Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up with big gains. China, Hong Kong, Taiwan and Indonesia gained more than 2%; India, Malaysia and the Philippines did better than 1%. Europe, Africa and the Middle East are currently doing very well. France, Poland, Turkey, Germany, Russia, South Africa, Switzerland, Hungary, the Netherlands, Italy, Sweden and the Czech Republic are up 1% or more. Futures in the States point towards a moderate gap up open for the cash market.

The dollar is down. Oil and copper are flat. Gold and silver are up slightly. Bonds are mixed.

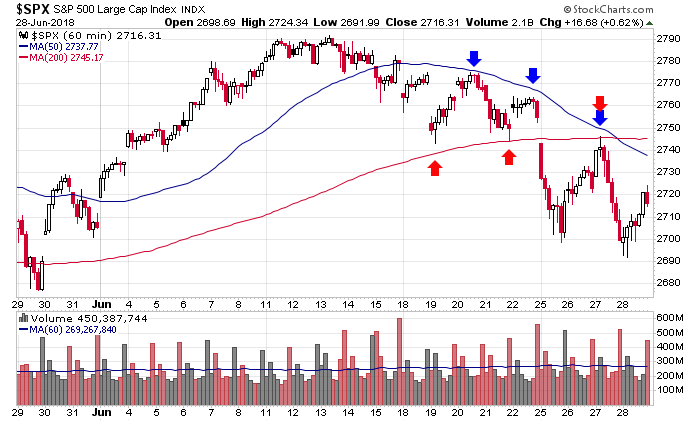

For the current short term downtrend to reverse, the SPX has to get back above its 50 on the hourly.

Overnight Stock Movers from barchart.com…

KB Home (KBH +1.68%) was upgraded to ‘Buy’ from ‘Underperform’ at Bank of America/Merrill Lynch with a price target of $37.

JPMorgan Chase (JPM +1.64%) gained more than 1% in after-hours trading after it said it will increase its quarterly dividend to 80 cents a share from 56 cents a share, well above consensus of 68 cents a share, and then said it will buy back up to $20.7 billion of its stock between July 1, 2018 and June 30,2019.

SYNNEX (SNX -0.75%) fell 4% in after-hours trading after it forecast Q3 adjusted EPS of $2.42 to $2.52, the midpoint well below consensus of $2.57.

Nike (NKE +0.49%) rose almost 6% in after-hours trading after it reported Q4 EPS of 69 cents, higher than consensus of 64 cents.

Ryder System (R -0.33%) was rated a new ‘Buy’ at Mizuho Securities with a price target of $85.

Citigroup (C +2.17%) gained 2% in after-hours trading after it said it will boost its quarterly dividend to 45 cents a share from 32 cents, better than estimates of 41 cents, and then said it plans to buy back up to $17.6 billion of its stock.

Wells Fargo (WFC +0.66%) climbed almost 3% in after-hours trading after it boosted its quarterly dividend to 43 cents a share from the current 39 cents a share, and then said it will buy back up to $24.5 billion of its stock.

Allison Transmission Holdings (ALSN unch) was rated a new ‘Buy’ at Mizuho Securities with a price target of $50.

KB Home (KBH +1.68%) rose more than 3% in after-hours trading after it reported Q2 revenue of $1.10 billion, higher than consensus of $1.04 billion.

Huntington Bancshares (HBAN +0.07%) gained more than 2% in after=hours trading after it said it plans to boost its quarterly dividend by 27% and buyback up to $1 billion of its stock.

Gemphire Therapeutics (GEMP -5.07%) surged nearly 60% in after-hours trading after it said its Gemcabene drug achieved the primary endpoint of reducing triglycerides in its Phase 2b trial in patients with severe hypertriglyceridemia.

Ziopharm Oncology (ZIOP +1.66%) climbed almost 4% in after-hours trading after it enrolled the first patient in its Phase I study of its Ad-RTS-hIL-12 plus veledimex in combination with Bristol-Myer-Squib’s OPDIVO drug for adult patients with recurrent glioblastoma.

Thursday’s Key Earnings

Nike (NYSE:NKE) +9.2% AH on a rebound in N.America.

Walgreens (WBA) -9.9% pressured by Amazon’s pharmacy move.

Today’s Economic Calendar

8:30 Personal Income and Outlays

9:45 Chicago PMI

10:00 Consumer Sentiment

1:00 PM Baker-Hughes Rig Count

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

2 thoughts on “Before the Open (Jun 29)”

Leave a Reply

You must be logged in to post a comment.

The market in trading range to oct, a new bull probably starts in second week of Oct, but buy and holding will require patience. I use 31 days to time moves from wherever we were/are. I like bonds which are at lows now or soon. TLT is interesting. I suspect that worldwide things will look up so I will hold some internationals in Europe, watch China carefully.

We need a couple down days in a row for a buy signal. This up down up down is hard for my trading style.