Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Japan and Australia moved up; China, Hong Kong and New Zealand moved down. Europe, Africa and the Middle East currently lean to the upside. Turkey, Greece, Finland, Norway, Hungary, Italy, Austria, Sweden and the Czech Republic are up; Germany and Denmark are down. Futures in the States point towards a moderate gap down open for the cash market.

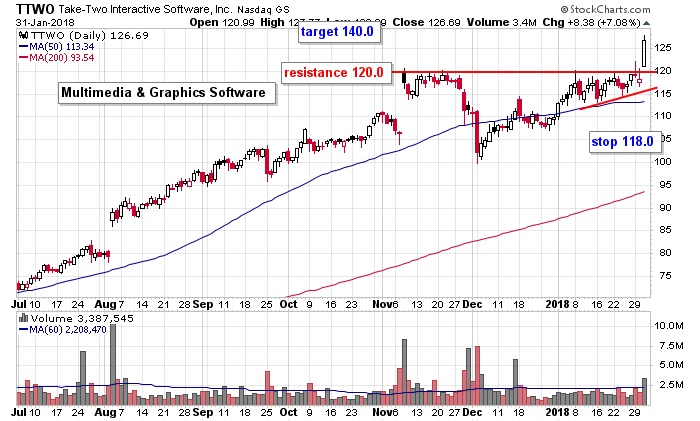

TTWO was a trade of ours coming into this week.

The dollar is down. Bitcoin is down. Oil is up; copper is flat. Gold and silver are flat. Bonds are down.

Stock headlines from barchart.com…

Facebook (FB -0.12%) is up 2% in pre-market trading after it said in an earnings call that daily active users in North America may fluctuate but the downward trend isn’t expected to continue. Facebook initially declined 5% in after-hours trading after it reported 1.40 billion daily active users in Q4, below consensus of 1.41 billion.

AT&T (T +0.03%) rose over 3% in after-hours trading after it reported Q4 adjusted EPS of 78 cents, higher than consensus of 65 cents.

Qualcomm (QCOM +1.88%) lost almost 1% in after-hours trading after it said it sees Q2 revenue of $4.80 billion to $5.60 billion, the midpoint below consensus of $5.58 billion.

Microsoft (MSFT +2.45%) lost nearly 2% in after-hours trading after it said it took net -82 cents a share loss in Q2 due to a $13.8 billion charge related to taxes owed on overseas cash.

Citrix Systems (CTXS +0.08%) fell almost 2% in after-hours trading after it said it sees Q1 revenue of $670 million to $680 million, below consensus of $683.8 million.

Vertex Pharmaceuticals (VRTX +0.20%) rose nearly 4% in after-hours trading after it reported Q4 adjusted EPS of 61 cents, better than consensus of 53 cents, and said it authorized a $500 million stock repurchase program.

Allegiant Travel (ALGT -0.09%) gained 2% in after-hours trading after it reported Q4 operating revenue of $378.6 million, above consensus of $377.1 million.

eBay (EBAY +0.45%) climbed almost 6% in after-hours trading after said it sees full-year net revenue of $10.9 billion to $11.1 billion, above consensus of $10.27 billion.

PayPal Holdings (PYPL +1.84%) fell over 10% in after-hours trading after eBay said it will replace PayPal with Adyent as its payments processor. PayPal was already down over 4% in after-hours trading after it said it sees full-year net revenue of $15.00 billion to $15.25 billion, weaker than consensus of $15.26 billion.

Qorvo (QRVO +1.56%) rallied 8% in after-hours trading after it reported Q3 adjusted EPS of $1.69, better than consensus of $1.60.

Tractor Supply (TSCO -2.32%) fell 4% in after-hours trading after it said it sees full-year EPS of $3.95 to $4.15, the midpoint below consensus of $4.15.

Open Text (OTEX +0.41%) jumped 12% in after-hours trading it reported Q2 adjusted EPS of 76 cents, higher than consensus of 63 cents.

Electro Scientific Industries (ESIO -0.93%) climbed almost 4% in after-hours trading after it reported Q3 adjusted EPS of 99 cents, higher than consensus of 83 cents.

QuinStreet (QNST -1.58%) surged 20% in after-hours trading after it reported Q2 revenue of $87.5 million, better than consensus of $75.3 million, and then raised guidance on full-year 2018 revenue growth to up 20% from an Oct 30 projection of up 10%-15%.

Wednesday’s Key Earnings

Anthem (NYSE:ANTM) +1.8% beating expectations.

AT&T (NYSE:T) +3.2% AH following strong guidance.

Boeing (BA) +4.9% lifted by its delivery outlook.

eBay (NASDAQ:EBAY) +8.4% AH giving a positive sales forecast.

Eli Lilly (NYSE:LLY) -5.4% on sluggish animal health.

Enterprise Products (NYSE:EPD) -2.4% narrowly beating estimates.

Facebook (FB) +1.4% AH with soaring mobile ad sales.

Microsoft (MSFT) +0.2% AH on major Azure growth.

Mondelez (NASDAQ:MDLZ) unmoved despite solid organic sales.

Paypal (NASDAQ:PYPL) -11.1% AH after eBay favors Adyen.

Qualcomm (NASDAQ:QCOM) -0.2% AH amid disputes with Apple.

Sirius XM (NASDAQ:SIRI) +2.7% despite in-line results.

Today’s Economic Calendar

Auto Sales

7:30 Challenger Job-Cut Report

8:30 Initial Jobless Claims

8:30 Productivity and Costs

9:45 PMI Manufacturing Index

9:45 Bloomberg Consumer Comfort Index

10:00 ISM Manufacturing Index

10:00 Construction Spending

10:30 EIA Natural Gas Inventory

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

3 thoughts on “Before the Open (Feb 1)”

Leave a Reply

You must be logged in to post a comment.

We are living dangerously: savings takes place at the top echelon of the economy,the top 40%, – where households are flush with cash and assets and where the saving rate is high.

But the growth in borrowing for consumption items (the negative saving rate) takes place mostly at the bottom 60%, where households are living paycheck-to-paycheck even if those paychecks are reasonably large and even if life is comfortable at the moment.

New Fed chair is living dangerously……so are all Americans.

Futures were higher and now crashing. Small caps have been under performing large caps. I am looking for a short term bottom right now. If we have a bad day today this could be it. I have to run numbers.

Jason

Loved your state of the market report.

This looks like 1999. or 1988. Buy the dips!!!!

volatility–yum yum