on something.

Do not trade today.

I advised not trading today.

Meaning no new positions.