Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down; China rallied 1.2%.

Europe is down across the board, but losses aren’t great.

Futures here in the States suggest a small gap down open, but this could change because I’m looking at the numbers 75 min before the open. …

Remember, unemployment numbers come out Friday and the market is closed Monday. There could be a lot of jockeying for position over the next couple days.

We’ve been here several times the last few months. The market drops, and all the bears come out of the woodwork predicting a huge sell-off that takes out the March low. Then a couple days later (or perhaps a week), the market is making new highs. As I like to say, a stopped clock is correct twice a day. Eventually the bears will be right…but many of them are broke, so it doesn’t matter. This has been once of the greatest rallies in history (in terms of the percentage move in a given period of time), and the bears tried picking a top how many times?

I think it’s silly to predict what the market is going to do because the role the government is playing is not something that’s ever been seen before. How many times the last couple months have you thought the market should correct or at least suffer a mild pullback only too see new highs registered a few days later? Several. When the gov’t is going to back stop everything, when the gov’t literally won’t let the market drop, nobody in their right mind should attempt predicting what will happen – to the upside or downside.

I’d rather just note the trend and go with the flow and play good defense.

My goal is to pull money out of the market, not nail an entire move. Your goal should be the same.

If you do research and form a strong opinion, you’ll likely get married (or at least engaged) to that opinion, and when the tide turns or when it becomes obvious you’re wrong, you’ll hold on stronger. But if you resist having such an opinion, you’ll be free to go with the flow.

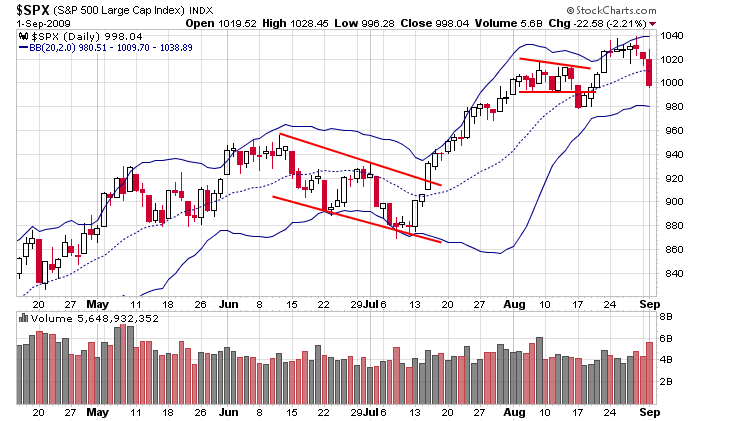

Here’s the daily SPX. Unless the market immediately bounces today, my minimum target is 980 – the bottom Bollinger Band.

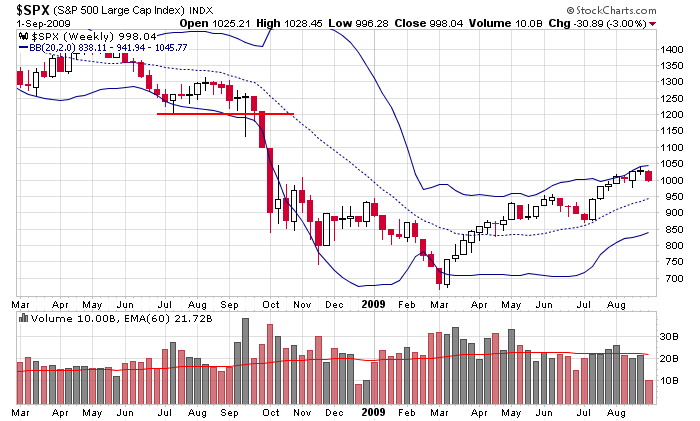

Here’s the weekly SPX. After 980, 950 is a level I’ll be watching.

These levels give me a frame of reference to work from, but I don’t hold out for them. Again, when the gov’t can make up the rules on the fly, how could anyone predict what will happen.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s Sector Performance

this week’s Earnings Reports

this week’s Economic Numbers

open a real-time futures demo account at…

0 thoughts on “Before the Open (Sep 2)”

Leave a Reply

You must be logged in to post a comment.

Is there a tradable correlation between the SPX and ES?

Rich…not sure what you’re asking.

Are you talking about divergences…ES makes higher high while SPY makes lower high?

If so, I don’t think it would be too helpful to look at that. The ES is too noisy. I prefer looking for a divergence between the ES and TF.

If this isn’t what you’re asking, please clarify.

Jason

I’ll look at the TF. Yes, I lunch trade the ES and am trying to get an edge. Since the ES is futures of the SPY I was wondering if there was a tradable correlation, like if one was guicker to react to the market than the other. On the morning TV shows the anouncer will say the furters are up or down. Is this info tradable/usable? Is there a tradable correlation between the futures and the index? Or some info/knowledge that gives an edge to trading the ES at lunch.

Thanks

I’ve never noticed a good enough correlation between the ES and SPY (or $SPX or $BKX or several others I’ve tried) to be used with confidence.

I have however noticed TF typically leads so when it diverges from ES, there’s money to be made. Here’s an old chart to give you an example.

Thanks for the chart. The ‘TF’ on my system is Thai Capital Fund and according to it the /ES should be going down.

TF is the Russell 2000 emini contract. 🙂

On my system \TF is the Russell and TF is the Thai Capital Fund.

Well said! The correct mental attitude.

One of the most concise, accurate posts I’ve read in a while.