Per Sam Stovall, formerly of S&P Capital IQ, every recession since 1960 has been preceded by y/y double-digit decline in housing starts. The average is -25%. The smallest (-10%) occurred ahead of the shallowest economic contraction while the biggest (-37%) occurred before deepest recession.

—————

Not a Leavitt Brothers subscriber but appreciate our work? Consider making a small donation.

—————

“Year-over-year” is a long time. It implies tops take time to form, but this doesn’t mean we can’t look for early warning signs.

Here’s a rundown of the housing group, mostly in terms of the companies that make the various finishes of a house.

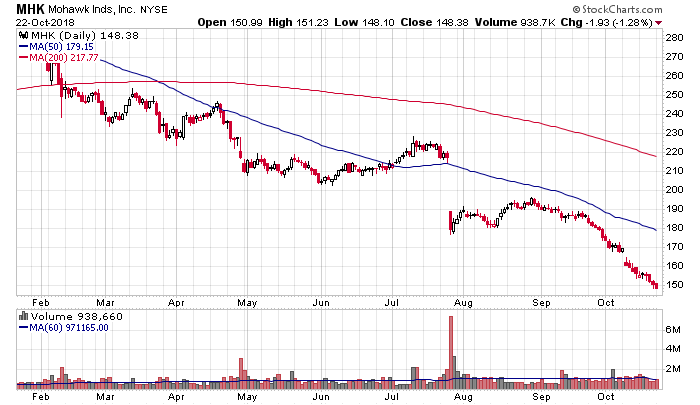

Mohawk (MHK) does flooring – carpet, ceramic tile, laminate, wood, stone, vinyl and rugs.

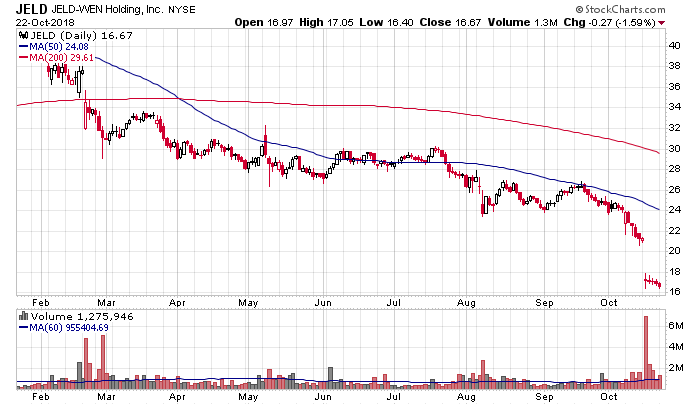

Jeld-Wen (JELD) does interior and exterior doors and wood, vinyl and aluminum windows.

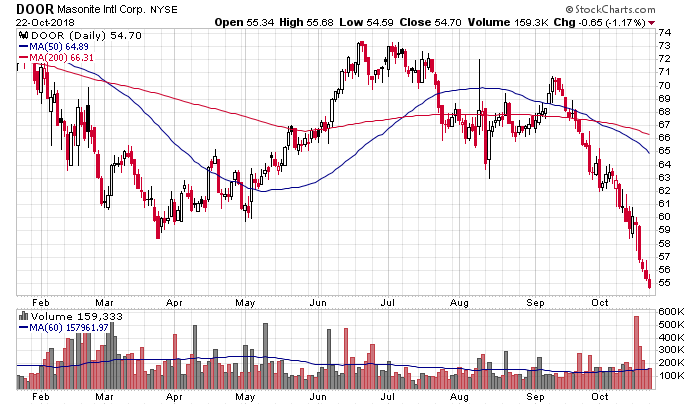

Masonite Worldwide (DOOR) makes interior and exterior doors.

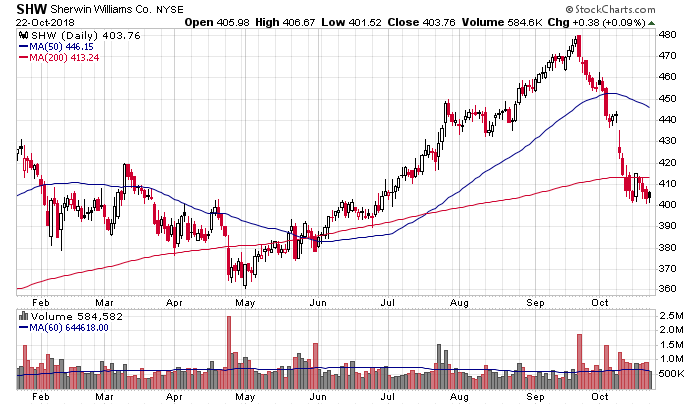

Sherwin Williams (SHW) does paint and other coating products.

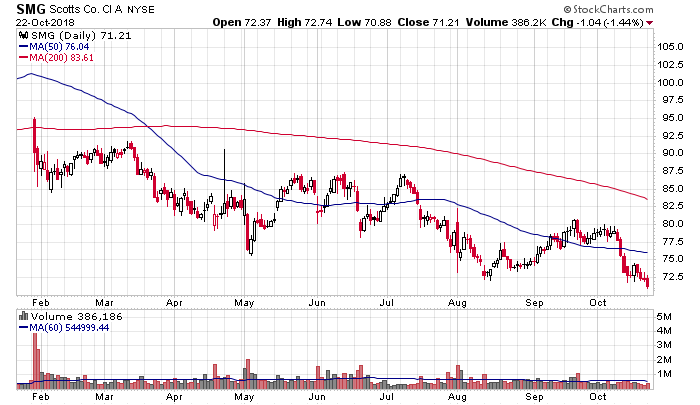

Scotts Miracle-Gro (SMG) does lawn and garden care.

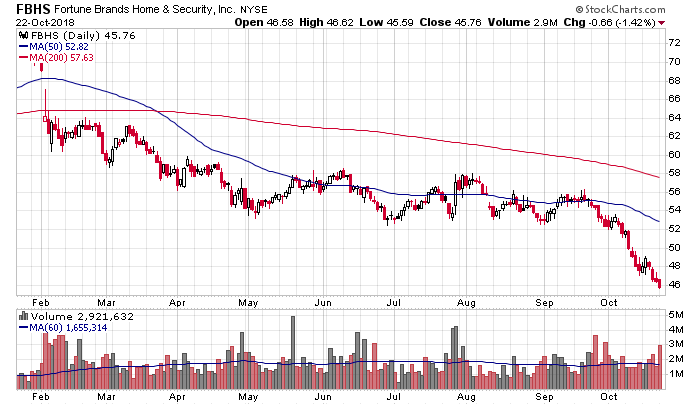

Fortune Brands Home & Security (FBHS) does cabinets, doors, windows, tool storage, garage organization and safety devices.

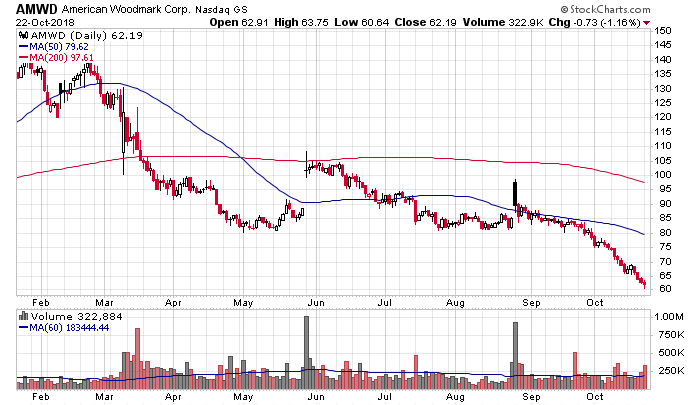

Amer Woodmark (AMWD) makes kitchen and bath cabinets.

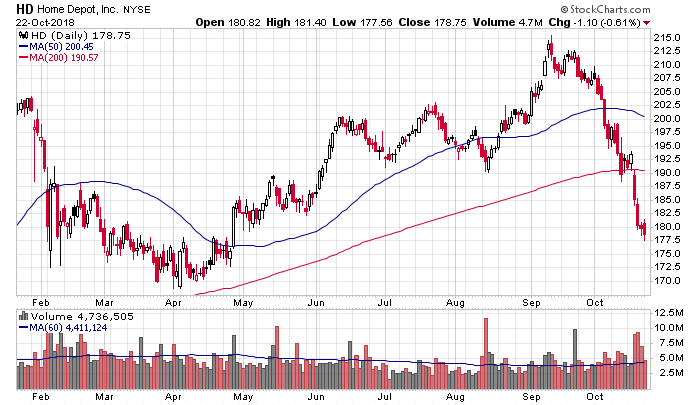

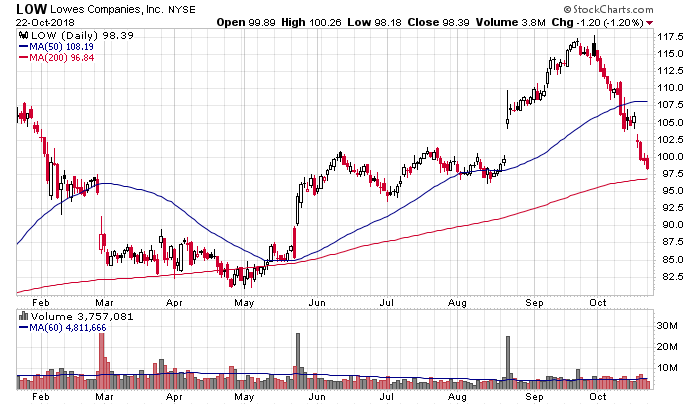

Home Depot (HD) and Lowe’s (LOW) sell a wide range of building materials, home improvement products and lawn and garden products.

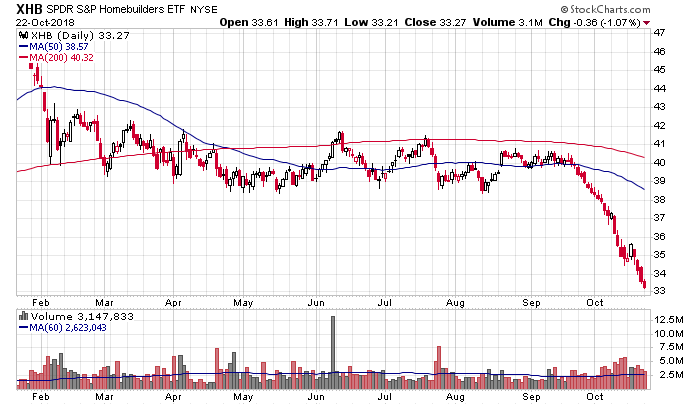

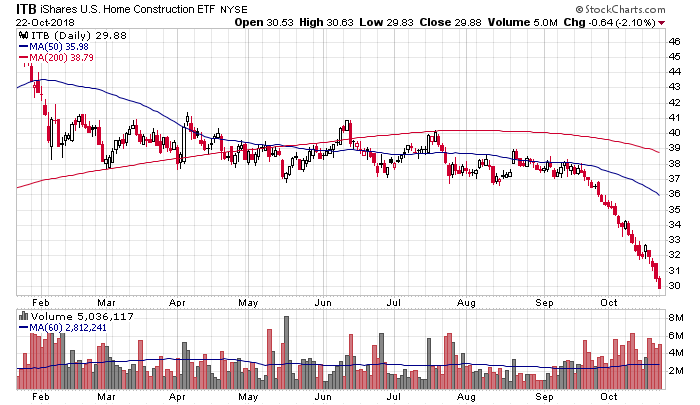

XHB and ITB are residential construction ETFs.

These charts speak for themselves. There’s no question housing is weakening – there are headlines highlighting various metrics dropping in key markets almost every day. And if a negative wealth effect takes place and consumers pull back on their spending just a little bit, the economy, which is 70% consumption based, will take a hit.

These charts are our warnings signs. We don’t have to wait for a y/y drop in housing starts to read what’s in the pipeline.

A market top is forming. It’ll take some time – possibly well into 2019 – but it’s still forming, so have a plan in place to navigate it.

5 thoughts on “Housing Stocks Warn a Top is Forming”

Leave a Reply

You must be logged in to post a comment.

And add to that the banks that can’t find traction for a while now and the situation is pretty gloomy.

Thanks

Jason

I enjoy your analyses. I cannot say I agree or disagree.

Interest rates are up. Housing has to get soft. Lumber prices have doubled in three years at least a my Menard’s and Home Depot. No one can find a contractor to do any work around here. In my area they only work for cash right now. This is not sustainable. I see the logging companies have greatly increased their staff. Sawmills are having trouble staffing up. The plywood plants are full bore. The number of rail road cars and trucks going through town is roughly doubled in the three years. There has to be a pullback at some point.

The fed will control interest rates hence housing starts.

There is still pent up housing demand and people are working and getting raises. The housing market has gone too far too fast and many are waiting to buy the dip. Houses that sold for 35K seven years ago are selling for 150K today.

I tend to watch the yield curve. the three month vs the 10 year is 94 basis points. Not enough to become alarmed about. If I see a 35 basis point spread I am out.

Paul

Where in the world could you buy a house for 35K? 🙂

Most of Michigan when the auto industry failed. The house I am referring is a nice home in Nashville (not where I live) on the river with 1/2 acre lot. There were many others. I bought a number of properties in Michigan. I bought condos for 15K each which one is now on the market for 90K. Even high end property has doubled in the last three years. There are still some fairly new homes in some of the former mining towns selling for under 50K one with a view of Lake Superior.

SURPRISE, SURPRISE: Among the S&P 500, 250 stocks were down 20% or more from their all-time closing highs (adjusted for splits and spin-offs) as of the close already on Oct. 15.

• 162 were down at least 30% from their all-time highs.

• 113 were down at least 40% from their all-time highs.

• 69 were down at least 50% from their all-time highs.

I think the top has already been, we we now in the bear-market (worldwide). ;-D