Good morning and greetings from Costa Rica. I’ve spent the last several days off the grid and without internet. I’m back to civilization but will be in Central America for the next month.

The Asian/Pacific markets closed mostly down. New Zealand and Australia did well, but Japan, China, Hong Kong, Taiwan, Thailand and the Philippines were weak. Europe, Africa and the Middle East are currently mostly up. France, Turkey, Germany, Russian, Spain, Italy, Belgium, Portugal and Austria are up 1% or more. Futures in the States point towards a relatively big gap up open for the cash market.

The dollar is down. Oil is up; copper is down. Gold and silver are up. Bonds are down.

Being away from the market for a couple days, I need a quick reminder of what’s going on.

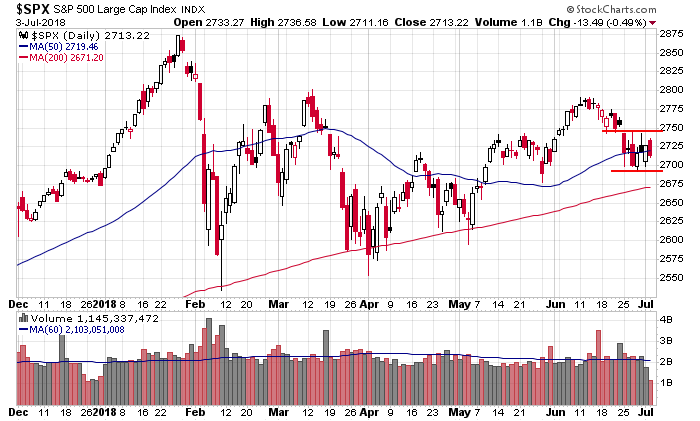

Here’s the daily S&P. It’s been straddling its 50 the last 7 days, and with a series of lower highs and higher lows, it’s the picture of neutrality. There is no momentum and staying power with any move. Today’s open will be close to yesterday’s open, but big gap ups haven’t meant much lately. We’ve been in conservative mode the last couple weeks. This chart tells us our stance has been wise, and it should be maintained.

Overnight Stock Movers from barchart.com…

Diamondback Energy (FANG +0.58%) was rated a new ‘Buy’ at TD Securities with a price target of $165.

Noble Energy (NBL +2.03%) was rated a new ‘Buy’ at TD Securities with a price target of $45.

Qorvo (QRVO -3.32%) was upgraded to ‘Overweight’ from ‘Sector Weight’ at KeyBanc Capital Markets with a price target of $95.

Fiat Chrysler (FCAU -1.00%) was upgraded to ‘Buy’ from ‘Hold’ at Jeffries.

DMC Global (BOOM +0.22%) was rated anew ‘Buy’ at Chardan with a price target of $59.

Veoneer (VNE +3.63%) was rated a new ‘Overweight’ at Barclays with a price target of $55.

Clean Energy Fuels (CLNE +1.64%) was downgraded to ‘Underperform’ from ‘Market Perform’ at Raymond James.

Advanced Energy Industries (AEIS -2.18%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Raymond James with a price target of $72.

Hexcel (HXL +0.21%) was upgraded to ‘Buy’ from ‘Hold’ at Canaccord Genuity with a price target of $80.

Deciphera Pharmaceuticals (DCPH +5.97%) was rated a new ‘Buy’ at SunTrust Robinson Humphrey with a price target of $60.

API reported Tuesday after the markets closed that U.S. crude stockpiles fell -5.51 million bbl last week.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

7:30 Challenger Job-Cut Report

8:15 ADP Jobs Report

8:30 Initial Jobless Claims

9:45 Bloomberg Consumer Comfort Index

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

2 thoughts on “Before the Open (Jul 5)”

Leave a Reply

You must be logged in to post a comment.

looks like a developing H/S and their is a triangle there

I was buying gas before the 4th of July the price was about 2.59. I was waiting in line to pay my fee and there was a young man cleaning the floor. We started talking and I said the price of gas will be over 3 on the 4th of July he replied it’s going up $200 a barrel and the stock market’s going to crash 10000 points. So I asked him what in this investment decision would you make his answer was if he had any money he would buy gold. If I have ever had a signal to tell me to go long this was it.