Good morning. Happy Friday. Happy Options Expiration Day.

This week the market has done exactly what it needed to do to cause lots of pain for the bears who expected a big sell-off and were willing to put their money where their mouths were by buying put options.

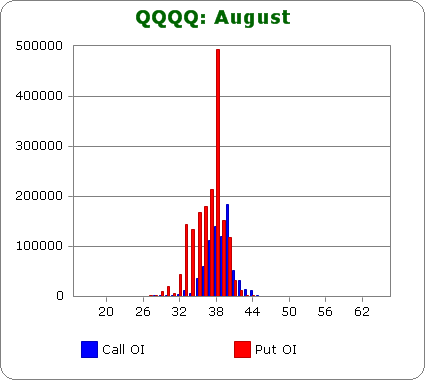

Here’s the QQQQ open-interest chart I talked about last weekend. … The stock closed at 39.76 yesterday. The last strike that has any decent OI is 40, so pretty much that huge block of puts (red bars) will expire worthless.

Even if the market drops today, most of those puts will expire worthless because their breakeven levels are at least a point – and more likely more – below their strikes. This type of analysis doesn’t always work. I’ve loosely followed the OI and have found its record month to month to be spotty. This month the market wasn’t going to let those put holders cash in.

The market tends to do exactly what you think, but not when you think.

Monday’s huge gap down has filled…the market is up slightly for the week…not bad considering we’ve had 2 gap downs great than 10 points.

Looking at several hundred charts yesterday gave me the following feeling…they don’t look as good as a couple weeks ago, but they don’t look bad either…and they definitely look much better than just a few days ago.

The Asian/Pacific markets closed mixed. China, which seems to be on everyone’s watchlist lately, rallied 1.7%. Europe is currently up across the board. Futures here in the States are up several points, so as of now we’ll be getting a gap up open for the cash market. More after the open…

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 21)”