Good morning. Happy Tuesday.

The Asian/Pacific markets closed with relatively big gains. Japan, China, Hong Kong, South Korea, India and Indonesia did very well. Europe, Africa and the Middle East currently lean to the upside. Poland, Turkey, Greece and South Africa are doing the best; Russia is down. Futures in the States point towards a mixed open for the cash market.

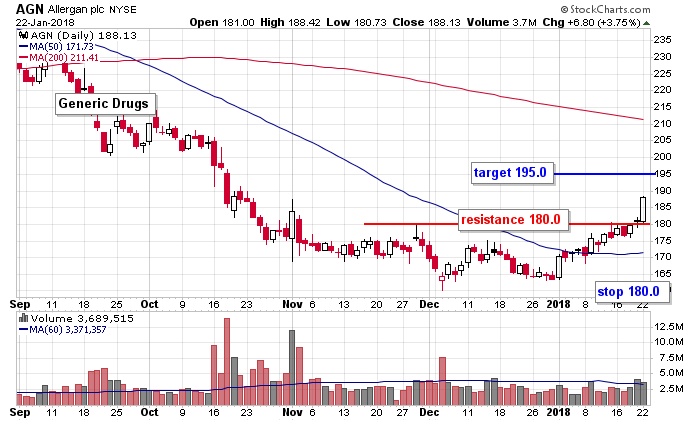

AGN was a setup of ours heading into this week.

The dollar is flat. Bitcoin is down. Oil is up; copper is down. Gold and silver are mixed. Bonds are up.

Stock headlines from barchart.com…

Netflix (NFLX +3.23%) climbed 9% in after-hours trading after it reported Q4 revenue of $3.29 billion, above consensus of $3.28 billion, and said it sees Q1 domestic streaming net additions of 1.45 million, higher than consensus of 1.28 million.

ResMed (RMD -1.32%) jumped over 11% in after-hours trading after it reported Q2 revenue of $601.3 million, better than consensus of $581.7 million.

ONEOK (OKE +2.67%) gained almost 2% in after-hours trading after it said it sees 2018 net income of $955 million to $1.16 billion, well above consensus of $874 million.

Rockwell Automation (ROK +0.21%) was rated a new ‘Buy’ at UBS with a 12-month target price of $240.

Whirlpool (WHR -0.53%) rose 3% in after-hours trading after President Trump imposed a tariff of up to the legal maximum of 50% on imports of large residential washing machines.

First Solar (FSLR -1.53%) rallied 5%, SunPower (SPWR +0.81%) climbed 4% and Vivint Solar (VSLR -4.05%) gained more than 1% in after-hours trading after President Trump imposed a 30% tariff on solar imports to the U.S.

Caterpillar (CAT +0.28%) was upgraded to ‘Buy’ from ‘Neutral’ at Seaport Global with a price target of $195.

TD Ameritrade Holding (AMTD +1.29%) gained 2% in after-hours trading after it said it sees full-year adjusted EPS of $2.55 to $3.05, the midpoint above consensus of $2.71.

Ultragenyx Pharmaceutical (RARE +8.60%) fell 2% in after-hours trading after it proposed a public offering of $175 million of its common stock.

Adamas Pharmaceuticals (ADMS +6.81%) lost 5% in after-hours trading after it announced it intends to sell $85 million of its common stock in an underwritten public offering.

Stemline Therapeutics (STML +5.17%) slid almost 5% in after-hours trading after it announced it intends to sell 3.7 million shares of its common stock in an underwritten public offering.

Jamba (JMBA -0.11%) dropped nearly 6% in after-hours trading after holders offered a 2.1 million block of shares at $8.25-$8.40.

ShiftPixy (PIXY +6.79%) rallied over 12% in after-hours trading after it reported Q1 revenue jumped +14.6% y/y to $6.5 million and Q1 gross billings climbed +14.7% y/y to $40.2 million.

Harvard Bioscience (HBIO -1.27%) jumped over 15% in after-hours trading after it sold its subsidiary Denville Scientific to Thomas Scientific for $20 million and acquired Data Sciences International for about $70 million.

Monday’s Key Earnings

Halliburton (NYSE:HAL) +6.4% upbeat on an oil recovery.

Netflix (NFLX) +8.3% AH smashing subscriber estimates.

Wynn Resorts (NASDAQ:WYNN) +8.7% announcing another Vegas hotel.

Today’s Economic Calendar

8:55 Redbook Chain Store Sales

10:00 Richmond Fed Mfg.

11:30 Results of $26B, 2-Year FRN Auction

6:30 PM Fed’s Evans: “The Future of Monetary Policy: Embracing the Unconventional”

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

3 thoughts on “Before the Open (Jan 23)”

Leave a Reply

You must be logged in to post a comment.

This is a tough market for my style to trade. Pullbacks are non existent.

the next pull back could be the start of a bear market,

Stock market bearishness is practically extinct. You would have to travel back in time to 1987 to find a greater level of disparity between investment adviser bulls (64.4%) and bears (13.3%). But when it turns bearish…and it wii, hold on.