Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. Japan, South Korea and Singapore did well; China, Indonesia and the Philippines were weak. Europe, Africa and the Middle East currently lean to the upside. France, Germany, Greece, Finland, Norway, Hungary, Spain, Israel and Sweden are doing well; the UAE is weak. Futures in the States point towards a moderate gap up open for the cash market.

The dollar is up. Bitcoin is up. Oil is flat; copper is up. Gold and silver are mixed and virtually flat. Bonds are down.

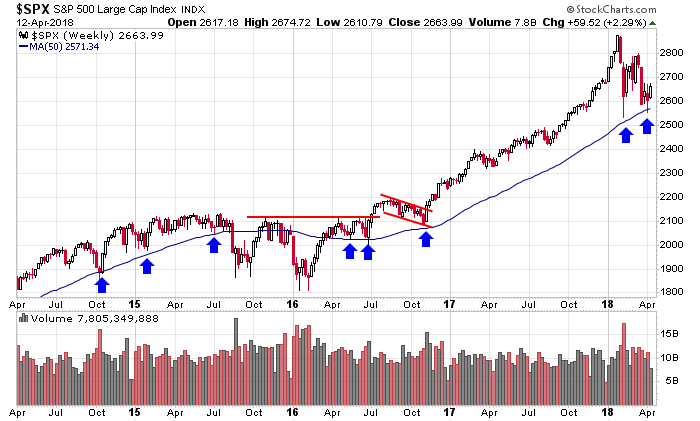

At the beginning of the week I posted this weekly SPX chart with a note to not get overly bearish. As long as the 50-week MA held, the overall trend was to be considered up. Now, with this week’s gains, the market is in better shape than it was four days ago, and a move into the 2700’s is very doable.

Stock headlines from barchart.com…

Netflix (NFLX +1.84%) gained almost 2% in pre-market trading after it was upgraded to ‘Buy’ at Deutsche Bank with a price target of $350.

Broadcom (AVGO -0.37%) climbed over 4% in after-hours trading after it announced a $12 billion stock buyback program.

Albemarle (ALB +0.09%) was upgraded to ‘Buy’ from ‘Hold’ at Citigroup with a price target of $106.

Starbucks (SBUX +0.02%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Cowen.

Zillow Group (Z +0.73%) rose 3% in after-hours trading after it reported preliminary Q1 revenue of $299 million to $301 million, above consensus of $295.1 million.

Southern Copper (SCCO +0.39%) was downgraded to ‘Underweight’ from ‘Neutral’ at JPMorgan Chase with a price target of $45.

Endocyte (ECYT +4.37%) was rated a new ‘Buy’ at Jeffries with a price target of $17.

Select Energy Services (WTTR +1.05%) was rated a new ‘Overweight’ at Stephens with a price target of $16.

Hostess Brands (TWNK -0.76%) announced that Andy Callahan will replace C. Dean Metropoulos ae CEO and president effective May 7.

Dropbox (DBX +2.94%) fell 3% in after-hours trading after Nomura Instinet initiated coverage of the stock with a recommendation of ‘Reduce’ with a price target of $21.

Hi-Crush Partners (HCLP +0.87%) was rated a new ‘Overweight’ at Stephens with a price target of $16.

Seven Stars Cloud (SSC +1.71%) slid almost 4% in after-hours trading after CFO Simon Wang resigned effective April 6.

Thursday’s Key Earnings

BlackRock (NYSE:BLK) +1.5% after topping estimates.

Delta (NYSE:DAL) +2.9% increasing passenger traffic.

Rite Aid (NYSE:RAD) -0.6% following in-line earnings.

Today’s Economic Calendar

7:30 Fed’s Rosengren speech

9:00 Fed’s Bullard speech

10:00 Consumer Sentiment

10:00 Job Openings and Labor Turnover Survey

1:00 PM Baker-Hughes Rig Count

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (Apr 13)”

Leave a Reply

You must be logged in to post a comment.

Banks report today, US debt is at new high today again. The bonds look bearish; interest rates rising, dollar is rising as external buyers looking at gains from exchange. Thank god it is Friday.