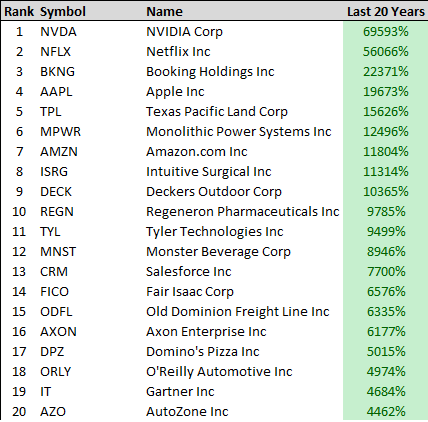

The following tables were posted on Twitter by Charlie Bilello. They are the top 20 stocks over the last 5, 10, 15, and 20 years. Check them out. Then I’ll comment.

The most obvious observation is: many stocks appear on more than one list.

NVDA is on all lists.

SMCI is on the 5, 10 and 15-year lists.

AVGO is on the first three lists.

AXON, which acquired Taser many years ago, is on all four.

TPL is on all four.

TSLA is on the first two.

MPWR and NFLX are on the 10, 15, and 20.

KLAC and CDNS are on the 10 and 15.

DPZ is on the 15 and 20.

There are only 20 stocks per list, so it’s notable when the same stocks appear multiple times. The strong stay strong. We know this. Morgan Stanley did a study years ago and found out 8% of stocks were responsible for 100% of the market’s gains. The other 92% canceled each other out. The best stocks tend to do great for a long time. Everything else is temporary.

A second observation involves the number of stocks on the 20-year list that don’t appear again, and the number on the 5-year list that didn’t appear before. This suggests there is some rotation.

BKNG, AAPL, ISRG, DECK, REGN, MNST and others are on the 20, but that’s it. This suggests they had their day in the sun a long time ago, but they haven’t been at the top of their class since.

HWM, TRGP, PWR, VST, GE, RCL, STLD, MPC, FICO and JBL are on the 5-year list but nothing older than that. So, these are either new companies that have only been around for 5 years (give or take a year), or they’ve finally figured stuff out.

If we were to guess what stocks will be on the 5-year list in five years, I’d bet several names will come from the current 5-year list. Winners keep winning.

If you want the wind at your back when you trade, it may be smart to work from a list of winning stocks. For trading purposes, shorter time frames are more appropriate. There will always be new winners, but if you start with a list of stocks that have done the best over the last month, quarter, half year and year, you’re in a good starting place.