Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. South Korea, India and Indonesia did well; Taiwan, Australia, Malaysia and Thailand were weak. Europe, Africa and the Middle East are currently mostly up. Turkey, Germany, the UAE, Greece, South Africa, Spain, Italy, Austria and Saudi Arabia are up; Poland and Kenya are down. Futures in the States point towards a gap up open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is down. Oil and copper are up. Gold and silver are up. Bonds are down.

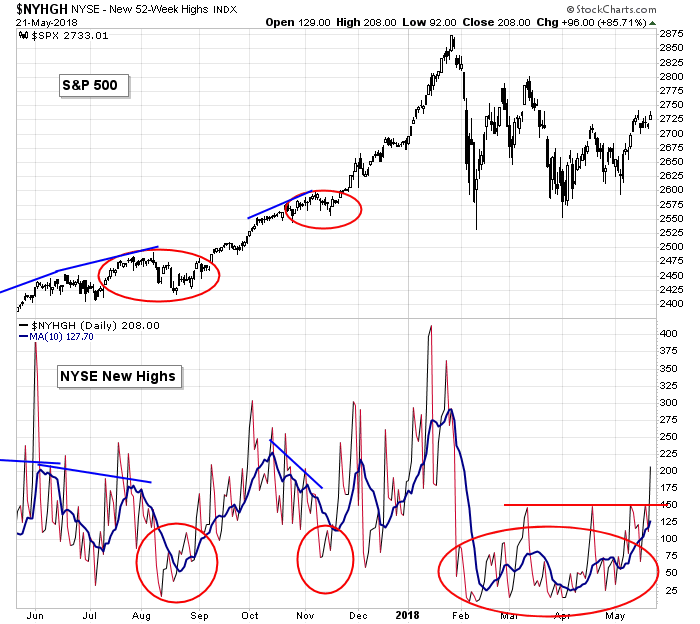

New highs broke out to their highest level since late-January. Another piece of evidence the market is in good shape.

Overnight Stock Movers from barchart.com…

Kohl’s (KSS +2.83%) rallied nearly 5% in pre-market trading after it reported Q1 comparable same-store sales rose +3.6%, stronger than consensus of +2.7%, and then forecast full-year adjusted EPS of $5.05 to $5.50, the midpoint above consensus of $5.24.

Macy’s (M +1.91%) was upgraded to ‘Positive’ from ‘Neutral’ at Susquehanna with a price target of $43.

Ford Motor (F +1.59%) is up 1.6%, General Motors (GM +0.79%) is up nearly 1% and Fiat Chrysler (FCAU +2.20%) gained more than 2% in pre-market trading after China said it cut import tariffs on passenger vehicles to 15% from 25%.

Universal Display (OLED +2.55%) was rated a new ‘Buy’ at Roth Capital Partners with price target of $136.

Nordson (NDSN +3.45%) dropped nearly 6% in after-hours trading after it forecast Q3 EPS of $1.47 to $1.63, well below consensus of $1.91.

2U Inc (TWOU -0.16%) fell nearly 5% in after-hours trading after it announced that it had commenced a proposed public offering of up to $300 million of its common stock.

Micron Technology (MU +3.91%) rose 4% in after-hours trading after it announced a $10 billion share repurchase authorization.

Pure Storage (PSTG -0.38%) slid more than 7% in after-hours trading despite its forecast for Q2 revenue of $296 million to $304 million, the midpoint right on consensus of $299.2 million.

Sailpoint Technologies Holding (SAIL -0.66%) dropped almost 9% in after-hours trading after a holder filed to sell 15 million shares.

Lamb Weston (LW -0.07%) was rated a new ‘Sell’ at Vertical Group with a price target of $56.

Hostess Brands (TWNK +1.18%) was rated a new ‘Buy’ a Vertical Group with a price target of $19.

Melinta Therapeutics (MLNT -3.31%) fell more than 7% in after-hours trading after it announced that it had commenced a proposed public offering of up to $75 million of its common stock.

Libbey (LBY -3.80%) slumped more than 25% in after-hours trading after suspended its dividend in an attempt to cut its debt and invest in strategic initiatives.

Ardelyx (ARDX -2.59%) slid almost 4% in after-hours trading after it announced that it had commenced an underwritten public offering of up to $50 million of its common stock.

Today’s Economic Calendar

8:55 Redbook Chain Store Sales

10:00 Richmond Fed Mfg

1:00 PM Results of $33B, 2-Year Note Auction

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

4 thoughts on “Before the Open (May 22)”

Leave a Reply

You must be logged in to post a comment.

Long weekend so things are slow, atypical and misleading in all probability. Holding 20% invested. Predicting Fed will push interest rates up and banks will find lending a full time task. Volcker rule is to be redesigned to make loans more readily available. Bet it does not work out well. Lousy fall is coming maybe.

Keep your foot on the gas.

Preponderance of technical evidence points to higher market levels. US-China trade kefuffle does not affect internal Chinese commerce. Buy BZUN, the $10 move from current levels is commencing. P&F target is $69, a marvelous number in more ways than one.

Thanks