Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down – several indexes lost at least 1%.

Europe is currently down across the board – Austria is getting killed; most other indexes are down ~ 1.5%.

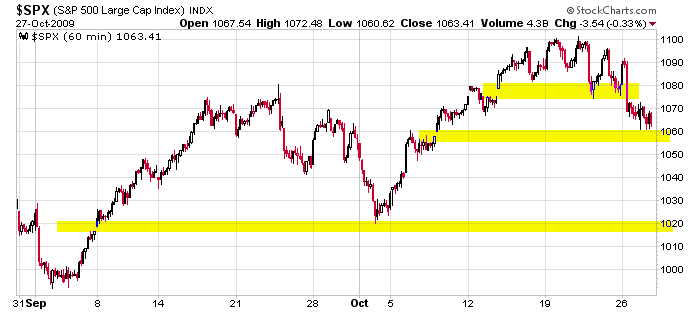

Futures here in the States suggests a gap down open for the cash market. This comes off the market being down 5 of the last 6 days. It will soon be due for a bounce, but I’m sticking with my short term target (SPX mid 1040’s) and intermediate term target (SPX 1005ish).

There’s not need for me to repost the monthly, weekly and daily charts I posted in yesterday’s report. So here’s the 60-min. It’s a couple points above 1060 gap support. If it loses that level (if futures hold, it’ll gap below that level), we could see a quick sell-off to 1050. But we’re due for a bounce soon. I wouldn’t be surprised to see yesterday’s lows get taken out and part of the gap get filled before the imbalance of support and demand again favored the bulls.

I have little interest in going long or being long…except for those reverse ETFs. 🙂

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers