Good morning. Happy Tuesday.

Except for China, the Asian/Pacific markets closed down across the board.

Europe is currently suffering sizeable losses – many indexes are down more than 2%.

Futures here in the States indicate a moderate gap down for the cash market that will put the market near Friday’s close.

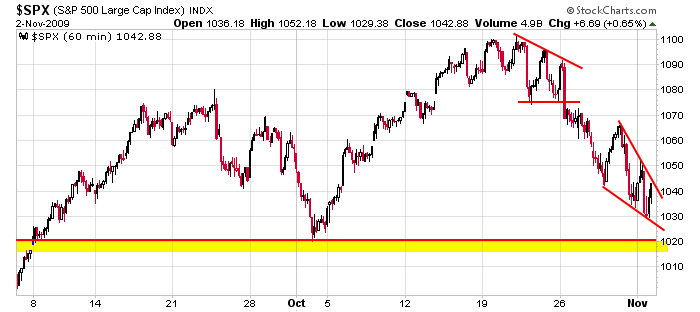

I turned bearish two weekends ago and maintain that stance. It remains to be seen whether this is a pullback within an overall up trend (most indexes have still registered higher highs and higher lows) or the beginning of an extended move down. But being a shorter term oriented trader, the near term trend is my guide. Hence why there are many short set ups on the trading list and no longs.

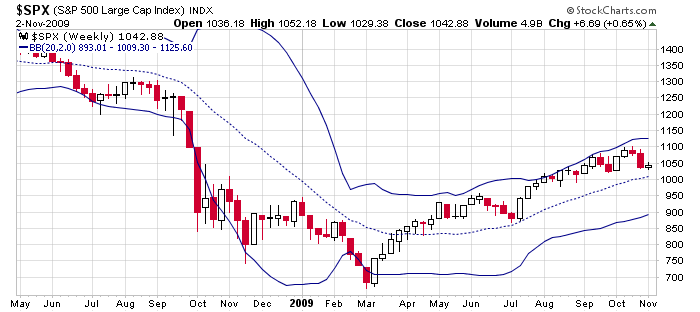

My next two downside targets for the SPX are the gap fill just under 1020 and 1010 (the middle of the Bollinger Bands on the weekly). See next two charts.

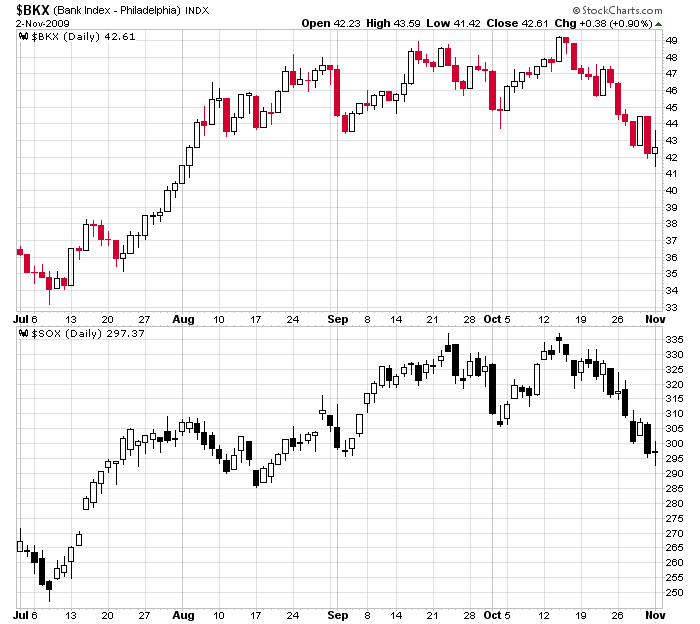

It’s worth noting that while most of the indexes have held their Oct lows so far, the banks and semis have made lower lows. Since the financials are such an important group right now, it’s unlikely the market rallies without them.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers