Good morning. Happy Monday. Hope you had a good weekend.

The Asian/Pacific markets closed with a lean to the upside. South Korea, Malaysia, Thailand, Taiwan and India did well; China and Hong Kong are down. Europe, Africa and the Middle East are currently split. Greece, Finland and Kenya are up; Turkey, South Africa, Russia and Portugal are down. Futures in the States point to moderate gap down open for the cash market.

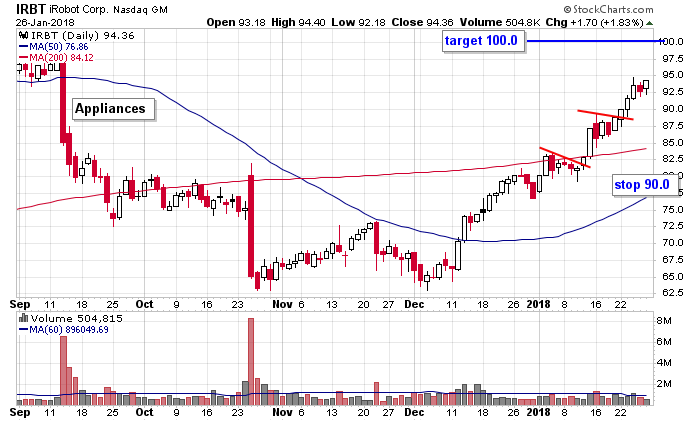

IRBT is one of our trades that’s working well for us.

The dollar is up. Bitcoin is down. Oil is down; copper is up. Gold and silver are down. Bonds are down.

Stock headlines from barchart.com…

Starbucks (SBUX -4.23%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Bernstein.

CBS (CBS +1.23%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Wells Fargo Securities.

Myriad Genetics (MYGN +0.20%) was rated a new ‘Sell’ at Goldman Sachs with a price target of $32.

Equinix (EQIX +0.55%) was upgraded to ‘Buy’ from ‘Neutral’ at UBS with a price target of $510.

Allergan (AGN -0.10%) was upgraded to ‘Overweight’ from ‘Equal-Weight’ at Barclays.

Keurig Green Mountain (GMCR -0.30%) said it will acquire Dr Pepper Snapple (DPS -0.04%) for $103.75 a share.

Lowe’s (LOW +0.96%) gained nearly 1% in after-hours trading after it announced a new $5 billion stock repurchase program in addition to the previous buyback program that had a remaining balance of $2.1 billion as of Nov 3.

Kroger (KR +2.05%) gained almost 1% in after-hours trading after CNBC reported Casey’s General Stores is eyeing Kroger’s convenience-store business.

Momo (MOMO +1.81%) gained over 1% in after-hours trading after it was upgraded to ‘Overweight’ from ‘Neutral’ at JPMorgan Chase with a price target of $40.

Karypharm Therapeutics (KPTI +4.07%) fell over 2% in after-hours trading after it filed to sell a $250 million mixed securities shelf offering.

National CineMedia (NCMI -0.30%) rose nearly 5% in after-hours trading after Standard General reported 16.9% in the company and said it seeks board representation.

Today’s Economic Calendar

8:30 Personal Income and Outlays

10:30 Dallas Fed Manufacturing Survey

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (Jan 29)”

Leave a Reply

You must be logged in to post a comment.

Bond bear is here, expect it to get worse as treasury issues more debt. Dividends may be appealing..?