Good morning. Happy Monday. Hope you had a good weekend.

The Asian/Pacific markets leaned to the downside. China and Hong Kong dropped more than 1%; Japan and India posted gains. Europe, Africa and the Middle East currently lean to the upside. Turkey and Greece are up more than 1%; Denmark, Austria and Saudi Arabia are also doing well. Kenya and Norway are weak. Futures in the States point towards a moderate gap up open for the cash market.

The dollar is down. Bitcoin is down. Oil is down; copper is up. Gold and silver are flat. Bonds are down.

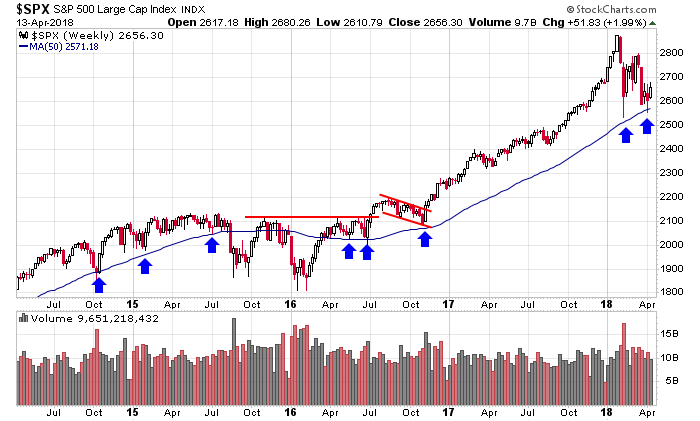

Here’s an update of the S&P weekly I’ve been posting. The index remains above its 50-week MA.

Stock headlines from barchart.com…

Costco (COST +0.05%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Wells Fargo Securities with a price target of $220.

Occidental Petroleum (OXY +2.58%) was upgraded to ‘Overweight’ from ‘Neutral’ at Piper Jaffray with a price target of $86.

Boston Beer (SAM -1.16%) was upgraded to ‘Neutral’ from ‘Sell’ at Goldman Sachs with a price target of $223.

Tractor Supply (TSCO -3.12%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman Sachs with a price target of $72.

Dean Foods (DF +1.47%) was downgraded to ‘Sell’ from ‘Neutral’ at Goldman Sachs with a price target of $8.

Kraft Heinz (KHC -0.03%) was downgraded to ‘Underperform’ from ‘Outperform’ at Credit Suisse with a price target of $55.

Temper Sealy International (TPX -0.29%) was downgraded to ‘Sell’ from ‘Hold’ at Loop Capital Markets with a price target of $36.

Vornado Realty Trust (VNO +0.76%) said a $34.7 million expense from a new GAAP accounting standard, a $23.5 million expense to New York city property transfer taxes, a $14.5 million write off from issuance costs and $6.5 million from “other items” will reduce its Q1 FFO by 37 cents a share.

Illumima (ILMN -0.27%) rise nearly 2% in after-hours trading after it announced a strategic collaboration with Bristol-Myers Squibb to develop and commercialize diagnostic measures to predict genomic biomarkers.

VeriFone (PAY unch) was downgraded to ‘Hold’ from ‘Buy’ at Jeffries.

Dynavax Technologies (DVAX -4.82%) jumped 15% in after-hours trading after an abstract for its SD-101 therapy combined with Merck’s Keytruda showed a “promising response rate” in patients with head and neck squamous cell carcinoma.

General Electric (GE +2.35%) may open lower this morning after it an accounting rule change prompted it to restate 2017 revenue at $118.2 billion, lower than the previously reported $122.1 billion, and restate 2016 total revenue at $119.5 billion compared with the originally reported $123.7 billion.

President Trump’s top economic adviser, Larry Kudlow, said after the markets closed Friday that he supports a currency policy for a steady dollar and he is optimistic the U.S. can avoid a trade fight with China.

Thursday’s Key Earnings

BlackRock (NYSE:BLK) +1.5% after topping estimates.

Delta (NYSE:DAL) +2.9% increasing passenger traffic.

Rite Aid (NYSE:RAD) -0.6% following in-line earnings.

Today’s Economic Calendar

8:30 Retail Sales

8:30 Empire State Mfg Survey

10:00 NAHB Housing Market Index

10:00 Business Inventories

1:15 PM Fed’s Bostic Speech

4:00 PM Treasury International Capital

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (Apr 16)”

Leave a Reply

You must be logged in to post a comment.

Earnings still in play today, but better bonds. Watching gold, ie, ABX etc. Where is Syria?