Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. China, New Zealand, Australia, Indonesia and the Philippines closed up. India dropped more than 2%; South Korea fell more than 1%; Japan and Singapore were also weak. Europe, Africa and the Middle East are currently mostly down. Poland, France, Germany, Greece, Denmark, South Africa, Spain, the Netherlands, Italy, Portugal, Austria and Sweden are down more than 1%. Futures in the States point towards a big gap down for the cash market.

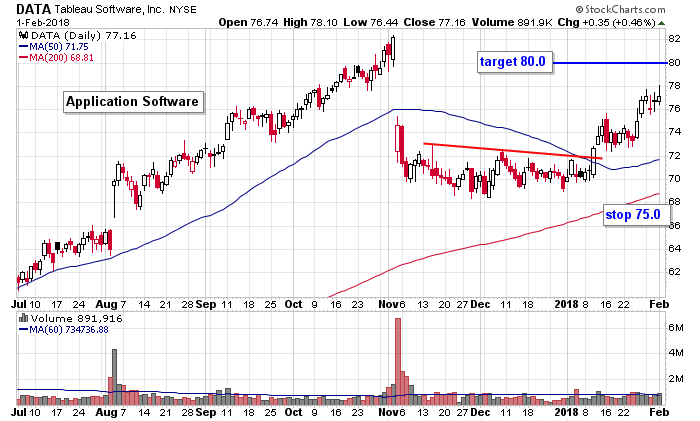

DATA is a trade of our that we’re still in.

The dollar is up. Bitcoin is down. Oil and copper are up. Gold and silver are down. Bonds are down.

Here are the employment numbers:

unemployment rate: 4.1% (was 4.1% last month)

nonfarm payrolls: +200K

private payrolls:

average workweek: down 0.2 hours at 34.2 hours

hourly wages: up 9 cents or 0.3% to $26.74

labor participation rate: flat at 62.7%

December job gains raised from 148K to 160K

November job gains cut from 252K to 216.

Stock headlines from barchart.com…

Alphabet (GOOGL -0.05%) fell nearly 4% in pre-market trading after it reported Q4 EPS of $9.70, below consensus of $10.04.

Amazon.com (AMZN -4.20%) jumped almost 6% in pre-market trading after it reported Q4 net sales of $60.45 billion, above consensus of $59.84 billion, and said it sees Q1 net sales of $47.75 billion to $50.75 billion, the midpoint higher than consensus of $48.70 billion.

Apple (AAPL +0.21%) rebounded from a 3% loss and rose nearly 2% in after-hours trading on optimism its profit-margins will expand after the average selling price for the iPhone in Q1 rose 14% y/y to $796. Apple had initially declined in after-hours trading after it forecast Q2 revenue of $60 billion to $62 billion, below consensus of $65.88 billion.

Amgen (AMGN -0.26%) fell 3% in after-hours trading after it reported Q4 revenue of $5.80 billion, below consensus of $5.85 billion, and then said it sees 2018 revenue of $21,8 billion to $22.8 billion, weaker than consensus of $22.9 billion.

Tableau Software (DATA +0.36%) rallied 15% in after-hours trading after it reported Q4 adjusted EPS of 12 cents, four times above consensus of 3 cents.

athenahealth (ATHN -0.32%) rose 4% in after-hours trading after it reported Q4 adjusted EPS of $1.11, well above consensus of 63 cents.

Deckers Outdoor (DECK +1.81%) climbed 5% in after-hours trading after it reported Q3 adjusted EPS of $4.97, well above consensus of $3.84, and then said it sees full-year adjusted EPS of $5.37 to $5.42, higher than consensus of $4.41.

OSI Systems (OSIS +0.79%) dropped 18% in after-hour trading after it disclosed the SEC is investigating the company’s compliance with the Foreign Corrupt Practices Act.

II-VI (IIVI +2.39%) fell over 3% in after-hours trading after it said it sees Q3 revenue of $27o million to $285 million, below consensus of $288.7 million.

Brooks Automation ({=BRKS rose 3% in after-hours trading after it reported Q1 adjusted EPS of 32 cents, better than consensus of 29 cents, and said it sees Q2 adjusted EPS of 33 cents-41 cents, stronger than consensus of 32 cents.

Impinj (PI +2.19%) plunged 27% in after-hours trading after it said it sees Q1 revenue of $20 million-$22 million, well below consensus of $29.6 million, and then CFO Evan Fein said he plans to step down effective March 30.

Mattel (MAT -3.28%) dropped over 8% in after-hours trading after it reported an unexpected Q4 loss of -72 cents a share, well below consensus of a EPS of 16 cents.

Natural Grocers by Vitamin Cottage (NGVC +5.00%) slumped 15% in after-hours trading after it reported Q1 adjusted EPS of 4 cents, weaker than consensus of 7 cents, and said Q1 gross margins fell to 26.3%, below consensus of 27.6%.

Viavi Solutions (VIAV +1.05%) jumped 8% in after-hours trading after it reported Q2 net revenue of $201.8 million, above consensus of $185.9 million, and then said it sees Q3 adjusted revenue of $190 million to $200 million, the midpoint higher than consensus of $193.4 million.

Thursday’s Key Earnings

Apple (AAPL) +2% AH on Q1 earnings beat and plans to reduce net debt.

Alphabet (NASDAQ:GOOG) -3% AH on Q4 earnings miss, higher TAC.

Amazon (NASDAQ:AMZN) +5% PM on Q4 earnings beat, AWS lift.

Visa (NYSE:V) -1% AH on Q1 earnings beat, lower operating margin.

Amgen (NASDAQ:AMGN) -1.7% AH on Q4 earnings miss.

GoPro (NASDAQ:GPRO) -6.7% AH on Q4 earnings miss, declining gross margins.

Cypress Semiconductor (NASDAQ:CY) +1.7% AH on Q4 earnings beat, in-line guidance.

Tableau Software (NYSE:DATA) +18% AH on Q4 earnings, robust guidance.

Mattel (NASDAQ:MAT) -6.4% AH on Q4 earnings and revenue miss.

Edwards Lifesciences (NYSE:EW) +2.4% AH on Q4 revenue growth.

Today’s Economic Calendar

8:30 Non-farm payrolls

10:00 Consumer Sentiment

10:00 Factory Orders

1:00 PM Baker-Hughes Rig Count

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

9 thoughts on “Before the Open (Feb 2)”

Leave a Reply

You must be logged in to post a comment.

markets are in a fragile state

dax can lead markets lower and a world debt implosion

that said usa stocks may have one more upward push before a world default depression

Can’t say as I buy that. There is too much economic activity. The yield curve is still steep. Except for some growth stocks the market is not overvalued.

Jason is right the trend is up.

My opinion.

A FED CONTROLLED BY /TRUMP.

STAY AWAY.

Futures in the States point towards a big gap down for the cash market. Which would often mean time to get in but my models say wait until Monday night Tuesday AM assuming the market falls more.

Kudos on the above trade if I am seeing it correctly DATA gapped up nice win !

USA WAS BANKRUPTED BY FUNNY MONEY OF BURNAKY AND OLDARMA

now fed trying to fix that by selling some of its bonds to fix its balance sheets

BUT TRUMP WANTS IT TO ADD I TRILLION MORE TO DEBT

the problem with europe japan and usa is that they are all bankrupt and can never fix it

WATCH YIELD CURVE INVERT

europe first

usa trend is up,but that means nothing

bitcoin trend was up till it crashed

parabolic up equals parabolic down

i am a big grizzly BEAR,DONT PAY ANY ATTENTION TO ME