Good morning. Happy Tuesday.

First a side note -> I’ve switched LB’s email service to a Google App. This entailed migrating 1000’s of old messages which is no problem but Google likes to figure out conversations and group emails together. Hence, some emails may get lost in the shuffle. If you’ve emailed me in the last day or so and haven’t gotten a response, I may not know where the message is, so if it’s important, write again.

On to the market.

The Asian/Pacific markets closed down – China and India lost more than 2%.

Europe is mixed with a bullish lean.

Futures here in the States are flat.

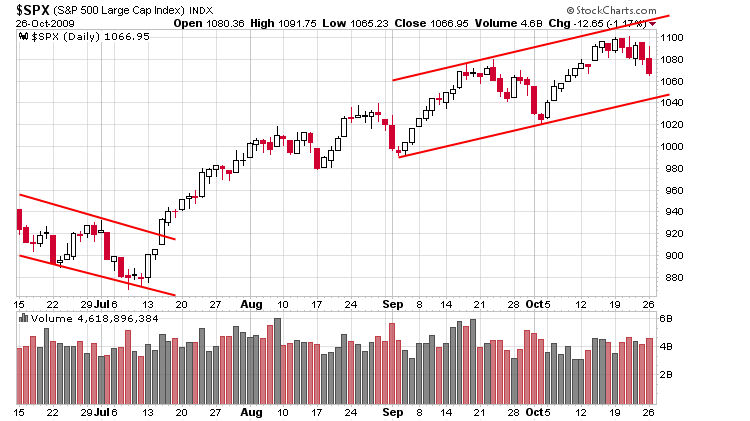

Heading into this week my bias was to the down side. The overall trend was up, but there were too many warning signs to ignore. This doesn’t mean I expect a significant top to be put in place and a lasting down trend to materialize. It just means in the near term (possibly up to a week or two), I’m looking for a pull back. Such a move will present an opportunity to make a few bucks on the short side (I prefer buying the reverse ETFs) and will reset many charts for the next round of breakouts.

My first downside target is ~ SPX 1040 – the trendline shown below.

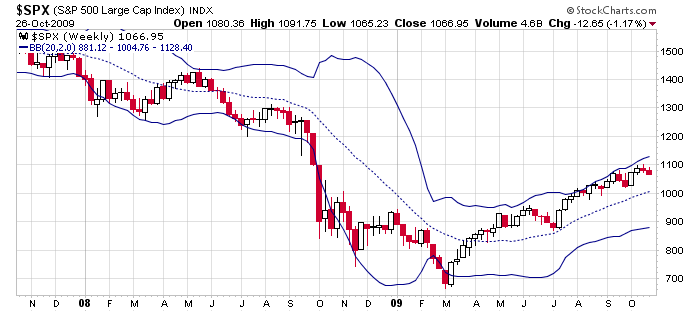

My second downside target is ~ SPX 1005 – the middle of the Bollinger Bands.

More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

Lt is more bullish than bearish. The liquidity which will stay until Nov 2010 will keep the market positive. When the QE starts to come out, so will the starch and the picture will be negative for some time. Until then I will just scalp a few and watch out for insanity in the banks.