Good morning. Happy Monday. Hope you had a good weekend.

The Asian/Pacific markets closed mostly up. Japan, Hong Kong, South Korea, India, New Zealand, Taiwan, Malaysia, Indonesia and Thailand did well; the Philippines were weak. Europe, Africa and the Middle East are currently mixed. The UAE, Greece, Hungary, Spain and Portugal are up; the UK, Turkey, Kenya and Austria are down. Futures in the States point towards a moderate gap up open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is down. Bitcoin is down. Oil and copper are up. Gold and silver are flat. Bonds are down.

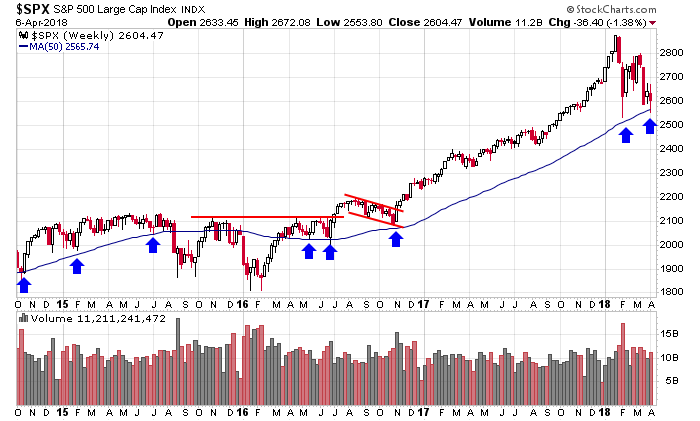

The market leans down, but let’s not get too bearish yet. The S&P’s 50-week MA continue to hold.

Stock headlines from barchart.com…

General Motors (GM -0.84%) is up over 2% in pre-market trading after it was upgraded to ‘Overweight’ from ‘Equal-Weight’ at Morgan Stanley with a price target of $48.

Agilent (A -3.09%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman Sachs.

TD Ameritrade Holding Co (AMTD -2.69%) was upgraded to ‘Buy’ from ‘Neutral’ at Bank of America/Merrill Lynch with a price target of $66.

Discover Financial Services (DFS -2.48%) was upgraded to ‘Equal-Weight’ from ‘Underweight’ at Stephens with a price target of $73.

Franklin Resources (BEN -2.44%) was downgraded to ‘Neutral’ from ‘Buy’ at Bank of America/Merrill Lynch.

Regeneron (REGN -2.73%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Raymond James.

Boeing (BA -3.06%) received a $12.3 billion deal for 47 dreamliners from American Airlines.

InteractiveCorp (IAC -2.04%), Barry Diller’s media company, is trading at a discount, according to a weekend article by Barrons.

Smartphone chipmakers such as Skyworks Solutions (SWKS -3.28%), Qorvo (QRVO -2.37%), Qualcomm (QCOM -3.49% and Synaptics (SYNA -3.72%) will struggle this year due to weak phone sales, according to a weekend article by Barrons. However, the article spoke favorably about phone screen maker Universal Display (OLED -2.99%) due to its favorable valuation after this year’s 43% drop.

China Internet (CIFS -8.61%) rallied 2% on some short-covering in after-hours trading, trimming Friday’s regular-session 8.6% drop on a Muddy Waters tweet that the noted short-seller remains short.

Cesca Therapeutics (KOOL -0.60%) fell 7% in after-hours trading after news the company filed to offer up to $20 million worth of shares.

Today’s Economic Calendar

12:30 PM TD Ameritrade IMX

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (Apr 9)”

Leave a Reply

You must be logged in to post a comment.

Markets hang on pending earnings to come. Heavy breathing is heard in my den.