Good morning. Happy Friday.

This week has played out nicely. I turned bearish over the weekend…my 6 bearish set ups calmly moved to their targets. Now I’m in wait and see mode. Besides the easy money being gone, the next week is unclear. The S&P dropped right to my target (mid 1040’s) and is now bouncing. Support and resistance from here are not easily identifiable. Not only do the charts need to reset, the market needs to decide what it wants to do next. Several key groups have registered lower lows recently – were these false breakdowns or the beginning of an extended move down? This is what the market needs to decide.

As noted a couple times, the pullback wasn’t that much different that previous pullbacks, so there’s no reason to get super bearish or assume the uptrend is over. If it doesn’t make sense for the market to keep rallying, don’t worry about it. The extent of the move off the Mar low already doesn’t make sense.

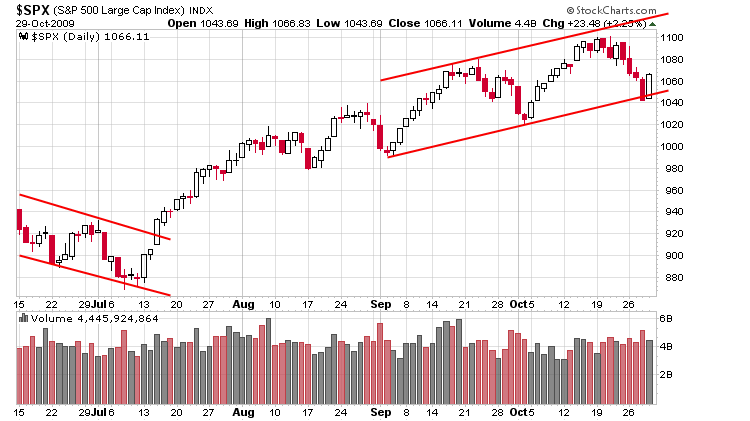

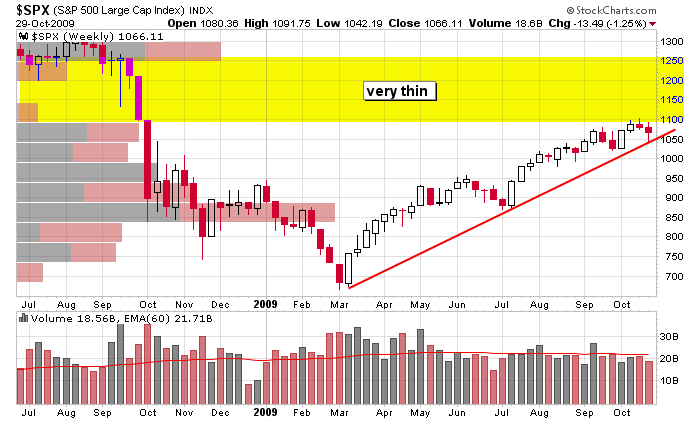

Here are the daily and weekly SPX charts. I see nothing wrong with the action.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 30)”

Leave a Reply

You must be logged in to post a comment.

Hello,

In reading Before the Market today, you said you went bearish the beginning of this week. I have been a little bearish for some time due to the rapid run up of equities, but I have consistently been wrong. Then this week brought the bears out, and I missed the action.

May I ask, what indicators or metrics di dyou use to signal a bearish market this week. I must admit I am lsot in all the data.

Thanks,

Steve

Steve…I will be doing a video this weekend covering this exact topic.

Jason

Bears in the woods. HELP! Or…, should we become bears?

QUESTION: What is the skinny on the class action lawsuit to do with Proshares?

quote:

The complaint alleges the Defendants violated the Securities Act by failing to disclose that the Funds are altogether defective as a securities product and as directional investment play.

Should this stop us from participating in this ETF?

Comments greatly appreciated.

see: http://finance.yahoo.com/news/Notice-of-Deadline-for-iw-1331202080.html?x=0&.v=1

Further…, and this is interesting, it seems the math behind the Proshares is only good for Day Trading. Otherwise, for longer periods than one day, if the Proshares are held, the mathematical expectations begin to skew. See this info piece and the links for specifics:

http://www.proshares-lawsuit.com/