Good morning. Happy Wednesday.

The Asian/Pacific markets are mostly down. Indonesia is up, but China, Japan, Hong Kong, India, New Zealand, Malaysia, Singapore and the Philippines are suffering stiff losses. Europe, Africa and the Middle East are currently down quite a bit. Poland, France, Turkey, Germany, Greece, South Africa, Finland, Switzerland, Hungary, Spain, the Netherlands, Italy, Israel, Austria, Sweden and Russia are down at least 1%, and many are down more than 2%. Futures in the States currently point towards a relatively big gap down for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

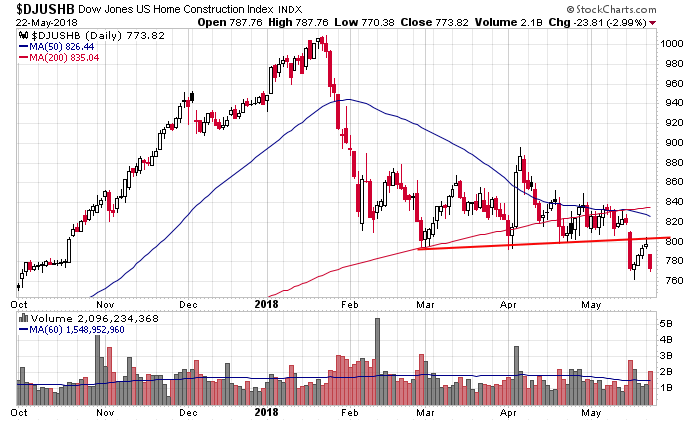

Home builders have been a sore spot lately. The group broke down last week, and with yesterday’s gap down and sell-off, it was rejected by the previous support level.

The dollar is up. Oil and copper are down. Gold and silver are mixed. Bonds are up.

Overnight Stock Movers from barchart.com…

Intuit (INTU -0.60%) was downgraded to ‘Underweight’ from ‘Equal-weight’ ar First Analysis with a price target of $160.

Celgene (CELG +2.57%) was downgraded to ‘Hold’ from ‘Buy’ at Argus Research.

Estee Lauder (EL +0.06%) was rated a new ‘Outperform’ at Evercore ISI with a price target of $170.

Urban Outfitters (URBN -2.55%) fell 2% in after-hours trading despite reporting Q1 gross margin of 32.8%, better than consensus of 32.6%.

Ameren (AEE +0.64%) was upgraded to ‘Neutral’ ‘from Sell’ at Goldman Sachs.

MetLife (MET +0.77%) gained nearly 1% in after-hours trading after it announced a new $1.5 billion share repurchase authorization.

Integrated Device Technology (IDTI +1.22%) was rated a new ‘Outperform’ at Cowen with a price target of $37.

Red Robin Gourmet Burgers (RRGB -4.53%) slumped 14% in after-hours trading after it reported Q1 adjusted EPS of 69 cents, below consensus of 75 cents.

Cypress Semiconductor (CY +1.24%) was rated a new ‘Outperform’ at Cowen with a price target of $21.

HP Enterprise (HPE -0.57%) gained 0.2% in after-hours trading after it forecast full-year adjusted EPS OF $1.40 TO $1.50, the midpoint above consensus of $1.41.

Blackline (BL -1.68%) fell more than 2% in after-hours trading after holder Silver Lake Sumeru Fund offered 3.5 million shares at $40.35-$40.50 via Morgan Stanley.

Quantenna (QTNA -0.86%) was rated a new ‘Buy’ at Stifel with a price target of $19.

The Container Store (TCS +8.20%) tumbled over 12% in after-hours trading after it reported Q4 adjusted EPS of 18 cents, weaker than consensus of 23 cents, and forecast full-year EPS of 35 cents to 45 cents, the midpoint below consensus of 42 cents.

Arcos Dorados Holdings (ARCO +3.45%) rallied almost 5% in after-hours trading after it announced a share repurchase program of up to $60 million in outstanding class A shares.

Tuesday’s Key Earnings

Hewlett Packard Enterprise (NYSE:HPE) +0.4% AH lifting its outlook.

Kohl’s (NYSE:KSS) -7.4% hit by calendar-related impacts.

TJX Cos. (NYSE:TJX) +3.3% upping its full-year forecast.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

9:45 PMI Composite Flash

10:00 New Home Sales

10:30 EIA Petroleum Inventories

11:30 Results of $16B, 2-Year FRN Auction

1:00 PM Results of $36B, 5-Year Note Auction

2:00 PM FOMC minutes

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

2 thoughts on “Before the Open (May 23)”

Leave a Reply

You must be logged in to post a comment.

I am beginning to appreciate the difference in quality within the REIT sector, as the higher-quality names like Simon Property Group (NYSE:SPG), Taubman Centers (NYSE:TCO), and Macerich Group (NYSE:MAC) are beginning to utilize their competitive advantages to provide differentiation. Always a market somewhere…building reits this month.

this is starting to look and feel like a flight to the dollar, which may be the first step of flight to safety. if that’s the case, this should be good for the bonds (u.s. treasuries of course, not brazilian sovereign debt or high-yield corporate bonds) but not so much for risk assets (equities, etc.).