Let’s take a look around the world. The S&P printed a new high last month and then dropped 10%. I’m most interested in seeing what markets are correlated with the US and which are suddenly strong and unaffected by weakness in the US.

Asia/Pacific

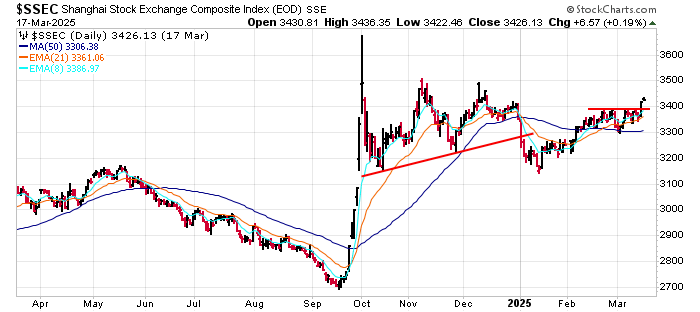

China has been erratic. It was weak last summer when the US was strong, and then it shot up in September. It’s unchanged since September but is at a year-to-date high right now. We know this. There have been a few China stocks on the trading list.

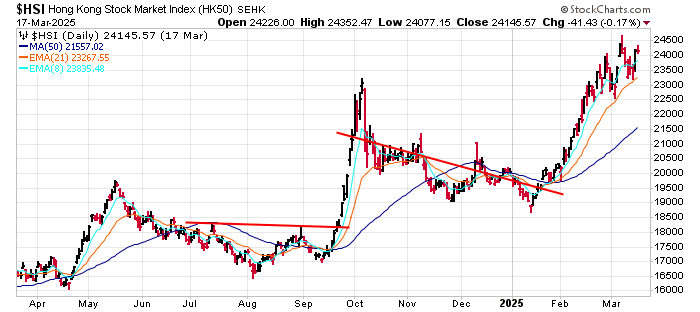

Hong Kong rallied with China in September, and after backing off for nearly four months, it shot up again in February. It’s one of the strongest markets.

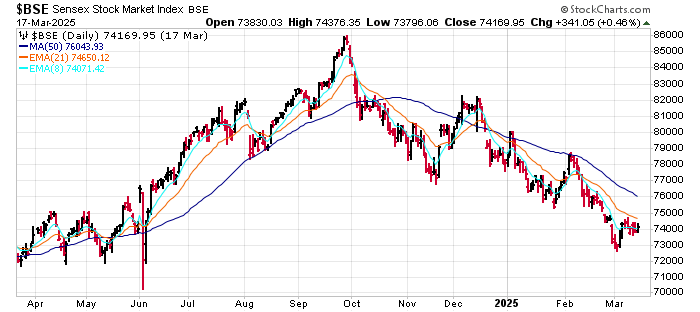

India has done a round trip. It calmly moved up for several months and is now giving it all back. But this just recent weakness. Going back to the COVID low, India has been one of the world’s best performers.

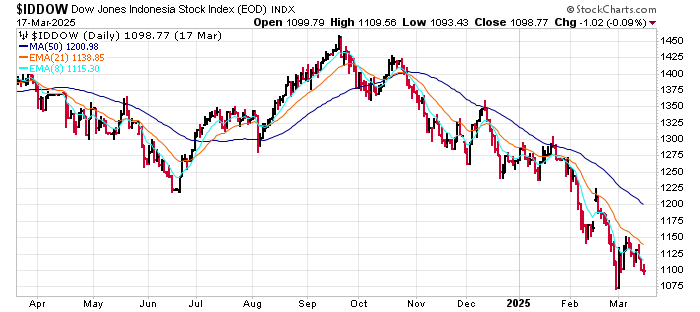

Indonesia traded in a range for most of 2021-2024 and then broke down in February. This is a 4+ year low.

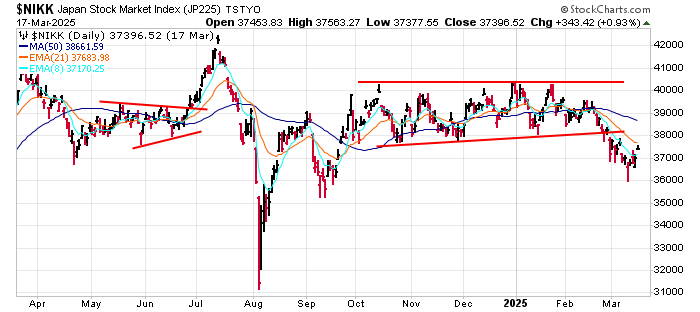

Japan printed a new high and then collapsed after the carry trade made news. Overall it’s been flat and mostly range bound the last year. But since it came off a huge 2023 and early 2024, a case can be made it’s simply consolidating its gains.

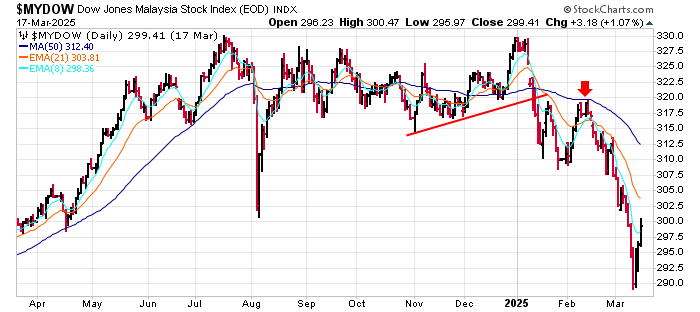

Malaysia rallied steadily off its mid-2023 low, but after flattening out in 2024, it’s fallen hard this year. It is not a place to be.

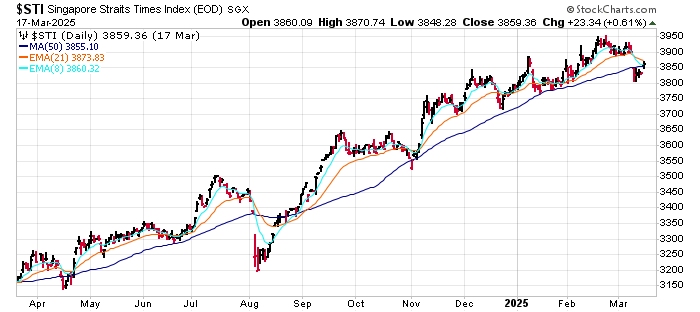

Singapore bottomed in late 2023, and other than a brief move down last August, it’s been one of the world’s best markets. And it continues to be strong, having resisted falling much the last month.

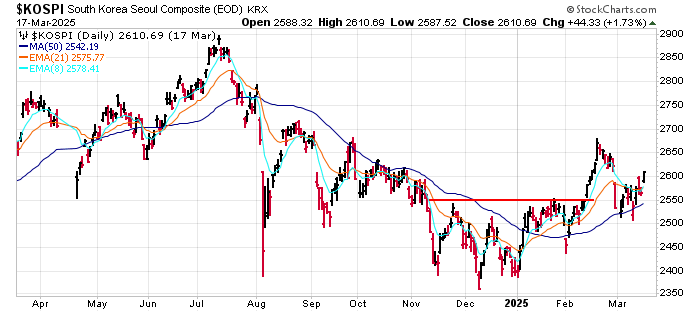

South Korea doubled off its COVID low but then gave more than half the gains back in 2021 and 2022. Since then it’s been mostly dead money. In the near term, it has perked up. While the US has fallen hard, South Korea broke out in February and is trying to move up, having just tested its 50.

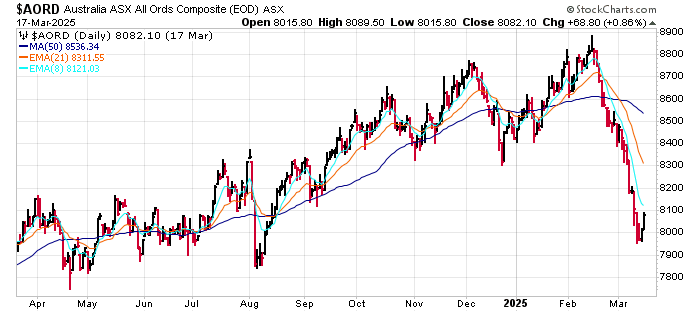

Australia has matched the movement of the US most of the last six years. It has moved up, corrected, and then moved up again. Now it’s falling hard, and unless the link breaks, it’ll continue to track the S&P.

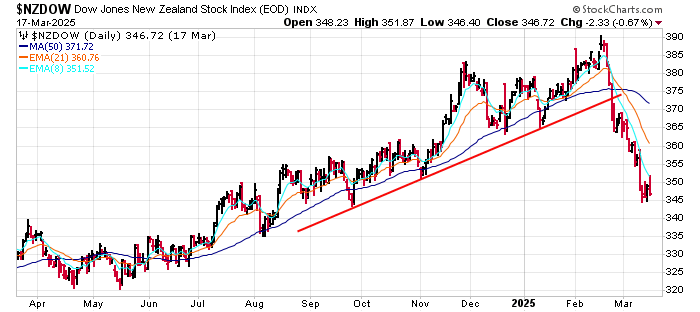

New Zealand got off track after its 2021 high but hooked back up with the US in late 2023. The higher high was matched last month, and it has suffered the same intense selloff. This chart is broken. It’ll take time to heal.

Europe/Africa

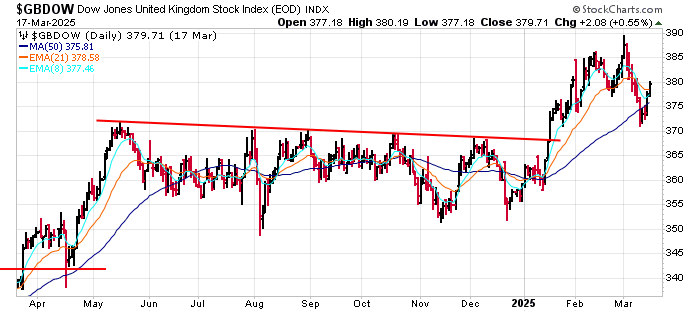

The UK spends most of its time grinding in ranges, so the fact that it broke out in January probably means it’s done for now. A higher high was followed by a lower low. Now it’s mid range. Not bad.

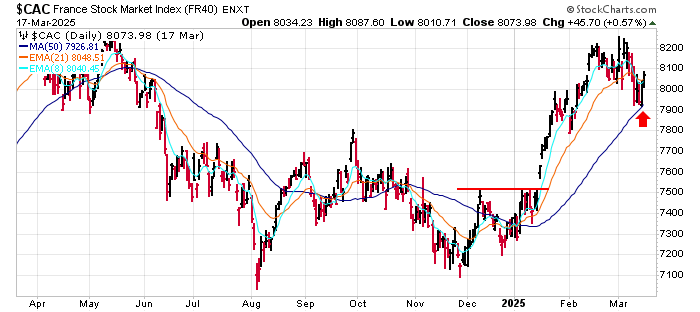

France printed a new high in Q1 and Q2 of last year and then fell over the summer. It has recaptured those losses and has handled the US losses well as it’s only a couple percent off its high.

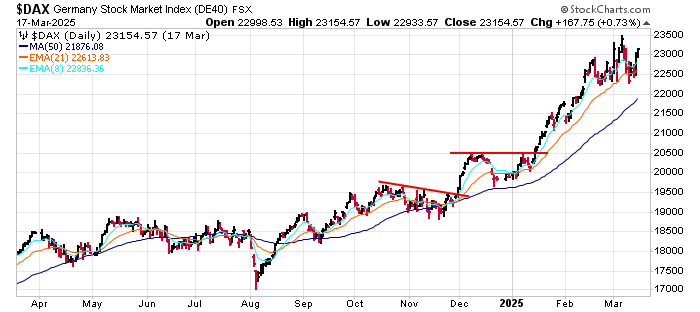

Germany is doing incredibly well. It matched the movement of the US off the 2022 low, and over the last month it has clearly held up well. It is a leader right now.

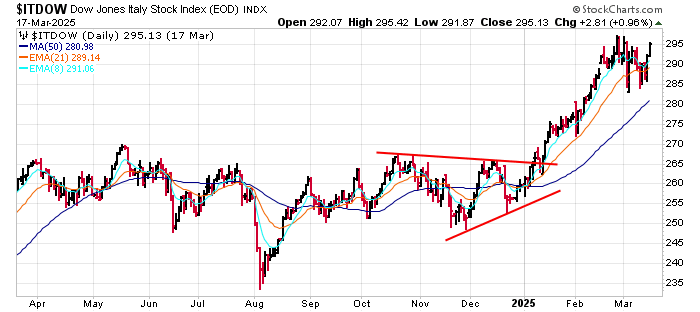

Italy based for more than a decade and then broke out in late 2023. More recently it consolidated for nine months in 2024 and then broke out in January. It has been unaffected by weakness in the US. Money is flowing here.

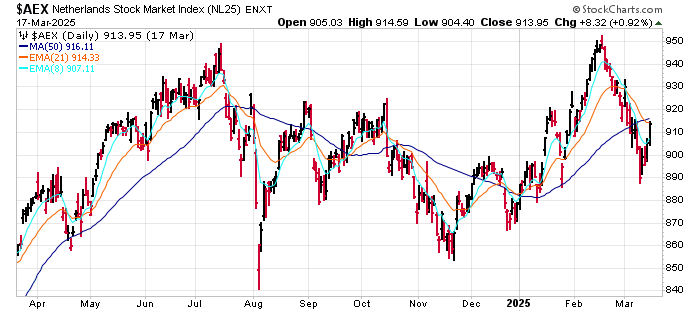

The Netherlands has been a sloppy mess. It printed a new high last month and then fell hard. Before that, it was all over the place, with several trending moves but no consistency.

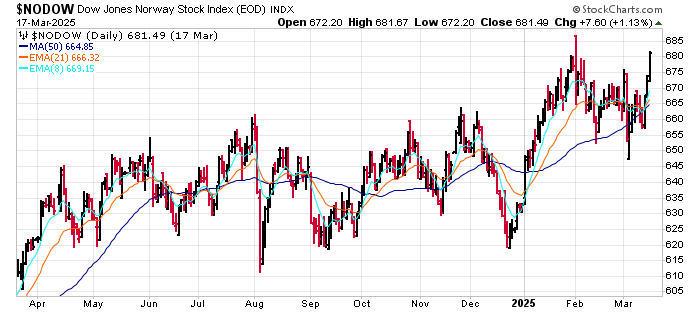

Norway rallied for two years off its COVID low and has spent the last three years being mostly range bound. While the US moved up and down, the Netherlands’ moves were muted. It has been disconnected, so it’s no surprise it’s been unaffected by the S&P’s weakness.

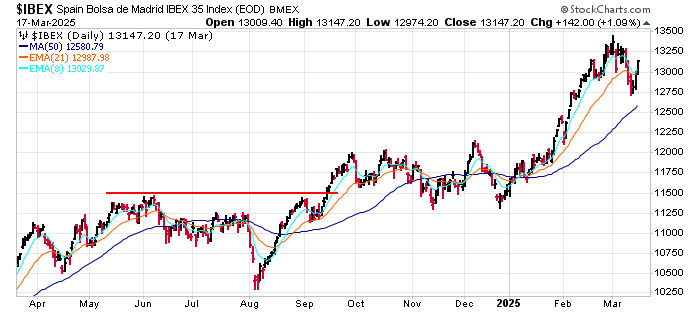

Spain has trended up and over since bottoming in 2023. It’s done great this year and isn’t far off its high.

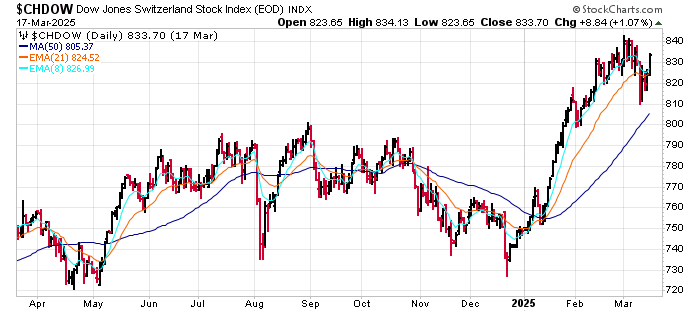

Switzerland was weak during Q4 of 2024 when many of its peers were flat or strong. But it has caught up. It has gone vertical this year and is minimally off its high.

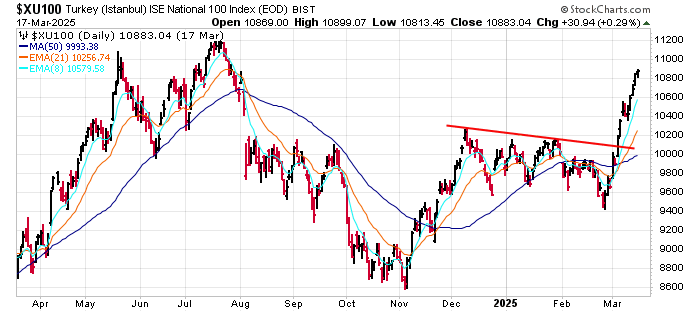

Turkey: has had currency issues, so we can’t trust its 1000% rally off its 2020 low. In the near term, it seems to have benefitted from issues in the US. It’s up more than 10% in just a couple weeks.

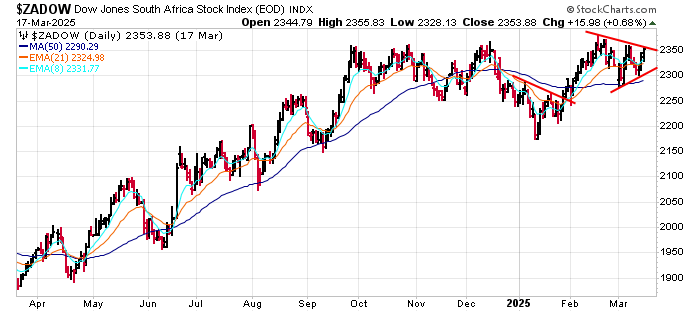

South Africa has calmly consolidated the last month between converging trendlines. The weakness in the US has not trickled here.

The Americas

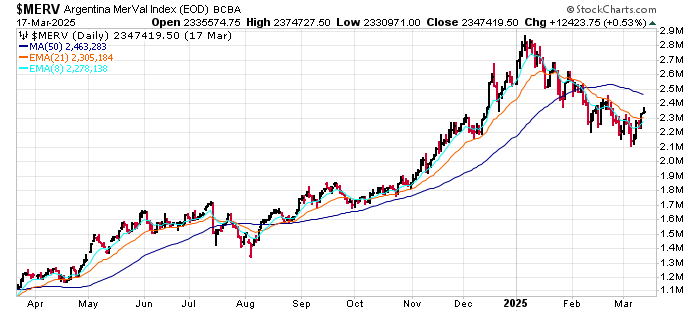

Argentina: has had currency issues, hence the 3000% move off the 2022 low. It dropped in January and February when the S&P was moving up and is flat over the last month. By itself, it is simply consolidating a huge 2024 gain.

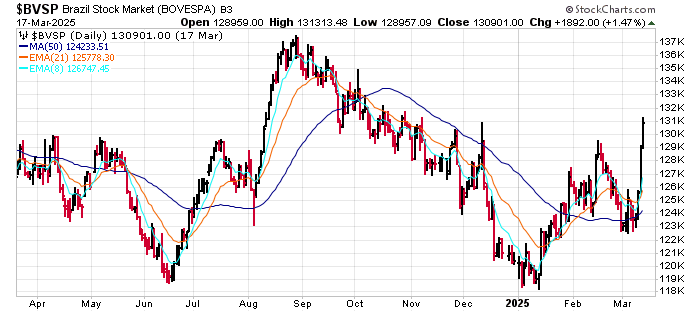

Brazil is a very volatile market. There are moderate swings all over its chart going back several years. It didn’t participate in the S&P’s strength the second half of last year and now it’s not being pulled down by its weakness.

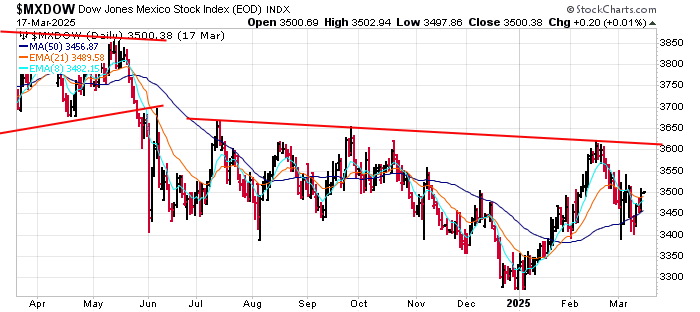

Mexico has been dead money for three years, and closer to home, it’s been basing, having fallen out of a top last year. Tariff talk has had a muted effect so far.

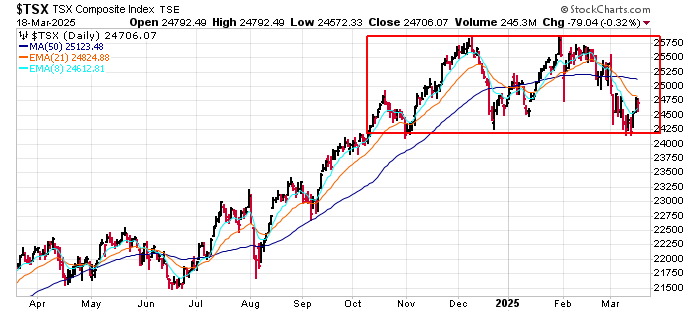

Canada has been range bound for five months, which means it mostly matched the movement of the S&P until just a couple weeks ago. It resisted falling much and is closer to reversing back up. And tariff talk hasn’t has hurt the market too much.

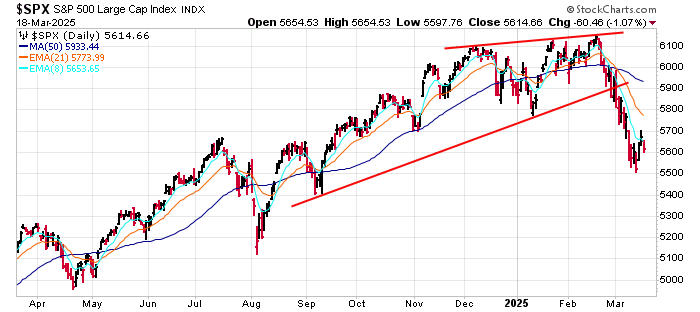

The United States trended up until a few weeks ago when it started a hard drop that turned into one of its worst 4-week drops in history. Something has clearly changed. A character shift has taken place. Damage has been done. The chart is broken. It’ll take time to fix.

Random Comments:

Let’s start with the US. After printing a new high, it fell 10% in one month.

Several Asian countries have also fallen hard or are trending down (Indonesia, Malaysia, India), but others have done well or are improving (South Korea, China, Hong Kong, Singapore).

Europe seems to be a beneficiary of weakness in the US. All the major markets there have held their gains and done moderately well the last month (the UK, Germany, France, Spain, Italy).

The rest of the Americas are split.

There’s clearly been a flow of money from the US to parts of Asia and Europe. The US is not leading any more. It’s not the strongest market – not even close. There are better markets to trade, even if it means looking into country ETFs.

Jason Leavitt