Good morning. Happy Tuesday.

The Asian/Pacific markets closed with stiff, across-the-board losses. Japan, China, Hong Kong, South Korea, Taiwan, Indonesia and the Philippines each dropped more than 1%. Europe, Africa and the Middle East are currently mostly down. South Africa is down 2%; the UK, Poland, Turkey, Greece, Germany, Spain, Portugal, Israel, Austria and Italy are also weak. Futures in the States point towards a moderate gap down open for the cash market.

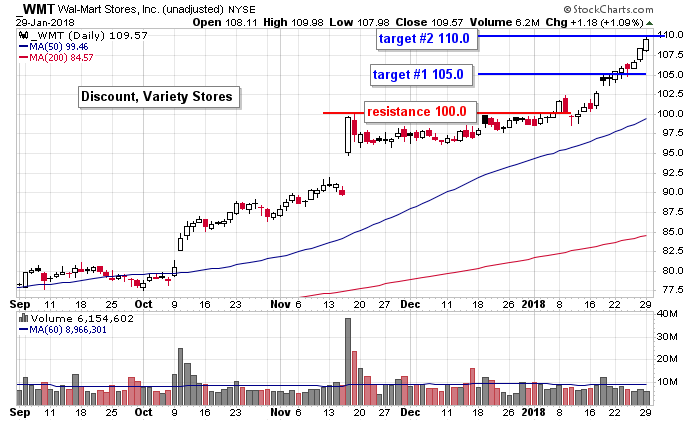

Walmart was a trade of ours from a couple weeks ago. It hit its second target yesterday.

vThe dollar is down. Bitcoin is down. Oil is down; copper is flat. Gold and silver are up. Bonds are down.

Stock headlines from barchart.com…

Apple (AAPL -2.07%) is down 1% in pre-market trading on carry-over weakness from Monday when it fell 2.6% when Nikkei reported Apple will cut its Q1 iPhone X prooduction in half due to slower-than-expected holiday sales.

Healthcare Services Group (HCSG -0.75%) will replace Buffalo Wild Wings in the S&P Midcap 400 prior to the open of trading Monday, Feb 5.

Extreme Networks (EXTR -0.65%) will replace Time in the S&P SmallCap 600 prior to the open of trade on Thursday, Feb 1.

Ryder System (R -0.02%) gained over 1% in after-hours trading after reported a one-time gain of $11.04 a share from the U.S. Tax Act

MetLife (MET -0.68%) dropped almost 5% in after-hours trading after it said it found “material weakness” in review of annuity reserves.

Sun Hydraulics (SNHY -0.89%) slid 4% in after-hours trading after it reported preliminary 2017 adjusted EPS of $1.54-$1.58, below consensus of $1.64.

Hawaiian Holdings (HA +2.04%) rallied almost 4% in after-hours trading after it reported Q4 adjusted EPS of $1.10, above consensus of $1.04.

Sanmina (SANM +1.08%) dropped nearly 3% in after-hours trading after it said it sees Q2 revenue of $1.60 billion to $1.70 billion, the midpoint just below consensus of $1.655 billion.

Ultra Clean Holdings (UCTT -5.07%) tumbled nearly 10% in after-hours trading after it commenced an underwritten public offering of $100 million in common stock.

Rambus (RMBS +0.14%) dropped 8% in after-hours trading after it said t sees Q1 adjusted EPS of 12 cents to 19 cents, weaker than consensus of 20 cents.

Antero Resources (AR -2.70%) climbed almost 6% in after-hours trading after it said it was evaluating options including capital return to address its relative “discount in trading value.”

Cymabay Therapeutics (CBAY -3.01%) fell 3% in after-hours trading after it filed a prospectus for offering shares of its common stock in an underwritten public offering.

Oclaro (OCLR -1.14%) gained almost 2% in after-hours trading after it was rated a new ‘Buy’ at Loop Capital Markets with a 12-month target price of $10.

Amarin Corp PLC (AMRN -6.09%) slid 4% in after-hours trading after it proposed a registered underwritten public offering of American Depositary Shares (ADRs), although no size was mentioned.

Monday’s Key Earnings

Lockheed Martin (NYSE:LMT) +2% after beating estimates.

Today’s Economic Calendar

FOMC meeting begins

8:55 Redbook Chain Store Sales

9:00 S&P Corelogic Case-Shiller Home Price Index

10:00 Consumer Confidence

10:00 State Street Investor Confidence Index

3:00 Farm Prices

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

3 thoughts on “Before the Open (Jan 30)”

Leave a Reply

You must be logged in to post a comment.

correction seems probable, going lean for a while. best.

Never miss playing a gap.. IF it looks right.

10y yield approaching five-year highs. 30y yield smack in the middle of its corresponding range. from this perspective, bond decline is showing a major internal divergence. until 30y rallies above 4%, hard to be a believer in long term trend change in bonds. if it does though, watch out. given the pace at which the dollar index declined so far, we probably cannot afford to lose the low-interest-rate environment. the last 15-point drop in the dollar index was positive for asset markets, the next 15-point drop (if it happens) will probably not be.